14.04.2016 09:15 - FSO, Prices (0353-1603-80) Producer and Import Price Index in March 2016 The Producer and Import Price Index remains stable overall Neuchâtel, 14.04.2016 (FSO) – The Producer and Import Price Index remained unchanged in March 2016 compared with the previous month at 99.0 points (base December 2015 = 100). Whereas the Producer Price Index increased by 0.1%, the Import Price Index remained unchanged on average. Compared with March 2015, the price level of the whole range...

Read More »Expectation for Doha may be Inflated

The weekend meeting between many OPEC and non-OPEC producers has helped spur the recent gains in the price of oil. We are concerned that market may be getting ahead of itself. First, the freeze in output that had previously been agreed by Russia, Saudi Arabia, and a few other countries was conditional on participation by Iran. We have consistently been suspicious of this condition. Iran has sacrificed or at least delayed its nuclear development in exchange for the lifting of the...

Read More »China – A Reversal of Urbanization?

Economic and Demographic Changes We have discussed China’s debt and malinvestment problems in these pages extensively in the past (most recently we have looked at various efforts to keep the yuan propped up). In a way, China is like the proverbial “watched pot” that never boils though. Its problems are all well known, and we have little doubt that they will increasingly find expression. China’s credit bubble is one of the many dangers hanging over the global economy’s head, so to speak....

Read More »Argentina – The Times, They Are A-Changing

Our Argentine “Ranch Rebellion” Is Over… for Now… Mauricio Macri shortly after his election – indicating that he actually has a plan. Photo credit: Enrique Marcarian / Reuters BUENOS AIRES, Argentina – Not much action on Wall Street yesterday. The Dow sold off slightly. Gold and oil were up a bit. How about here in Argentina? “Everything has changed. Everything.” One of the analysts in our Buenos Aires office explained how the recent election of business mogul Mauricio Macri as...

Read More »Dueling Fed GDP Trackers

The decentralized nature of the Federal Reserve lends itself to both a division of labor and competitive analysis. Some Federal Reserve branches have alternative inflation measures and trade-weighted indices of the dollar. On the whole, this seems beneficial for investors and policymakers. One tool developed by the Atlanta Fed has been widely embraced. It is a tracking measure for US GDP using real-time data. Yesterday the New York Fed announced that it had created its own GDP...

Read More »FX Daily, April 13: US Dollar Comes Back Bid

The US dollar is well bid in the Europe and is poised to start the North American session with the wind to its back. Despite firmer equity and industrial metal prices, most emerging market currencies are also succumbing to the rebounding greenback. The euro has yet to convincingly breakout of the range that has confined it this month. That would require a break of the $1.1300 area. However, as we have noted the two-year interest rate differential between the US and Germany, which does...

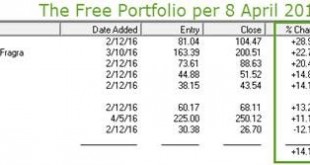

Read More »The Free Portfolio and the Age of the Alpha Stock

This free portfolio is offered to help investors understand that what they may have learnt about risk and return do not correspond to the realities of investing today. COMMENTS ON THE PORTFOLIO Unfortunately Sketchers (SKX), which lost more than 12% has not yet bottomed out. There is a theory, which says that the market is always right, but I believe that the market is always wrong. SKX’s data indicates the latter: Q1 EPS Forecast Q2 EPS Forecast Current Year Forecast Next Year...

Read More »State of Fear – Corruption in High Places

Mr. X and his Mysterious Benefactors A recent photograph of Mr. X. Photo credit; Peter Foley / Bloomberg via Getty Images As the Australian Broadcasting Corporation (ABC) reports, a money-laundering alarm was triggered at AmBank in Malaysia, a bank part-owned by one of Australia’s “big four” banks, ANZ. What had triggered the alarm? Money had poured into the personal account of one of the bank’s customers, a certain Mr. X, in truly staggering amounts. Hundreds of millions of dollars...

Read More »Yes, the Dollar Should Be Backed by Gold…

A Return to Gold Sorry boys and girls, you’ll have to start without us… Photo credit: Susan Candelario BUENOS AIRES, Argentina – “What if you were appointed to head the Fed? In your first week on the job, what would you do?” The question was not exactly serious. Neither was the answer. “We’d call in sick.” Drought, old age, traffic congestion, meanness, purple drink, bad taste, rap, suburbs, cancer, government, Hillary Clinton, restaurant music, shorts, Facebook, obesity – there are a...

Read More »More Thoughts about the Yen

Every so often there is a market move that appears inexplicable. The conundrum now is the yen’s strength. Of course, there are numerous attempts to shed light on the yen’s rise, but many, like ourselves, are not very satisfied. Perhaps part of the problem is that many participants are looking for a single narrative that explains why the dollar peaked against the yen last June near JPY125.85 and fell to almost JPY107.60 yesterday. However, closer inspection suggests the dollar’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org