Speculators in the currency futures made mostly small adjustments to their gross foreign currency exposure. There were only three position adjustments of more than 5k contacts. Since the markets turned on 11 February, the Canadian dollar has been the strongest of the major currencies, appreciating a little more than 4.5% against the US dollar. Gross shorts have been nearly halved since then. They were cut by 6.9k contracts or about 10% to reach 61.5k contracts during the recent...

Read More »Emerging Markets: What has Changed

(from my colleague Dr. Win Thin) 1) China’s central bank announced a 0.5% cut in the required reserve ratio2) Moody's cut the outlook on China's Aa3 rating to negative from stable3) Argentina and the main holdouts agreed to a debt restructuring deal4) Brazilian press reported that a senator implicated both Rousseff and Lula in the corruption probe as part of a plea bargain5) Chile is cutting back government spending this year in response to low copper prices In the EM equity space,...

Read More »US Jobs Headline Better than Details

The optics of the US jobs report was better than the details, which is the exact opposite of the January employment report. The US dollar strengthened on the news. The US created 242k jobs in February. The consensus was for around 195k. The January gain of 151k was revised up to 172k The household survey showed a 530k increase. The market expected a 175k. In January the household survey showed an increase of 615k. Combined the household survey has showed over a million new jobs. ...

Read More »US Jobs Data Awaited, but Barring Significant Surprise, May Not be Key Driver

The US dollar is mixed ahead of the US employment data. The Antipodeans and Scandis are doing best while sterling and the Canadian dollar are under-performing. Investors appetite for risk has increased. The market is confident that the next Fed hike is unlikely to be delivered before June. The implied yield on the June Fed funds futures contract is 45 bp. This is up from 38.5 bp on February 11. If the Fed were to hike rates on June 15 and Fed funds were to average 38 bp in the first...

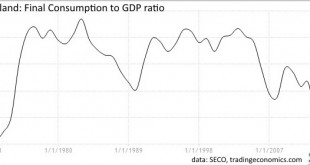

Read More »Swiss GDP and Swiss Franc Shock Propaganda

For the Swiss press, 2015 has been the year of the “Swiss franc shock“. Based on the GDP release from the Swiss ministry of economics (SECO), we wanted to know what in the Swiss economy got really “shocked”. The following table compares the Swiss GDP components and population data since 2009. Economists might think that the “Swiss franc shock“, the suddenly far stronger franc in January 2015 should lead to less exports and more imports, hence to a considerable weakening of “Net...

Read More »Great Graphic: Inflation Expectations via 10-Year Breakevens

Over the next fortnight the major central banks, including the ECB, BOJ, Fed and BOE will hold policy-making meetings. Of the four, expectations are the highest for the ECB to ease policy. Given the poor economic data, including deflationary pressures, and the tightening of financial conditions, the BOJ could also adjust policy. However, after the G20 meeting, it seems as if the bar for fresh monetary easing is higher than it had previously appeared. This does not mean that the BOJ...

Read More »Markets Calm; Waiting For…?

The global capital markets are quiet today, as investors await fresh impetus which could come in the form of tomorrow's US national employment figures. There is also next week's ECB meeting that looms large for investors. The euro is trading quietly. In fact, through the European morning, the euro has been confined to a little more than a third of a cent above $1.0850. It has not been above $1.09 since Monday, and despite contrasting economic signals, and the anticipation of more...

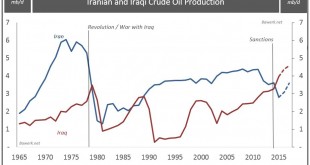

Read More »Revolutionary Guards: The Way of the Iranian Future

Iranian elections have supposedly put a very nice ‘moderate’ spin on Iranian politics in parliamentary ranks, and more importantly, Assembly of Experts composition. While it would be churlish to deny, it represents a significant step forward for President Rouhani’s agenda to 2017, albeit a number of vital caveats remain for how real any political shift actually is. We’ll do the Parliament first, and then move onto the Assembly second. With a ‘grand finale’ of what it means for Iranian...

Read More »Are Central Banks Exaggerating Deflation Risks?

Deflation is portrayed as the great economic scourge. It exacerbates debt servicing costs and encourages consumers to defer purchases. Central banks in Japan and Europe have responded with aggressive, unorthodox measures, often combining asset purchase programs with negative interest rates. However, deflation is not very deep, and the measurement is not very precise. In recent years, it has become common for many central banks to define their mandate of price stability as being...

Read More »Markets Take Another Step Away from the Edge

The angst that characterized the first several weeks of the year continues to dissipate. Major equity markets are extending their two-week recovery into a third week. Immediate concerns about the US falling into a recession have eased. The market have withstood some downward pressure on the Chinese yuan. Late yesterday Moody's cut its outlook for China's credit rating to negative from stable, and this did not cause much of a ripple in the capital markets. In fact, the Shanghai and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org