From the official news release Interim results of the Swiss National Bank as at 31 March 2017 The Swiss National Bank (SNB) reports a profit of CHF 7.9 billion for the first quarter of 2017. A valuation gain of CHF 2.2 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 5.3 billion. The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets. Strong fluctuations are therefore to be expected, and only provisional conclusions are possible as regards the annual result. The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse SNB Results Longterm 2016 - Click to enlarge Profit on foreign currency positions The net result on foreign currency positions amounted to CHF 5.3 billion. Interest income accounted for CHF 2.1 billion and dividends for CHF 0.6 billion. Movements in bond prices differed from those in share prices. A loss of CHF 1.6 billion was recorded on interest-bearing paper and instruments.

Topics:

George Dorgan considers the following as important: Featured, newslettersent, SNB, SNB balance sheet, SNB equity holdings, SNB Gold Holdings, SNB Press Releases, SNB profit, SNB results, SNB sight deposits, Swiss National Bank

This could be interesting, too:

investrends.ch writes SNB schreibt 2025 definitiven Gewinn von 26,1 Mrd Franken

investrends.ch writes Der Franken und die Grenzen der Geldpolitik

investrends.ch writes UBS-Prognose: Dollar tendiert seitwärts – Euro steigert sich

investrends.ch writes SNB passt Verzinsung von Sichtguthaben erneut nach unten an

From the official news release

Interim results of the Swiss National Bank as at 31 March 2017

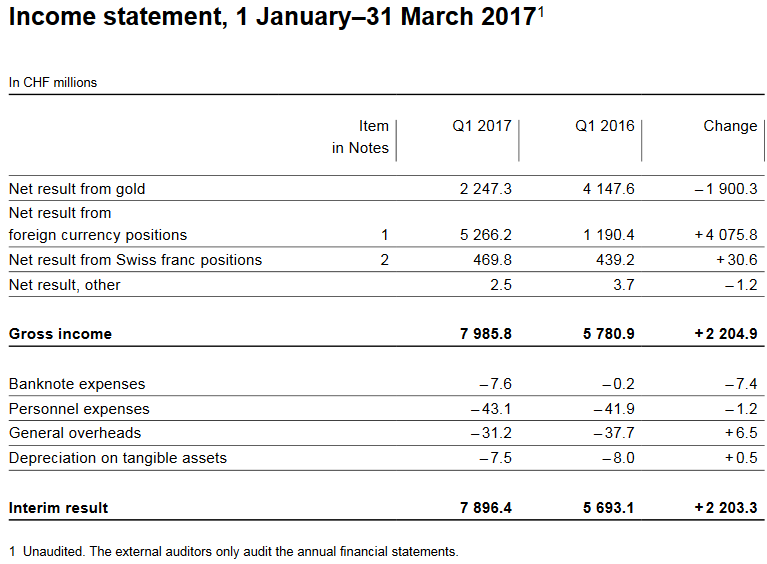

The Swiss National Bank (SNB) reports a profit of CHF 7.9 billion for the first quarter of 2017.A valuation gain of CHF 2.2 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 5.3 billion.The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets. Strong fluctuations are therefore to be expected, and only provisional conclusions are possible as regards the annual result.

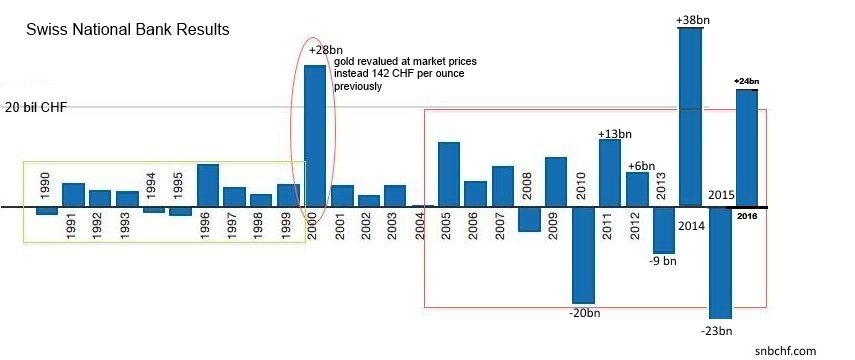

The increasing volatility of SNB EarningsAnnual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse |

SNB Results Longterm 2016 |

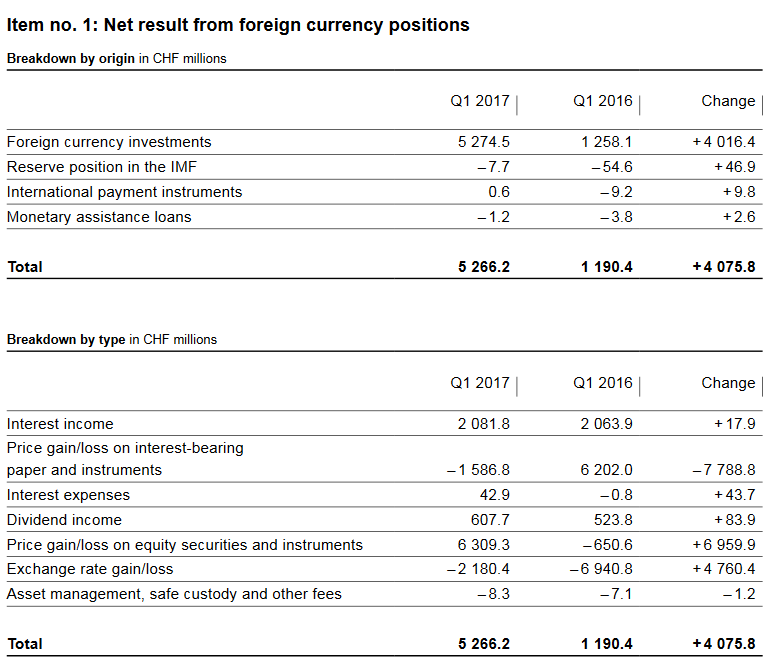

Profit on foreign currency positions

|

SNB Results in the first 1 Quarters 2017: +2.2 billion CHF Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||

Valuation gain on gold holdings

Percentage of gold to balance sheetAfter long years, the part of gold is rising again, albeit only slightly.

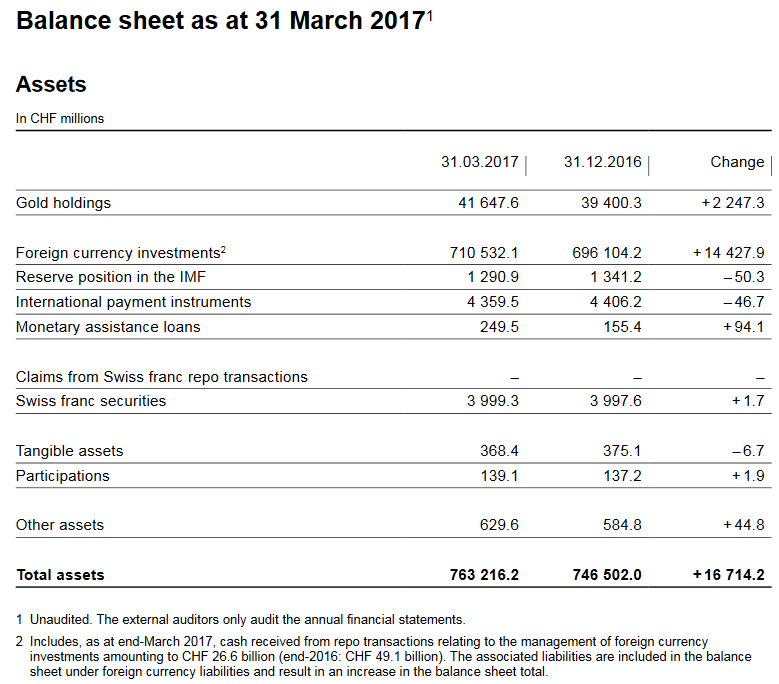

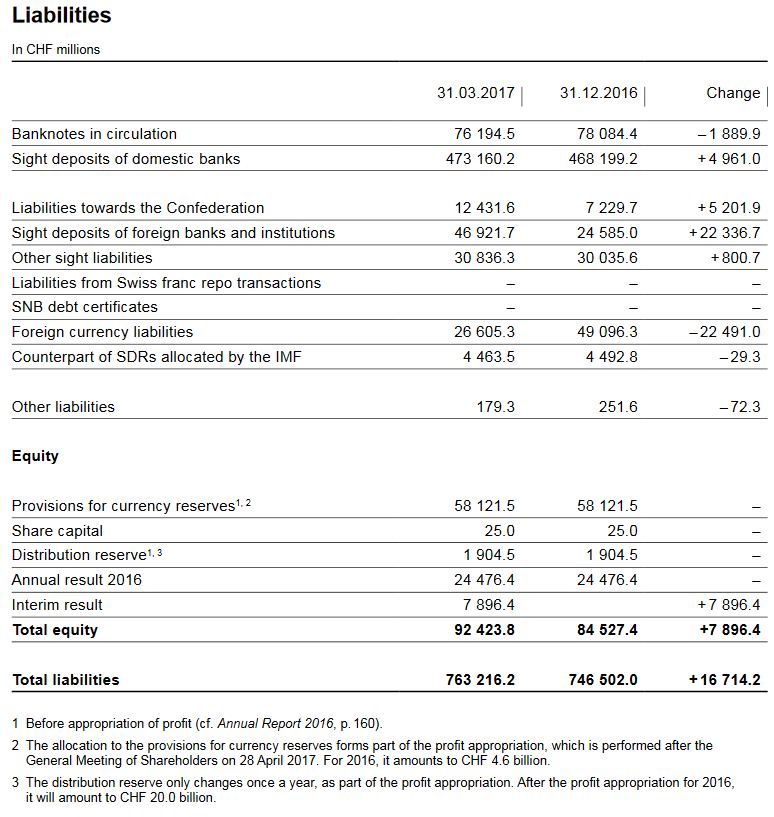

Balance Sheet The balance sheet has expanded by over 16,7 bn. francs

|

Balance Sheet at 31 March 2017 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||

Profit on Swiss franc positionsThe SNB maintains its profitability, last but not least, thanks to the reduction of the profitability of banks. When too many funds arrive on their accounts, they must deposit them on their sight deposit account at the SNB.

Negative Interest ratesFurthermore, the SNB harms the Swiss economy, when it reduces the profits of Swiss banks by negative interest rates. But with this measure she maintains her own profitability.

|

One essential part of SNB profits are negative interest rates Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||

SNB LiabilitiesSight deposits is the biggest part of SNB interventions

Banknotes in circulation: -1.9 bn francs to 76 bn. CHF Provisions for currency reserves

|

Liabilities track the SNB interventions Source: snb.ch - Click to enlarge |

Tags: Featured,newslettersent,SNB balance sheet,SNB equity holdings,SNB Gold Holdings,SNB profit,SNB results,SNB sight deposits,Swiss National Bank