Erroneous Analysis of Precious Metals Fundamentals We came across an article at Bloomberg today, talking about silver supply troubles. We get it. The price of silver has rallied quite a lot, so the press needs to cover the story. They need to explain why. Must be a shortage developing, right? At first, we thought to just put out a short Soggy Dollars post highlighting the error. Then we thought we would go deeper. Here’s a graph showing the price action in silver since the beginning of the year, overlaid with our abundance indicator. Silver Abundance and Price Silver price vs. silver abundance. It’s uncanny, isn’t it? As the price has risen, silver has become more abundant to the market. Anyone buying silver on the grounds of anticipated “supply troubles” — much less buying it with leverage — is making a mistake. Silver Abundance and Price – click to enlarge. This doesn’t mean the rally couldn’t extend further. We would kind of expect that at this point, just from watching the momentum. It does mean that the story is false, and when the price action reverses, there are going to be dreadful losses. Especially to those who buy with leverage. Stocks vs. Flows Let’s debunk a few other errors in the article. “Output from mines will fall for the first time since 2011…” Mankind has been accumulating silver for many thousands of years.

Topics:

Keith Weiner considers the following as important: Debt and the Fallacies of Paper Money, Featured, newsletter, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Erroneous Analysis of Precious Metals Fundamentals

We came across an article at Bloomberg today, talking about silver supply troubles. We get it. The price of silver has rallied quite a lot, so the press needs to cover the story. They need to explain why. Must be a shortage developing, right?

At first, we thought to just put out a short Soggy Dollars post highlighting the error.

Then we thought we would go deeper. Here’s a graph showing the price action in silver since the beginning of the year, overlaid with our abundance indicator.

Silver Abundance and PriceSilver price vs. silver abundance. It’s uncanny, isn’t it? As the price has risen, silver has become more abundant to the market. Anyone buying silver on the grounds of anticipated “supply troubles” — much less buying it with leverage — is making a mistake. |

This doesn’t mean the rally couldn’t extend further. We would kind of expect that at this point, just from watching the momentum. It does mean that the story is false, and when the price action reverses, there are going to be dreadful losses. Especially to those who buy with leverage.

Stocks vs. Flows

Let’s debunk a few other errors in the article.

“Output from mines will fall for the first time since 2011…”

Mankind has been accumulating silver for many thousands of years. Unlike gold, some of it is consumed. Unlike any ordinary commodity, most of it is not. Economists call this the ratio of stocks to flows — inventories divided by annual production.

In gold and silver, stocks to flows is measured in decades. In ordinary commodities, it’s months. In wheat, crude oil, or lithium if inventories build up too much, that is called a glut. The price crashes until the glut is worked off.

There is no such thing as a glut in gold or silver, nor a shortage. This is part of what makes them money.

“Production is declining just as signs of stabilization in China’s economy fuel optimism…”

We would not bet on this.

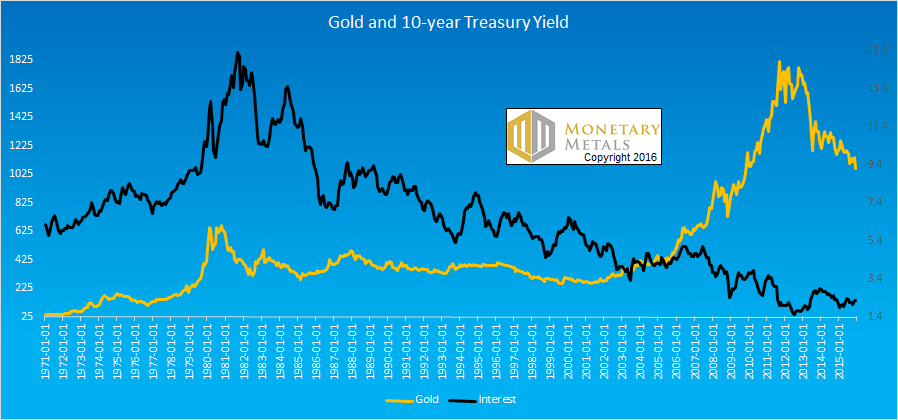

“Both metals are benefiting from increased expectations that the Federal Reserve will be slow to raise interest rates this year…”

Every time we see this old saw, we wonder if anyone has access to historical gold prices and interest rates. Here’s a graph we published in our Outlook 2016.

Gold and 10-year Treasury YieldThe gold price vs. the yield on the 10 year treasury note. |

Whether the Fed is to raise interest this year or not, there is no correlation to the price of gold or silver. Whatever may drive the price of silver to $20 much less $50, it won’t be a 50 bps hike or cut in the funds rate.

“Output will drop 2.4 percent to 784.8 million ounces in 2016…”

Supply of a monetary metal consists of the stocks plus the flows. All of that hoarded metal is potential supply, at the right price and under the right conditions. Stocks are a large multiple greater than flows. And this article is citing analysis that predicts a 2.4 percent change to flows. In the total supply, this may be about 2.4 percent of 2.4 percent.

Moving Silver Around

“Holdings in exchange-traded funds backed by silver surged more than 1,132 metric tons this year”

This is a measure of silver stocks moving from one place to another. This statistic might be important to businesses in the trade, such as refiners and depositories. It is not useful in predicting the price.

Ironically, the big gain in ETF inventories may be metal coming from Asia. Metal flows from where it is cheaper to where it is priced more richly. If speculators relentlessly push up the ask price on the ETFs, then they will draw in metal from where it is cheaper.

To underscore our point about abundance, isn’t this a sign of it? The marginal use of metal is to go into paper vehicles designed to let asset managers speculate on the price of silver using an equity.

Caveat emptor argenti.

Charts by: Monetary Metals

Dr. Keith Weiner is the president of the Gold Standard Institute USA, and CEO of Monetary Metals. Keith is a leading authority in the areas of gold, money, and credit and has made important contributions to the development of trading techniques founded upon the analysis of bid-ask spreads. Keith is a sought after speaker and regularly writes on economics. He is an Objectivist, and has his PhD from the New Austrian School of Economics. He lives with his wife near Phoenix, Arizona.

Previous post Next post