A New Bull Market in Gold? On April 10, the Incrementum Fund’s advisory board held its quarterly meeting. Two of the regulars (Zac Bharucha and Rahim Taghizadegan) were unable to attend this time, but we were joined by special guest Brent Johnson, the CEO of Santiago Capital. The transcript of the meeting with all charts can be downloaded further below. Gold, June futures contract, daily As indicated, the main (but not the only) topic of the discussion was gold. This was an obvious choice in light of the strong rebound in gold and silver and the scorching performance of gold mining stocks in Q1. Gold, June futures contract, daily In the Q1 meeting on January 10, a fairly strong consensus had developed that it was still a good idea to go long gold and gold mining stocks – in spite of the drawn-out bottoming process trying everybody’s patience. As is often the case, the fact that this process had created a lot of uncertainty and bearish sentiment in the market turned out to be a good sign. The question was now whether or not the recent move was just another flash in the pan or something more serious. When reading the transcript, keep in mind that the meeting took place on April 10, so any comments focused on the very short term obviously don’t incorporate the most recent developments yet.

Topics:

Pater Tenebrarum considers the following as important: Debt and the Fallacies of Paper Money, Featured, newsletter, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

A New Bull Market in Gold?

On April 10, the Incrementum Fund’s advisory board held its quarterly meeting. Two of the regulars (Zac Bharucha and Rahim Taghizadegan) were unable to attend this time, but we were joined by special guest Brent Johnson, the CEO of Santiago Capital. The transcript of the meeting with all charts can be downloaded further below.

Gold, June futures contract, dailyAs indicated, the main (but not the only) topic of the discussion was gold. This was an obvious choice in light of the strong rebound in gold and silver and the scorching performance of gold mining stocks in Q1. |

In the Q1 meeting on January 10, a fairly strong consensus had developed that it was still a good idea to go long gold and gold mining stocks – in spite of the drawn-out bottoming process trying everybody’s patience. As is often the case, the fact that this process had created a lot of uncertainty and bearish sentiment in the market turned out to be a good sign.

The question was now whether or not the recent move was just another flash in the pan or something more serious. When reading the transcript, keep in mind that the meeting took place on April 10, so any comments focused on the very short term obviously don’t incorporate the most recent developments yet.

A wide variety of factors influencing the gold price and pertinent to the recent rally were discussed – ranging from measures of inflation expectations and how the gold price tends to interact with them, to gold’s usefulness as a hedge against counterparty risk, to the commitments of traders report which has recently received so much attention by numerous market observers.

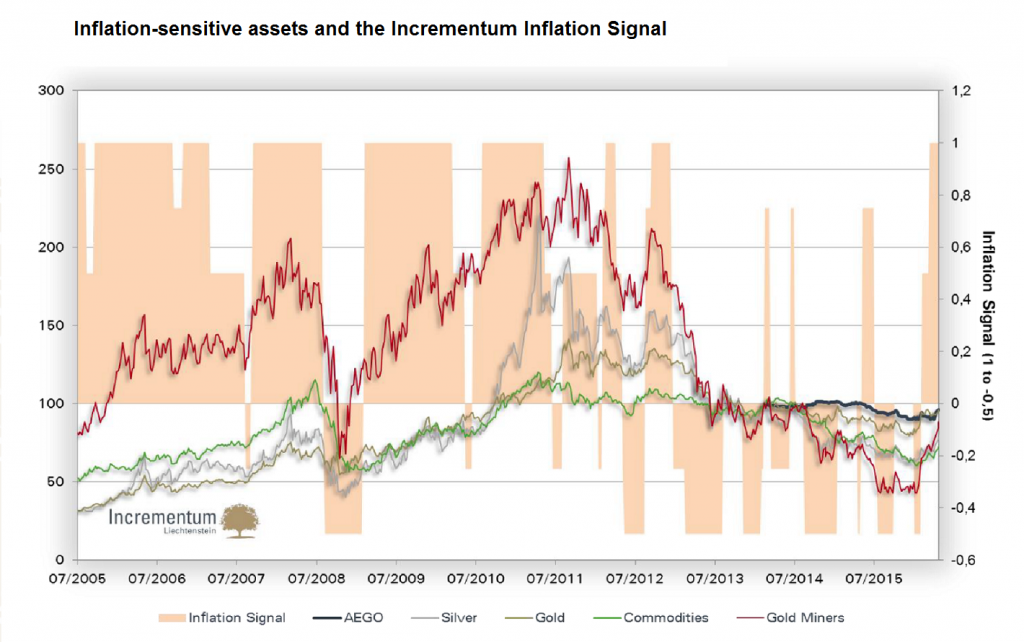

The Incrementum Inflation Signal vs. inflation-sensitive assetsIt should also be noted that the proprietary Incrementum inflation signal has actually turned up, giving the fund the green light to invest in inflation-sensitive assets. It is noteworthy that this has been the signal’s strongest upturn since a long period of strong volatility and mostly negative readings began in 2012. |

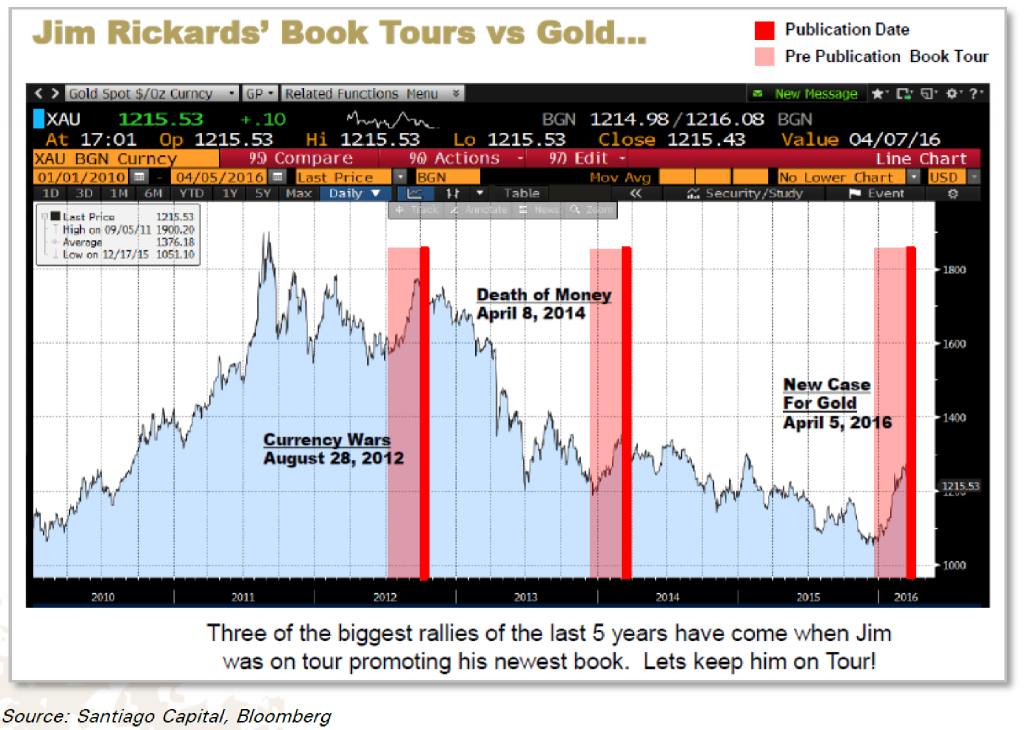

Every time a new book by Jim Rickards is published and he goes on tour to promote it, gold tends to rally stronglyJim Rickards delivered a very interesting update on the currency policies currently pursued by governments and their influence on the action in gold and commodities, while Frank Shostak provided a broad overview of global monetary and economic trends with a special focus on China. Brent Johnson inter alia brought a wealth of charts along to the discussion, which included a new indicator that seems to be giving excellent timing signals for gold. In fact, it shows the time periods during which it is generally most profitable to enter long positions in gold: the Jim Rickards book tour indicator! |

Conclusion/ Download Link

As always, we hope you will enjoy the discussion and get something useful out of it. The transcript can be downloaded here (pdf): Incrementum/AEGO advisory board meeting, April 2016.

Charts by: BarChart, Incrementum AG, Santiago Capital / Bloomberg

Previous post Next post