Swiss Franc The Euro has risen by 0.12% to 1.1665 CHF. EUR/CHF and USD/CHF, November 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Prospects of a deal with the EU has sent sterling to its best level in two months against the dollar. It reached $1.3430 in early European turnover. It had sunk to nearly $1.3220 yesterday as European markets were closing, which was a...

Read More »WEF founder flags need for solidarity

The city of Geneva honoured Schwab this year for his work in relation to WEF, which is based in Geneva. (© KEYSTONE / SALVATORE DI NOLFI) - Click to enlarge In an interview with newspaper NZZamSonntag, Klaus Schwab, founder of the World Economic Forum, says that WEF is more relevant than ever. “We’re the witnesses to a transformation from a unipolar to a multipolar world. In this situation, the attempt to...

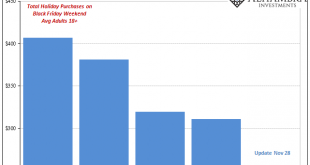

Read More »Fading Black Friday

Black Friday was once the king of all shopping. A retailer could make its year up on that one day, often by gimmicking its way to insane single-day volume. Those days, however, are certainly over. Though the day after Thanksgiving still means a great deal, as the annual flood of viral consumer brawl videos demonstrate, it’s just not what it once was. The change has meant something in terms of economic commentary, too....

Read More »Switzerland UBS Consumption Indicator October: UBS consumption indicator trends sideways

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. The UBS consumption indicator was quoted at 1.54 points in October, suggesting that private consumption is growing at a solid pace in the fourth quarter. A weaker Swiss franc and a drop in unemployment provide...

Read More »Un algorithme du Credit Suisse avait pour but de gagner de l’argent au détriment de ses clients

- Click to enlarge Le grand déballage des « arrières cuisines » des marchés des changes et de leurs dérives se poursuit sur tous les continents . Les petits arrangements entre traders sur un des marchés les moins régulés, ne sont plus tolérés. Dernier exemple en date aux Etats-Unis, la banque Credit Suisse a reçu une amende de 135 millions de dollars pour la violation de certaines règles (partage...

Read More »FX Daily, November 28: Greenback Ticks Up in Cautious Activity

Swiss Franc The Euro has risen by 0.10% to 1.1687 CHF. EUR/CHF and USD/CHF, November 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is consolidating its recent losses with a small upside bias. What promises to be an eventful week has begun with the Bank of England stress test and the publication of the Fed’s Powell prepared remarks for his confirmation...

Read More »Precious Metals Supply and Demand – Thanksgiving Week

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Grain of Salt Required The price of gold fell $7, and that of silver 24 cents. This was a holiday shortened week, due to Thanksgiving on Thursday in the US (and likely thin trading and poor liquidity on Wednesday and Friday). So take the numbers this week, including the basis, with a grain of that once-monetary commodity,...

Read More »Weekly Technical Analysis: 28/11/2017 – USD/CHF, USD/JPY, EUR/USD, GBP/USD, GBP/JPY

USD/CHF The USDCHF pair fluctuates around 0.9800 level, accompanied by stochastic reach to the overbought areas now, while the EMA50 keeps pushing negatively on the price and protects trading inside the bearish channel that appears on chart. Therefore, these factors encourage us to continue suggesting the bearish trend in the upcoming sessions, and breaking 0.9800 will confirm opening the way to head towards 0.9730...

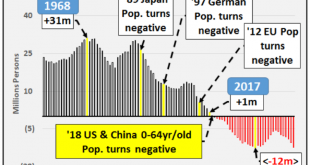

Read More »Demographic Dysphoria: Swiss Village Offers Families Over $70,000 To Live There

Across the world, demographic dysphoria is taking shape, creating numerous headaches for governments. To avoid the next economic downturn, governments are searching for creative measures to increase population growth and deliver a sustainable economy. In Europe, a near decade of excessive monetary policy coupled with a massive influx of refugees have not been able to reverse negative population growth– first spotted in...

Read More »Bitcoin Facts

A Useful Infographic When we last wrote more extensively about Bitcoin (see Parabolic Coin – evidently, it has become a lot more “parabolic” since then), we said we would soon return to the subject of Bitcoin and monetary theory in these pages. This long planned article was delayed for a number of reasons, one of which was that we realized that Keith Weiner’s series on the topic would give us a good opportunity to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org