Tax Receipts vs. the Stock Market Following the US Treasury’s update of April tax receipts, our friend Mac mailed us a few charts showing the trend in corporate tax payments. Not surprisingly, corporate tax payments and refunds mirror the many signs of a slowing economy that have recently emerged. An overview in chart form follows below. First up, corporate tax receipts in absolute figures. Corporate Tax Receipts Corporate tax receipts in absolute dollars and cents – this is quite astonishing considering that the amount of money in the US economy has increased by roughly 125% since early 2008. Corporate taxes by contrast haven’t even made it back to the 2007 peak. Corporate Tax Receipts The next chart shows tax refunds to companies – these traditionally increase when companies aren’t doing as well as they would like: Corporate Tax Refunds Corporate tax refunds have begun to turn up – they have led the last downturn by about 7 months Corporate Tax Refunds The next chart shows the underlying trend in the form of the 12-month rolling change in net corporate tax receipts.

Topics:

Pater Tenebrarum considers the following as important: Debt and the Fallacies of Paper Money, Featured, newsletter, On Economy, The Stock Market

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Tax Receipts vs. the Stock Market

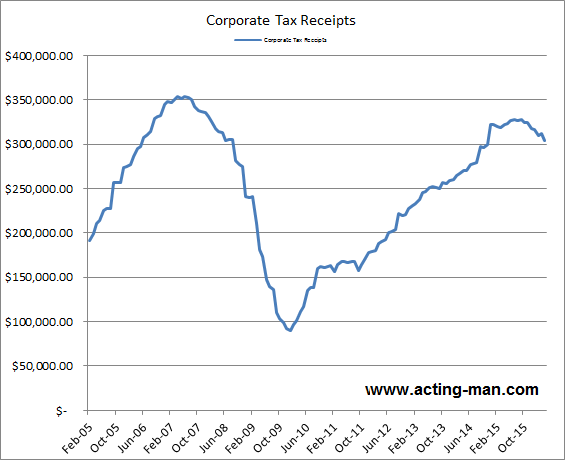

Following the US Treasury’s update of April tax receipts, our friend Mac mailed us a few charts showing the trend in corporate tax payments. Not surprisingly, corporate tax payments and refunds mirror the many signs of a slowing economy that have recently emerged. An overview in chart form follows below. First up, corporate tax receipts in absolute figures.

Corporate Tax ReceiptsCorporate tax receipts in absolute dollars and cents – this is quite astonishing considering that the amount of money in the US economy has increased by roughly 125% since early 2008. Corporate taxes by contrast haven’t even made it back to the 2007 peak. |

Corporate Tax Receipts |

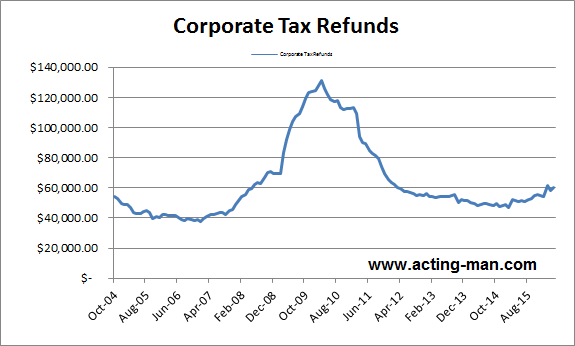

The next chart shows tax refunds to companies – these traditionally increase when companies aren’t doing as well as they would like:

Corporate Tax RefundsCorporate tax refunds have begun to turn up – they have led the last downturn by about 7 months |

Corporate Tax Refunds |

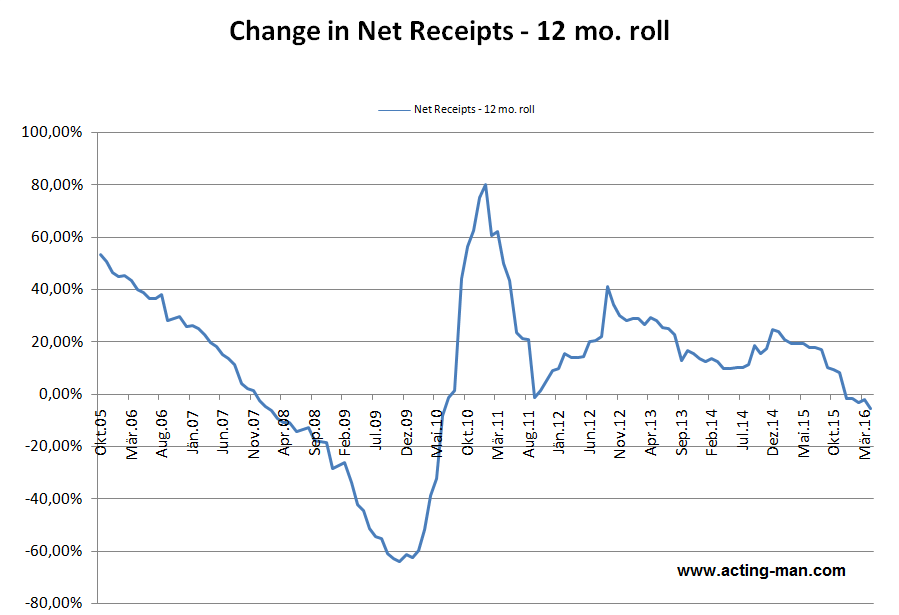

The next chart shows the underlying trend in the form of the 12-month rolling change in net corporate tax receipts.

12 month rolling change in net corporate tax receiptsThis shows actually a quite noteworthy development: the 12 month rolling change has just crossed into negative territory to the greatest extent since late 2007 (there was a very tiny dip below the zero line in 2011 as well, during the peak of the euro area debt crisis): |

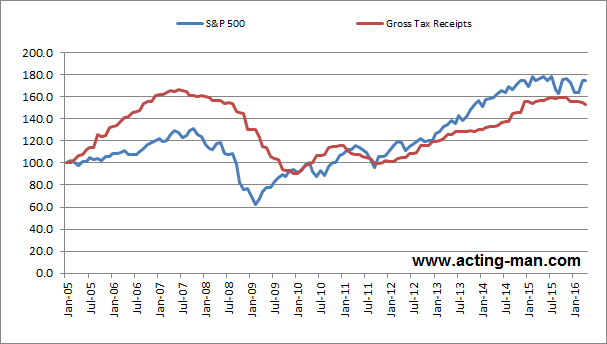

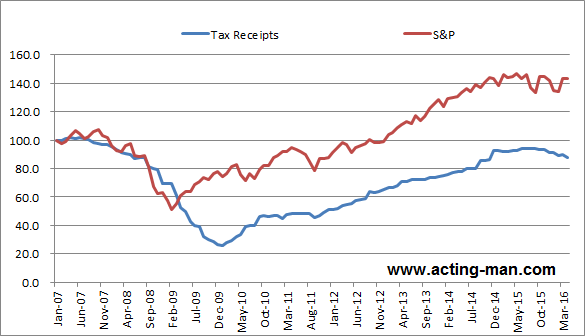

Mac had the interesting idea to compare gross corporate tax receipts to the S&P 500 index as well. In a way, it can be thought of as an alternative market valuation measure. As he notes to this chart:

“The market and tax receipts began to diverge at about the exact same time that QE1 began.”

Corporate tax receipts vs. the S&P 500Corporate tax receipts (red line) vs. the S&P 500 (blue line), indexed since 2005. Note the large positive gap prior to 2010 and the persistent (and now widening) negative gap since then. |

Corporate tax receipts vs. the S&P 500 |

Moving the starting point of the above comparison to January 2007 makes the diverging trends even more obvious (note that the colors have been switched in this chart):

S&P 500 (red line) vs. corporate tax receipts (blue line) – drifting apart. |

S&P 500 (red line) vs. corporate tax receipts (blue line) – drifting apart. |

Conclusion

Several things can be gleaned from this: 1. the economy is indeed slowing down, and corporate profits are coming under pressure (notwithstanding the non-GAAP and buyback influenced per share data reported by listed companies); 2. aggregate corporate tax receipt data are apparently a good leading indicator of economic downturns (but not of upturns, presumably because write-downs tend to lag economic recoveries); 3. the stock market’s valuation and the real economy have drifted apart quite a bit – this is nothing new of course, but it is once again confirmed by these data as well.

Charts by: Mac for acting-man.com

Previous post