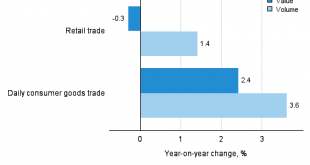

02.05.2016 09:15 – FSO, Economic Surveys (0353-1604-60) Retail trade turnover in March 2016 Swiss retail trade turnover falls by 2.4% Neuchâtel, 02.05.2016 (FSO) – Turnover in the retail sector fell by 2.4% in nominal terms in March 2016 compared with the previous year. This decline has been ongoing since January 2015. Seasonally adjusted, nominal turnover fell by 0.1% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real...

Read More »Retail trade turnover in March 2016: Swiss retail trade turnover falls by 2.4%

02.05.2016 09:15 – FSO, Economic Surveys (0353-1604-60) Retail trade turnover in March 2016 Swiss retail trade turnover falls by 2.4% Neuchâtel, 02.05.2016 (FSO) – Turnover in the retail sector fell by 2.4% in nominal terms in March 2016 compared with the previous year. This decline has been ongoing since January 2015. Seasonally adjusted, nominal turnover fell by 0.1% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real...

Read More »Carly Fiorina: Running Mate Turns Into Fall Girl

Odd Couple While checking on the US primaries a few days ago, we came across a piece of news informing us that pretend candle-swallower Ted Cruz had picked Carly Fiorina as his “vice-presidential running mate”. Our first thought upon hearing this was “WTF”? The match made in heaven… two loooosers find each other. Photo credit: AP It’s not so much that he’s picking another “loooooser” as The Donald would put it…the real absurdity of it is that even if Cruz were to win every single one of...

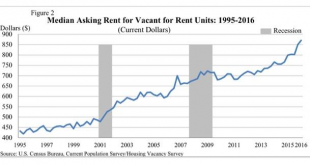

Read More »Great Graphic:US Rents and Core Inflation

This post is extremely important for understanding the differences between CPI inflation in Europe and in the U.S. “Shelter” makes up 32.8% of the U.S. CPI basket, or 42% of the core inflation rate. It is mostly driven by “Owner’s equivalent rent of primary residence”. Shelter inflation in the U.S. is 3.2% per year (March 2016), but shelter inflation is only 1% in Europe. CPI in the United States (source) in % Shelter 32.776 Rent of primary residence 5.930 Lodging away from home...

Read More »China: Services Companies Benefit on Lower Tax with VAT introduction

Yesterday, China announced one of the most important tax reforms of the past twenty years. It is replacing a business tax on gross revenue for non-manufacturing companies with a VAT. Manufacturing companies have been subject to a VAT approach for a few years. The reform extends it from manufacturing and a few services in a pilot program to industry-wide application. It will now cover construction, real estate, finance and consumer services. The shift to the VAT is expected to reduce...

Read More »Emerging Market Preview for the Week Ahead

EM ended the week on a firm note, which should carry over into this week. The biggest near-term risk to EM is the US jobs data on Friday, as the weekly claims data points to another strong gain. Otherwise, the global liquidity backdrop remains EM-supportive. Thailand reported April CPI earlier today. It rose 0.07% year-over-year. The market expected another decline after the -0.5% in March. This is well below the 1-4% target range. However, growth remains quite robust, averaging...

Read More »FX Daily, May 02: New Month, Same Heavy Dollar

In quiet turnover, with China, Hong Kong, Singapore and London markets closed, the US dollar is trading with a heavier bias against all the major currencies. Lower commodity prices, including oil and copper, appears to be taking a toll on some emerging market currencies, including the South African rand. Japanese markets were closed last Friday and will be closed the next three sessions. The yen appreciated nearly 5% in the aftermath of the FOMC/BOJ meetings last week. The greenback’s...

Read More »Paper Gold Is Rising

The Metals Take Off Photo via sprottmoney.com The price of gold shot up over $60 this week. The price of silver moved up proportionally, gaining over $0.85. The mood is now palpable. The feeling in the air is that of long suffering suddenly turned to optimism. Big gains, if not the collapse of the price-suppression cartel, are now inevitable. The headlines and articles, screaming for gold to hit $10,000 to $50,000, are pervasive. Today we won’t dwell on our favorite point that if the...

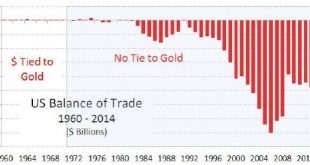

Read More »How Unsound Money Fuels Unsound Government Spending

Sound money advocates are often hit with the charge of being “doom and gloomers.” Yes, we do warn that unsound monetary policies enable unsustainable fiscal commitments, which will lead eventually to a currency crisis. Sound money advocates are also often portrayed as party poopers. Yes, we do seek to take away the bottomless punch bowl of easy money and replace it with something more solid. However, we are not pessimists or killjoys by nature. To the contrary, we are quite optimistic about...

Read More »Bank of Japan: The Limits of Monetary Tinkering

Damned If You Do… After waking up on Thursday, we quickly glanced at the overnight market action in Asia and noticed that the Nikkei had tanked rather noticeably. Our first thought upon seeing this was “must be the yen” – and so it was. The BoJ cannot manipulate the yen anymore. June yen futures, daily – taking off again – click to enlarge. Given the BoJ’s bizarre plan to push consumer price inflation to a 2% annualized rate within [enter movable goal post here] years, Mr. Kuroda...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org