There is a common ploy used by many analysts and reporters that often simply does not stand up to close scrutiny, and would in fact be mocked in the university. The ploy is to take two time series and put them on the same chart but use different scales. Such a ploy often is used to demonstrate a closer relationship between the two variables than is actually the case. A current example is a chart of the dollar-yen rate and Japanese stocks. Here is a Great Graphic that was in the...

Read More »Higher Inflation Lifts Sterling, Yen Stabilizes

There are three highlights to the foreign exchange market today. First, the yen is marginally softer. The yen's strength this month has been the main development. After making a marginal new high yesterday, some semblance of stability emerged in North America yesterday, and this has carried over into today's activity. The greenback largely held above JPY107.90 and rose to JPY108.40 in late Asia. It has been consolidating in the European morning. Japan's Finance Minister appeared...

Read More »Revisiting the CRB Index

The CRB Index is building on last Friday's gains, when it gapped higher. That gap marked the end of the down move we anticipated on March 28. The index fell through the two supports we identified (171.30 and 169.50), before bottoming on April 4 near 164.70. We had thought that a three-legged correction off the January 20 low was complete. However, the recent price action suggest that a five-wave move is more likely. First, the gap higher last Friday has not been filled. It leaves a...

Read More »Gold Stocks Break Out

No Correction Yet Photo via Museo del Oro / Bogota Late last week the HUI Index broke out to new highs for the move, and so did the XAU (albeit barely, so it did not really confirm the HUI’s breakout as of Friday). Given that gold itself has not yet broken out to a new high for the move, it would normally be expected to do so, as Jordan Roy-Byrne argues here. The chart below shows the situation as of Friday (HUI, HUI-gold ratio and gold): The HUI and the HUI-gold ratio have broken...

Read More »In Memoriam: Dr. Tibor Machan

A Rara Avis – The World Is Poorer Without Him In It Dr. Tibor Machan, libertarian philosopher Our friend Dr. Tibor Machan, a greatly valued contributor to this site, has passed away on March 24. Unfortunately, we haven’t known Tibor for very long. We got into touch with him after reading some of his work at Mises.org and the Daily Bell, and asked him if he would like to occasionally publish articles on Acting Man as well. To our delight, he immediately agreed. In the time we were in...

Read More »ZIRP, NIRP, QE, Bank Collapse and Helicopters Coming Too Late – The Lehman Effect Hits Europe – Hard!

It’s official, I’m calling a banking crisis in Europe. Things didn’t go well the last time I did this. Of course, many will say, “But the rating agencies have learned their collective lessons. They would most assuredely warn us if the European banks are close to going bust, right?!!!”. Yeah, right! Reference our past research note on so-called trusted parties in private blockchains for banks. Those interested in purchasing the 22 page report on what is likely the first major bank to fall...

Read More »Is the Dollar Bottoming against the Yen?

The yen's surge may be easing. It made a new marginal high in Asia, but has not been able to sustain it Technically, a hammer candlestick pattern may be traced out by the greenback's recovery today. Supporting the greenback is the movement in interest rate differentials. The US 10-year premium over Japan has widened by nearly 10 bp since last Thursday. Near 184 bp, it is the widest this month. The two-year premium has also widened at 96 bp. It is also the widest this month. The...

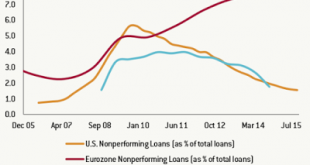

Read More »Great Graphic: Nonperforming Loans, Another Divergence

Early in the financial crisis, the US forced all large banks to take an infusion of capital. This helped put a floor under the US financial system. Regulators and stakeholders encouraged US banks to address the significant nonperforming loan problem. The eurozone banking woes persist. Before the weekend, the shares of the one the largest banks was trading at 25 -year lows. The problem with nonperforming loans though is largely concentrated in the periphery. Italy is moving to...

Read More »The Precious Metals Conspiracy

Tricky and Dangerous Assumptions A metallic conspirator and his flying factotum… Image via sceptic.com For at least a few weeks now, we have noticed a growing drumbeat from a growing corps of analysts. Gold is going to thousands of dollars. And silver is going to outperform. Reasons given are myriad. Goldman Sachs apparently said to short gold, so if one assumes that the bank always advises clients to take the other side of its trades — a tricky and dangerous assumption at best — then...

Read More »A Fatal Flaw in the System

The Hard Rocks of Real Life Photo credit: Andrei Shumskiy BALTIMORE – The Dow dropped 174 points on Thursday, the biggest fall in six weeks. Not the end of the world. Maybe not even the end of this year’s bounce-back bull run. As you’ll recall, stocks sold off at the beginning of the year, too. Then, investors were buoyed up after central banks got to work – jimmying the credit market on their behalf. The Fed swore off any further “normalization” until later in the year. Central banks...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org