In an unusual development, sterling is outperforming today. It rose to a four-day high near $1.4230 on what appears to be mostly modest position adjustment in relatively subdued turnover. The $1.40 area held on repeated tests in the second half of last week. Stops were triggered above $1.4160 forcing latest shorts to cover. The news stream was not particularly helpful with the British Chamber of Commerce warning that the economy slowed in Q1 with the balance of services the poorest...

Read More »Emerging Markets: Preview of the Week Ahead

Some dovish signals from the Fed and a bounce in oil prices helped EM end last week on a firm note. This week, the US retail sales report could be important, and the same goes for CPI and PPI data too. The Fed’s Dudley, Kaplan, Harker, Williams, Lacker, Lockhart, Powell, and Evans all speak this week. The Fed releases its Beige Book Wednesday for the upcoming FOMC meeting April 27. Within specific EM countries, risks remain in place. We continue to feel that markets are too...

Read More »Same Drivers, Different Direction

Over the past three months and the past month, the dollar has fallen against all the major currencies but the British pound. Sterling's underperformance can largely be explained by uncertainty created by the Tory government's sponsored referendum on continued EU membership. Most of the polls show those wanting to remain hold on to a slight lead. However, the potential impact is widely understood to be so powerful, that many investors have sought protection. This is being accomplished...

Read More »Specs Shift to Net Long Canadian Dollar and Set New Record Gross Long Yen

Speculators in the futures market were not particularly active in Commitment of Traders reporting week ending April 5. There was only one gross position adjustment which we regard as significant (defined as a 10k contract change), and that was in the yen. Yen bulls extended their gross long position by 13.3k contract to new record of 98.1k contracts. However, the bears are beginning to get itchy and have sold into the yen gains for the second consecutive week. The gross short yen...

Read More »Little Technical Evidence that Greenback’s Slump is Over

Although there is no convincing technical evidence that dollar's retreat in Q1 is over, we suspect it is nearly complete. We will be especially sensitive to reversal patterns, divergences with technical indicators, and other signs that the move is exhausted. The fundamental economic driver of our medium term constructive outlook for the US dollar, the divergence of monetary policy between the major central banks, relative health of the financial sector, and absorption of capacity,...

Read More »Gold – The Best Defense Strategy

The War on Cash is on! If you are used to making visits to your bank to make your credit card payments, you may find this no longer an option in the future. Some banks are no longer accepting (or limiting their acceptance) of cash deposits. The war on cash forges on. Paper money, which is indeed more or less worthless, is slowly being taken out of circulation and being replaced by digital currency. This shift presents of course the same fundamental problem as paper money itself:...

Read More »Gold: Still Misunderstood

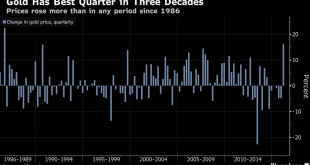

Myths That Just Won’t Die Gold just had its best quarter in 30 years. Not surprisingly, gold bears are coming out of the woodwork en masse in the mainstream media and the analyst community (see e.g. this recent write-up by Mish on the Goldman Sachs analyst who has been screaming “short gold” since right before it started rocketing higher in early February). Below we will discuss a specific assertion that tends to be repeated over and over again. Gold had a very strong quarter, but...

Read More »Emerging Markets: What has Changed

Bank Indonesia signaled it may pause its easing cycle Vietnam undertook a massive cabinet shuffle MSCI is reviewing Nigeria’s standing in its equity indices due to the impact of ongoing FX controls Russia’s central bank tilted a bit more dovish South Africa’s parliament voted down President Zuma’s impeachment proposal by a vote of 233-143 The impeachment process in Brazil moved forward another step Brazil’s Prosecutor General submitted a report to the Supreme Court saying that Lula’s...

Read More »Denmark Peg Under Pressure, but Won’t be Abandoned

In the first quarter, there was some speculation that currency pegs either in the Middle East or Hong Kong were going to give way. We argued that the pegs would in fact hold, and hold they have. In fact, pressure on the Saudi and Hong Kong pegs have dissipated. Since the end of last month, Denmark's peg against the euro (+/- 1% band) has come under pressure. Indeed, the pressure is the most acute since January 2015. When the Swiss abandoned the cap on the franc then, speculative...

Read More »Yen Pares Gains, Dollar-Bloc Firms

The surging yen has been the main feature in the foreign exchange market in recent days, but its advancing streak has been stopped with today's setback. The greenback traded briefly dipped below JPY107.70 in North America yesterday but has not been below JPY!08 today. It is near JPY109 as NY dealers return to their posts. Japanese officials may have ratcheted up their rhetoric a notch, but the ultimately it simply seems the yen buying dried up. Either the demand at the beginning of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org