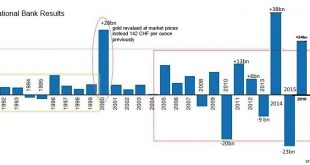

From the official news release Interim results of the Swiss National Bank as at 31 March 2017 The Swiss National Bank (SNB) reports a profit of CHF 7.9 billion for the first quarter of 2017. A valuation gain of CHF 2.2 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 5.3 billion. The SNB’s financial result depends largely on developments in the gold, foreign exchange...

Read More »SNB posts 7.9 billion CHF Profit in Q1

From the official news release Interim results of the Swiss National Bank as at 31 March 2017 The Swiss National Bank (SNB) reports a profit of CHF 7.9 billion for the first quarter of 2017. A valuation gain of CHF 2.2 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 5.3 billion. The SNB’s financial result depends largely on developments in the gold, foreign exchange...

Read More »FX Daily, April 27: Several Developments ahead of the ECB meeting

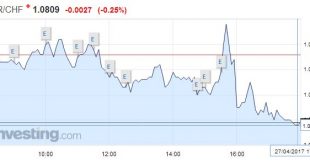

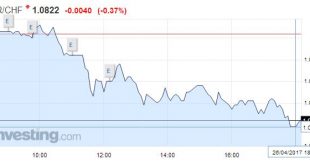

Swiss Franc EUR/CHF - Euro Swiss Franc, April 27(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The ECB meeting and the press conference that follows it is the main event. However, it has had to compete with the Bank of Japan and Riksbank meetings, as well as the further reflection of the tax reform proposals by the Trump Administration yesterday. Also, after a misdirection over pulling out of...

Read More »Draghi Does Nothing and Talks about It

Summary: Draghi confirms rate on hold and maintains easing bias. Growth risks are becoming more balanced. Inflation has yet to get on a sustained upward path. As widely expected, the ECB left its key rates and asset purchase plan intact. It reiterated its forward guidance that rates will remain at present levels or lower. Draghi was more confident about the economy, suggesting that the downside risks had...

Read More »Cracks in Ponzi-Finance Land

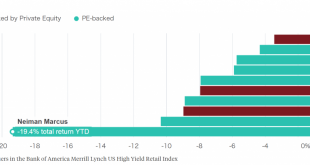

Retail Debt Debacles The retail sector has replaced the oil sector in a sense, and not in a good way. It is the sector that is most likely to see a large surge in bankruptcies this year. Junk bonds issued by retailers are performing dismally, and within the group the bonds of companies that were subject to leveraged buyouts by private equity firms seem to be doing the worst (a function of their outsized debt loads)....

Read More »Who Will Live in the Suburbs if Millennials Favor Cities?

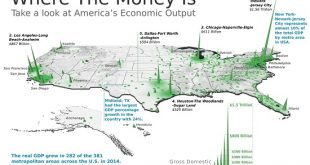

Who’s going to pay bubble-valuation prices for the millions of suburban homes Baby Boomers will be off-loading in the coming decade as they retire/ downsize? Longtime readers know I follow the work of urbanist Richard Florida, whose recent book was the topic of Are Cities the Incubators of Decentralized Solutions?(March 14, 2017). Florida’s thesis–that urban zones are the primary incubators of technological and...

Read More »To The Asian ‘Dollar’, And Then What?

The Bretton Woods system was intentionally set up to funnel monetary convertibility through official channels. The primary characteristic of any true gold standard is that any person who wishes can change paper claims into hard money. It was as much true in any one country as between those bound by the same legal framework (property). What might differ were the standards for satisfying those claims (“good delivery”...

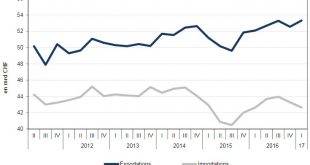

Read More »Swiss Trade Balance March 2017: Increase in Exports and Stagnation of Imports

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity increases, while REER assumes constant productivity in comparison to trade partners. On the other side, a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to...

Read More »FX Daily, April 26: Dollar Stabilizes Ahead of Trump and ECB

Swiss Franc EURCHF - Euro Swiss Franc, April 26(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Last week Theresa May called a snap General election due to take place on 8th June. Historically a snap election has caused the currency in question to weaken, however on this occasion Sterling strengthened. It was a shrewd move by May to call an election while the competition is so weak. A conservative...

Read More »French Selection Ritual, Round Two

Slightly Premature Victory Laps The nightmare of nightmares of the globalist elites and France’s political establishment has been avoided: as the polls had indicated, Emmanuel Macron and Marine Le Pen are moving on to the run-off election; Jean-Luc Mélenchon’s late surge in popularity did not suffice to make him a contender – it did however push the established Socialist Party deeper into the dustbin of history. That...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org