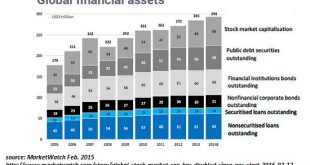

Shall we compare the damage that will be done when all these bubbles pop? Regardless of one’s own views about bitcoin/cryptocurrency, what is truly remarkable is the asymmetry that is applied to questioning the status quo and bitcoin. As I noted yesterday, everyone seems just fine with throwing away $20 billion in electricity annually in the U.S. alone to keep hundreds of millions of gadgets in stand-by mode, but the...

Read More »Japan: It isn’t What the Media Tell You

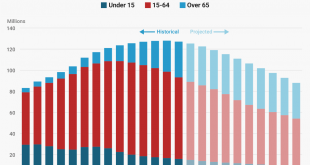

Known for Being Terrible For the past few decades, Japan has been known for its stagnant economy, falling stock market, and most importantly its terrible demographics. Japan's Population by age, 1950 - 2065A chart of Japan’s much-bewailed demographic horror-show. - Click to enlarge Most people consider a declining population to be a bad thing due to the implications for assorted state-run pay-as-you-go Ponzi...

Read More »Hochriskante SNB-Verschuldung: von Herrn Jordan selbst bestätigt!

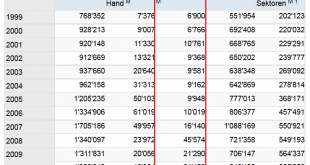

Und das dazu noch zweimal… Wer ist sich in unserem Land bewusst, dass Ende 2016, die Gesamtverschuldung der Schweiz gegenüber dem Ausland den imposanten Betrag von 1‘721 Milliarden (!) Franken erreichte? Diese, auf dem Datenportal der SNB für alle zugängliche Info, darf mit einer weiteren bemerkenswerten Beobachtung vervollständigt werden. Und zwar: die Nationalbank ist selbst in Höhe von über 100 Milliarden Franken...

Read More »Swiss Retail Sales, October: -2.7 Percent Nominal and -1.6 Percent Real

The Used Goods Question Retail sales in several countries like Germany, Japan and Switzerland continue to fall or they remain steady for years. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans or Japanese pay more attention so...

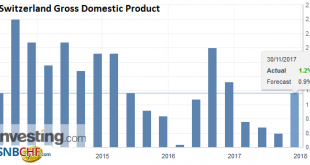

Read More »Switzerland Q3 GDP: +1.2 percent QoQ

Switzerland’s real gross domestic product (GDP) grew by 0.6 % in the 3rd quarter of 2017,* boosted by manufacturing in particular. Many service sectors also contributed to growth, including trade, business services and healthcare. By contrast, value added fell slightly in construction and the financial sector. On the expenditure side, both domestic final demand and foreign trade underpinned GDP. Consumption, investment...

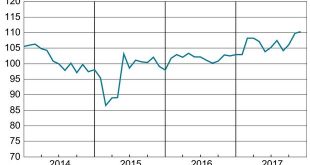

Read More »KOF Economic Barometer: Swiss Economy Gains Pace

The KOF Economic Barometer continued its upward tendency in November. It rose by 0.5 points to 110.3 points (after revised 109.8 in October). This is the third consecutive increase of the indicator. The Swiss economy continues to gain momentum towards the end of the year. As in the previous month, the indicators for manufacturing are responsible for a substantial part of the increase. In addition, the...

Read More »FX Daily, November 30: US Dollar Comes Back Bid, but Brexit Hopes Underpin Sterling

Swiss Franc The Euro has risen by 0.37% to 1.1705 CHF. EUR/CHF and USD/CHF, November 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is broadly firmer. The rise in US yields yesterday has seen the greenback extend its recovery against the yen. It briefly pushed through JPY112.40, after dipping below JPY111.00 at the start of the week, for the first time...

Read More »Health insurance premium index 2017: Premium increases from 2016 to 2017 curb growth in disposable income by 0.3 percentage points

Premium growth from 2016 to 2017 dampens the development of disposable income by 0.3 percentage points Neuchâtel, 24.11.2017 (FSO) – The health insurance premiums index (CIPI) recorded a growth of 3.8 percent over the previous year for the 2017 premium year. The KVPI thus achieved an index level of 185.3 points (base 1999 = 100). The impact of premium development on the growth of disposable income can be estimated...

Read More »Swiss Financial Accounts, 2016 edition

Financial assets and liabilities of the institutional sectors The financial accounts form part of Switzerland’s system of national accounts. They show the financial assets and liabilities of the economy’s institutional sectors, which are non-financial and financial corporations, general government and households. The major developments in the financial accounts are outlined below. Households In 2016, household...

Read More »Bitcoin – Die Tulpenknolle des Computerzeitalters

Von 10 auf 100 auf 1’000 auf 10’000 Dollar. Das ist die Kursentwicklung von Bitcoins in den wenigen Jahren seit ihrem Bestehen bis gestern früh. Der Vergleich mit der Tulpenmanie in der Hochblüte Hollands ist nicht mehr fern. Der Preis einer kostbaren Tulpenzwiebel stieg im 17. Jahrhundert in Holland auf das über 60-fache eines durchschnittlichen damaligen Jahressalärs. So gesehen könnte ein Bitcoin aus Schweizer Sicht...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org