From the official news release Interim results of the Swiss National Bank as at 31 March 2017 The Swiss National Bank (SNB) reports a profit of CHF 7.9 billion for the first quarter of 2017. A valuation gain of CHF 2.2 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 5.3 billion. The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets. Strong fluctuations are therefore to be expected, and only provisional conclusions are possible as regards the annual result. The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse SNB Results Longterm 2016 - Click to enlarge Profit on foreign currency positions The net result on foreign currency positions amounted to CHF 5.3 billion. Interest income accounted for CHF 2.1 billion and dividends for CHF 0.6 billion. Movements in bond prices differed from those in share prices. A loss of CHF 1.6 billion was recorded on interest-bearing paper and instruments.

Topics:

Swiss National Bank considers the following as important: Featured, newsletter, SNB, SNB balance sheet, SNB equity holdings, SNB Gold Holdings, SNB Press Releases, SNB profit, SNB results, SNB sight deposits, Swiss National Bank

This could be interesting, too:

investrends.ch writes Schweizer Firmen ziehen wieder Investitionen aus dem Ausland ab

investrends.ch writes Die Zurückhaltung der SNB wird mehrheitlich begrüsst

investrends.ch writes Schweizer Inflation fällt etwas stärker als gedacht

investrends.ch writes SNB erzielt nach 9 Monaten einen Gewinn von 12,6 Milliarden Franken

From the official news release

Interim results of the Swiss National Bank as at 31 March 2017

The Swiss National Bank (SNB) reports a profit of CHF 7.9 billion for the first quarter of 2017.A valuation gain of CHF 2.2 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 5.3 billion.The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets. Strong fluctuations are therefore to be expected, and only provisional conclusions are possible as regards the annual result.

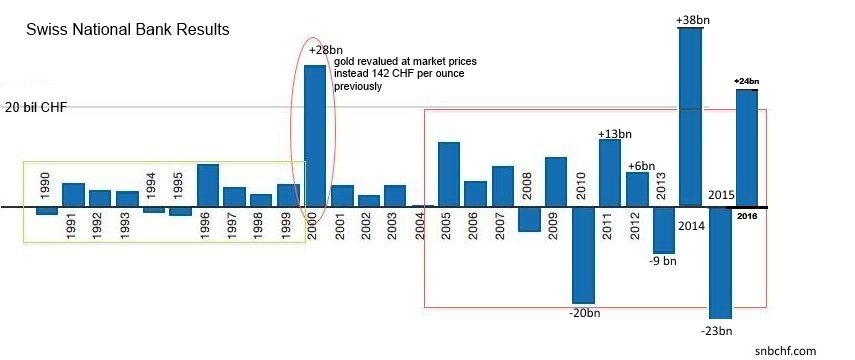

The increasing volatility of SNB EarningsAnnual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse |

SNB Results Longterm 2016 |

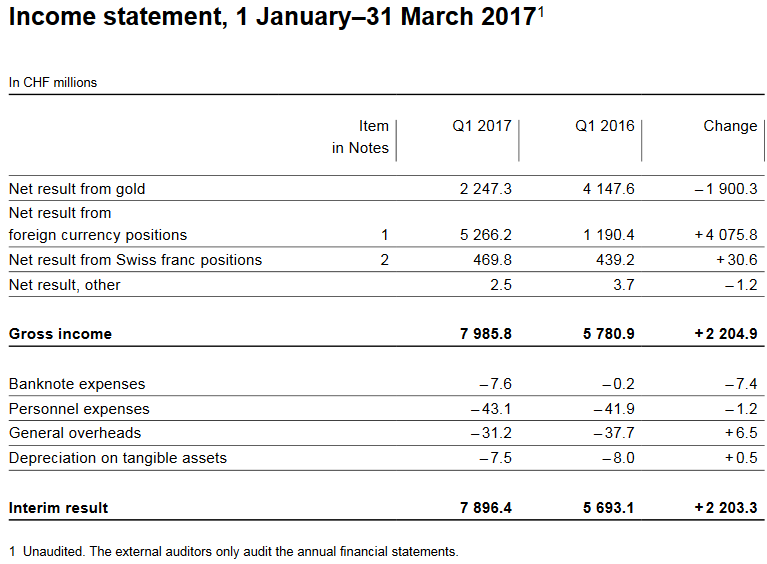

Profit on foreign currency positionsThe net result on foreign currency positions amounted to CHF 5.3 billion.

Interest income accounted for CHF 2.1 billion and dividends for CHF 0.6 billion. Movements in bond prices differed from those in share prices. A loss of CHF 1.6 billion was recorded on interest-bearing paper and instruments. By contrast, equity securities and instruments benefited from the favourable stock market environment and contributed CHF 6.3 billion to the net result. Overall, exchange rate-related losses amounted to CHF 2.2 billion.

|

SNB Results in the first 1 Quarters 2017: +2.2 billion CHF Source: snb.ch - Click to enlarge |

Valuation gain on gold holdingsA valuation gain of CHF 2.2 billion was achieved on gold holdings, which were unchanged in volume terms. Gold was trading at CHF 40,045 per kilogram at end-March 2017 (end-2016: CHF 37,885).

Profit on Swiss franc positionsThe profit on Swiss franc positions, which totalled CHF 0.5 billion, essentially resulted from the negative interest on sight deposit account balances.

|

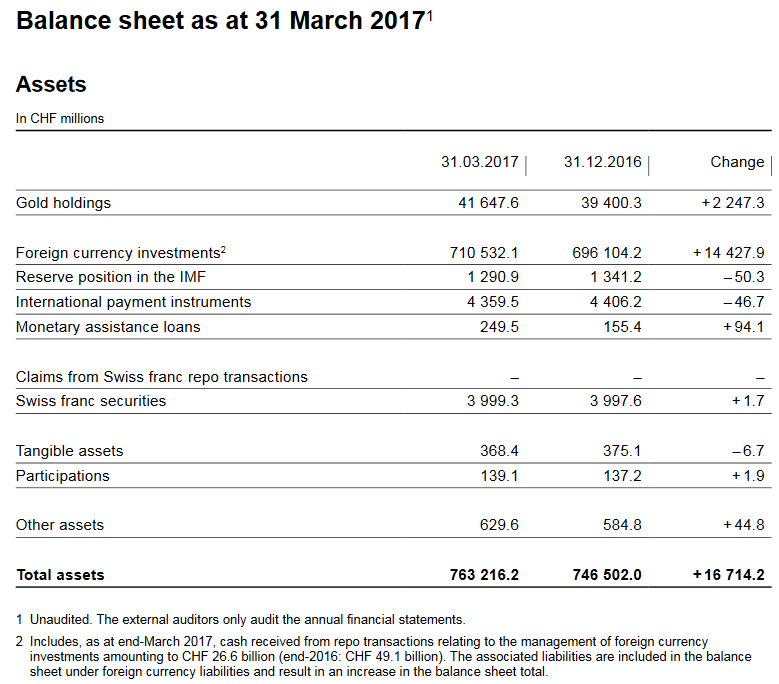

Balance Sheet at 31 March 2017 Source: snb.ch - Click to enlarge |

Provisions for currency reservesAs at end-March 2017, the SNB recorded a profit of CHF 7.9 billion, before the allocation to the provisions for currency reserves.

In accordance with art. 30 para. 1 of the National Bank Act (NBA), the SNB is required to set aside provisions permitting it to maintain the currency reserves at the level necessary for monetary policy. The allocation for 2017 will be determined at the end of the year.

|

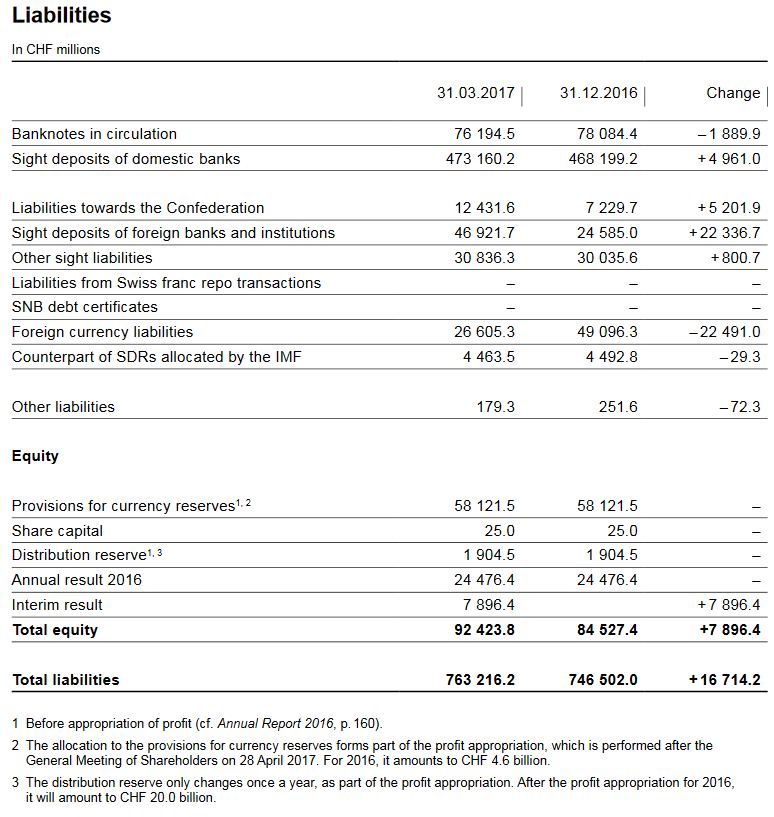

Liabilities track the SNB interventions Source: snb.ch - Click to enlarge |

Tags: Featured,newsletter,SNB balance sheet,SNB equity holdings,SNB Gold Holdings,SNB profit,SNB results,SNB sight deposits,Swiss National Bank