The Great Financial Crisis has exposed a deep chasm in economics and economic policy. No single institution is this crystallized more than at the Bank of Japan. The former Governor, Shirakawa brought policy rates to nearly zero to combat deflation. His successor, Kuroda, took the central bank in the completely other direction. He has introduced three elements of unconventional policy in an institution that was wedded to orthodoxy. These include an aggressive expansion of the central...

Read More »Switzerland 2015-2045: Population Increase by Immigration, Ageing Effects

12.05.2016 09:15 – FSO, Demography and Migration (0353-1605-00) Population projections for the cantons in Switzerland 2015-2045 Large increase expected in number of retired people Neuchâtel, 12.05.2016 (FSO) – Almost all cantons will record positive population growth over the next thirty years. This growth will be accompanied by a marked increase in the number of people of retirement age in all the cantons according to the new population trend scenarios for Switzerland’s cantons...

Read More »Arizona Governor Ducey Vetoes Gold

In my testimony in support of the gold legal tender bill this year, I discussed failing pension funds. Retirees who count on their pension checks are being told that their monthly check will be reduced by up to 60%. This is devastating to them, obviously. What isn’t obvious is the cause. In the news coverage of this, the angry pensioners are blaming the union, the fund manager, and Wall Street in general. None of them point the finger where it needs to be pointed. The Fed has centrally...

Read More »Heretical Thoughts and Doing the Unthinkable

Heresy! Legendary former hedge fund manager Stanley Druckenmiller at the Ira Sohn conference – not an optimist at present, to put it mildly. Photo credit: David A. Grogan / CNBC NORMANDY, France – The Dow rose 222 points on Tuesday – or just over 1%. But we agree with hedge-fund manager Stanley Druckenmiller: This is not a good time to be a U.S. stock market bull. Speaking at an investment conference in New York last week, George Soros’ former partner warned that… “…higher...

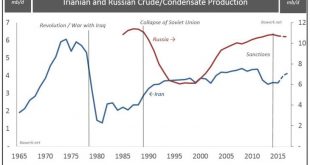

Read More »OPEC Politics: Russian King, Iranian Crown Prince?

Another month, another OPEC meeting beckons for 2nd June. But unlike typical meetings on the Danube (let alone dust filled haze of Doha), the producer group might just have a new King in town. It comes in the form of Russia; the number one global producer that’s not even technically a member of the cartel. Confused? Don’t be. The argument is quite simple. Irianian and Russian Crude/Condensate Production Iranian and Russian Crude/Condensate Production – click to enlarge. Unlike...

Read More »Population projections for the cantons in Switzerland 2015-2045: Large increase expected in number of retired people

12.05.2016 09:15 – FSO, Demography and Migration (0353-1605-00) Population projections for the cantons in Switzerland 2015-2045 Large increase expected in number of retired people Neuchâtel, 12.05.2016 (FSO) – Almost all cantons will record positive population growth over the next thirty years. This growth will be accompanied by a marked increase in the number of people of retirement age in all the cantons according to the new population trend scenarios for Switzerland’s cantons...

Read More »Should the Gold Price Keep Up with Inflation?

The popular belief is that gold is a good hedge against inflation. Owning gold will protect you from rising prices. Is that true? Most people define inflation as rising prices. Economists will quibble and say technically it’s the increase in the quantity of money, however Milton Friedman expressed the popular belief well. He said, “Inflation is always and everywhere a monetary phenomenon.” There you have it. The Federal Reserve increases the money supply and that, in turn, causes an...

Read More »Staying Home on Election Day

Pretenses and Conceits US election circus: Deep State Rep vs. Rage Channeller The markets are eerily quiet… like an angry man with something on his mind and a shotgun in his hand. We will leave them to brood… and return to the spectacle of the U.S. presidential primaries. On display are all the pretenses, conceits, and absurdities of modern government. And now, the race narrows to the two most widely distrusted and loathed candidates. The first, a loose reality-TV star with a hot...

Read More »Gold – The Commitments of Traders

Commercial and Non-Commercial Market Participants The commitments of traders in gold futures are beginning to look a bit concerning these days – we will explain further below why this is so. Some readers may well be wondering why an explanation is even needed. Isn’t it obvious? Superficially, it sure looks that way. As the following chart of the net position of commercial hedgers illustrates, their position is currently at quite an extended level: Gold Hedgers Position Net position...

Read More »Spain Sells 3x Oversubscribed 50-Year Bond

Following a scramble by European nations to issue ultra long-dated government paper, which saw France and Belgium sell 50-year bonds last month, while Ireland and Belgium went all the way and issued century bonds, with even Switzerland locking in 42-year paper yesterday, moments ago Spain was the latest to extend maturities all the way to 2066 when it sold €3 billion in 50 year bonds at Midswaps+50. According to MarketNews, the issue was over 3 times oversubscribed with the orderbook...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org