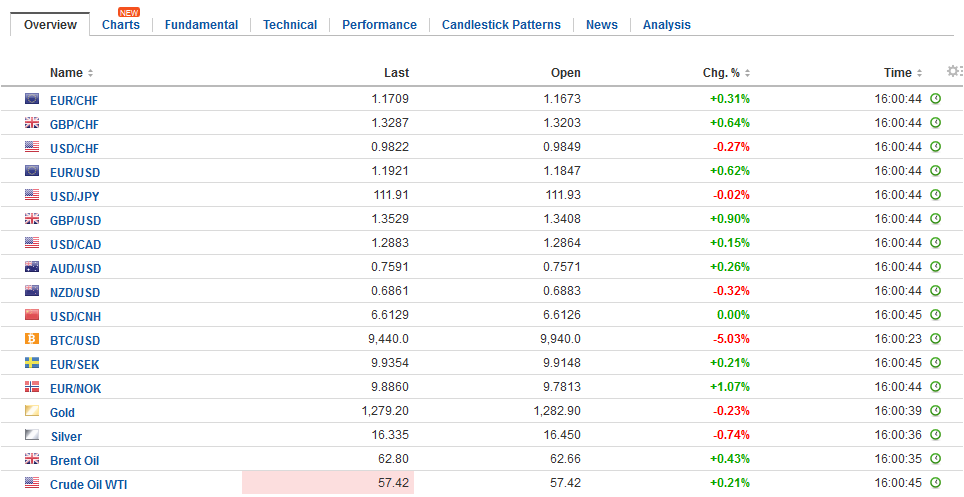

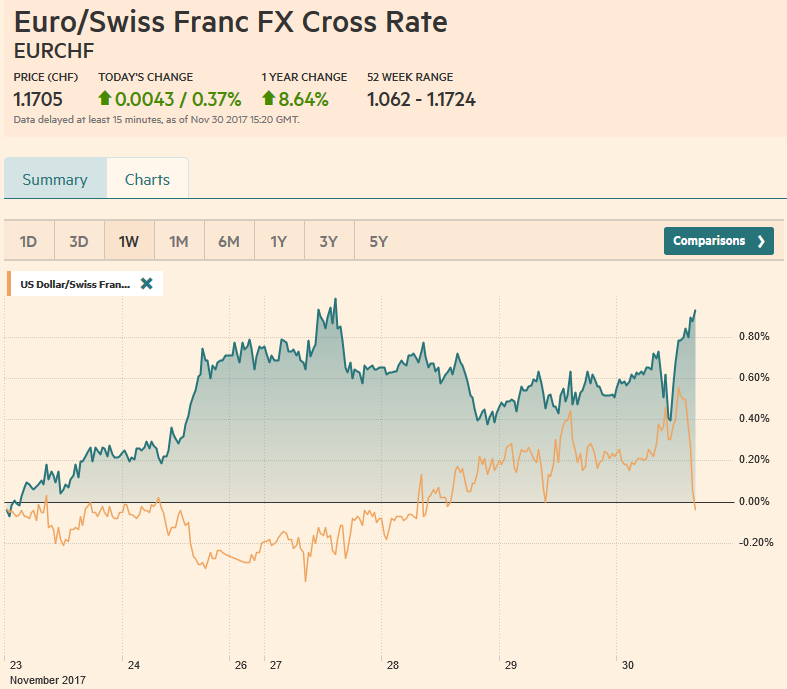

Swiss Franc The Euro has risen by 0.37% to 1.1705 CHF. EUR/CHF and USD/CHF, November 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is broadly firmer. The rise in US yields yesterday has seen the greenback extend its recovery against the yen. It briefly pushed through JPY112.40, after dipping below JPY111.00 at the start of the week, for the first time since mid-September. Since the end of last week, been capped at the 200-day moving average against the yen, found near JPY111.70, but yesterday it pushed past. There are nearly bln of options struck between JPY112.20-JPY112.65. The euro was initially firmed in Asia but ran out of steam in front of

Topics:

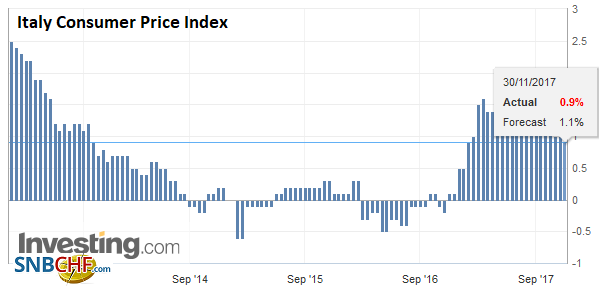

Marc Chandler considers the following as important: CAD, China Manufacturing PMI, China Non-Manufacturing PMI, EUR, EUR/CHF, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Eurozone Unemployment Rate, Featured, France Consumer Price Index, FX Trends, GBP, Germany Retail Sales, Germany Unemployment Change, Germany Unemployment n.s.a., Germany Unemployment Rate, Italy Consumer Price Index, Japan Construction Orders, Japan Industrial Production, JPY, newsletter, Spain Gross Domestic Product, U.S. Chicago PMI, U.S. Core PCE Price Index, U.S. Initial Jobless Claims, U.S. Personal Income, USD, USD/CHF, Yuan

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.37% to 1.1705 CHF. |

EUR/CHF and USD/CHF, November 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

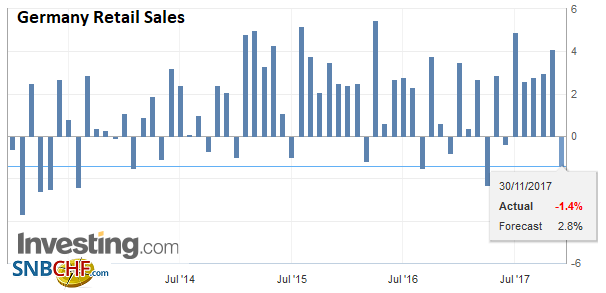

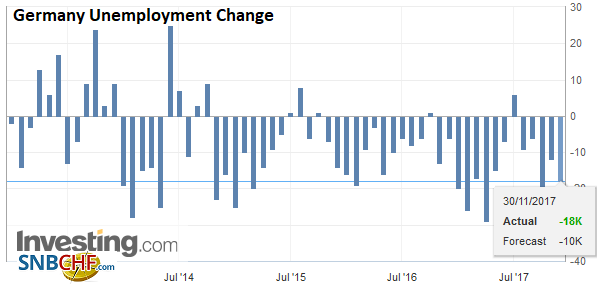

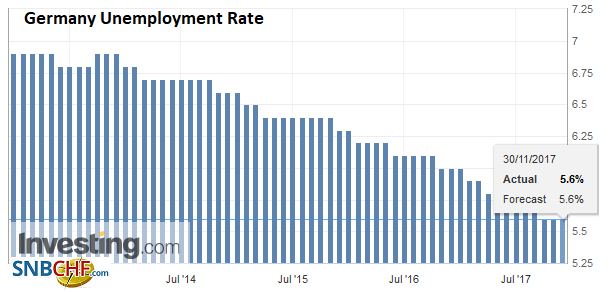

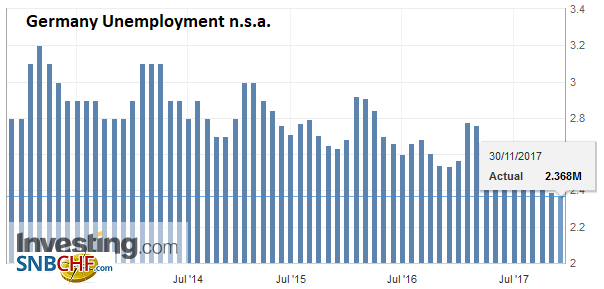

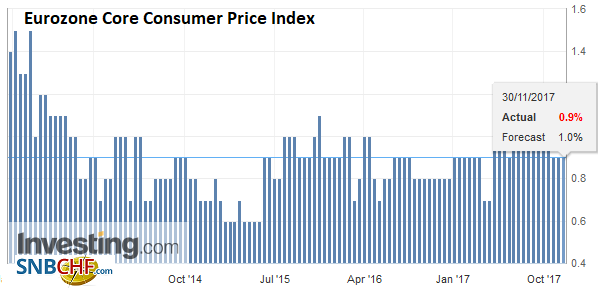

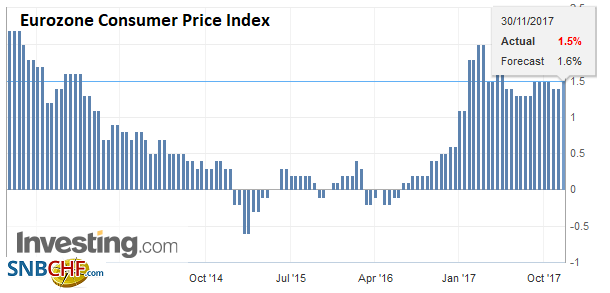

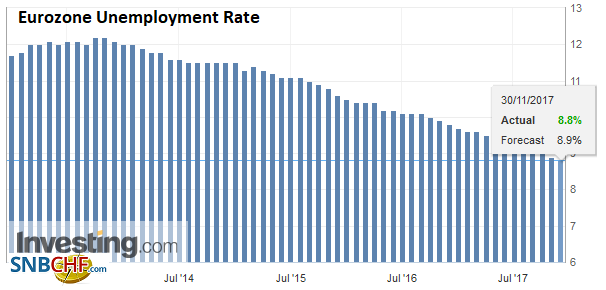

FX RatesThe US dollar is broadly firmer. The rise in US yields yesterday has seen the greenback extend its recovery against the yen. It briefly pushed through JPY112.40, after dipping below JPY111.00 at the start of the week, for the first time since mid-September. Since the end of last week, been capped at the 200-day moving average against the yen, found near JPY111.70, but yesterday it pushed past. There are nearly $1 bln of options struck between JPY112.20-JPY112.65. The euro was initially firmed in Asia but ran out of steam in front of yesterday’s high near $1.1880. Although there was some positive economic news, like the larger than expected decline in German unemployment (-18k), and the eurozone unemployment fell eased to 8.8% from 8.9%. However, the market took its cues from the disappointing inflation figures. The preliminary estimate of November CPI rose to 1.5% from 1.4%. This was a touch less than expected, but the larger disappointment was with the core CPI. It was unchanged at 0.9%. Recall that the core rate bottomed in early 2015 at 0.6%. The improvement, despite the extraordinary monetary policy and the swelling of the central bank’s balance sheet, has succeeded in barely lifting the core rate off its floor. Despite the strong real; sector and survey data, which will likely prompt the ECB staff to raise their economic projections that were less optimistic than the EC’s forecasts, the disappointment with price pressures will keep the hawks at bay. |

FX Daily Rates, November 30 |

| The euro is finding good bids ahead of important support seen at $1.1800. There are nearly 2.5 bln euros in options struck at $1.1840-$1.1845 that expire today that could be in play in the North American morning. There is also pressure on the euro coming from the sterling cross. The euro has been sold below GBP0.8800. It is approaching the low from November 2 seen near GBP0.8765. Nearby support is seen near GBP0.8740-GBP0.8750.

Sterling has been bolstered by reports that an agreement in principle on the Irish border may be at hand. Time is running out. Prime Minister May’s lunch with Juncker this coming Monday appears to be the key deadline. The UK would likely have to affirm its commitment to the Good Friday Agreement. Ireland wants to have a written commitment that regulatory regime will not diverge post-Brexit. It is a difficult issue. It comes down to where a harder border will exist–between Northern Ireland and the Republic, which all parties say is unacceptable, or a hard border in the UK to demarcate the special status of Northern Ireland, as in the Hong Kong-China model. In the ten sessions before this week, sterling appreciated in eight. After slipping Monday, it is up for the third consecutive session today. The year’s high was set on September 20 near $1.3660. Provided it holds above $1.34, that is the next important target. |

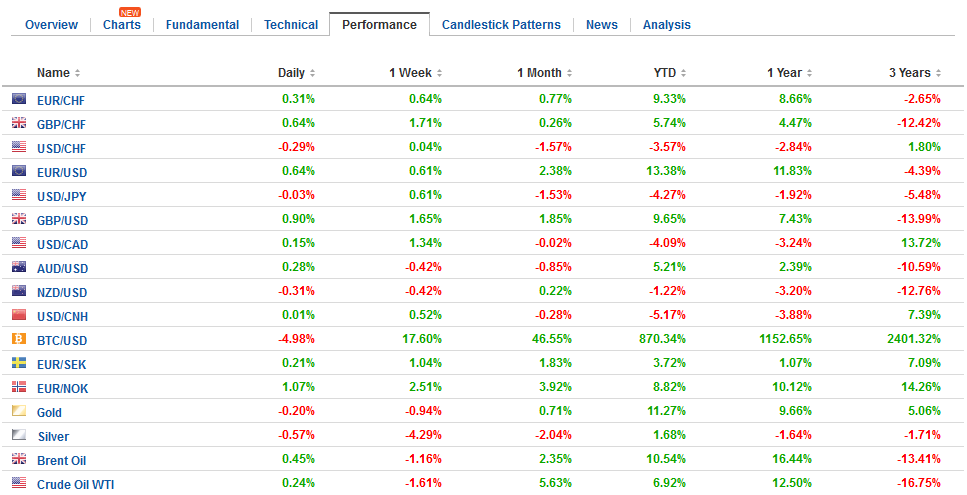

FX Performance, November 30 |

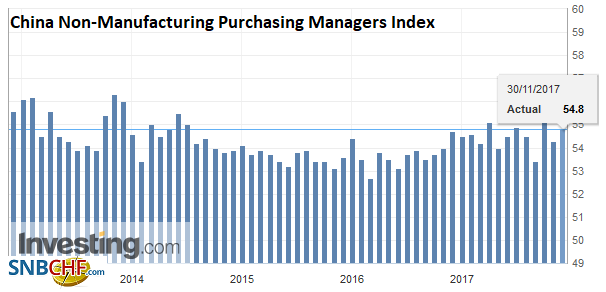

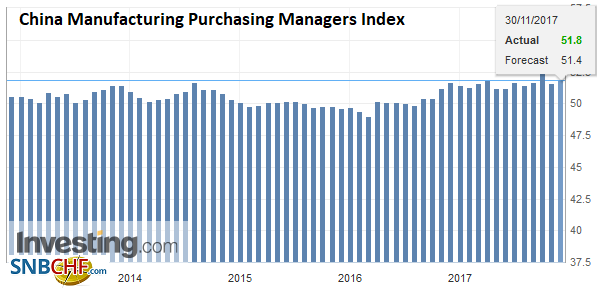

ChinaChina reported slightly better than expected PMI readings. The official manufacturing PMI rose to 51.8 from 51.6. Many had expected a small decline. The non-manufacturing PMI rose to 54.8 form 54.3. |

China Manufacturing Purchasing Managers Index (PMI), Nov 2017(see more posts on China Manufacturing Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

| Chinese shares fared better than most in the region. The Shanghai Composite fell 0.6%. Tuesday’s low near 3300, was the low since late August. The yuan is steady today in the face of the dollar’s firmer today, which makes it among the strongest currencies today. |

China Non-Manufacturing Purchasing Managers Index (PMI), Nov 2017(see more posts on China Non-Manufacturing PMI, ) |

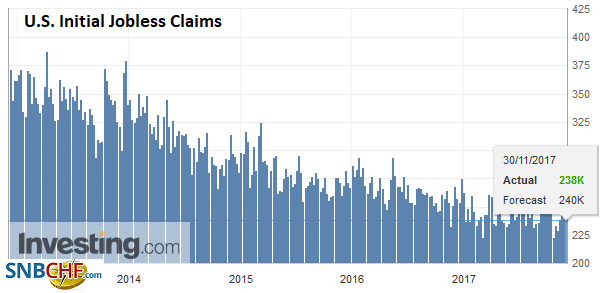

United StatesThere are three talking points in the US. First, tax reform. It may be voted on by the Senate today. It is close, and there is some talk of last-minute tweaks that could include a discretionary spending cut trigger instead of a corporate tax increase trigger, which seems to be more in keeping with the spirit of the thrust of this tax bill. |

U.S. Initial Jobless Claims, 30 November(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

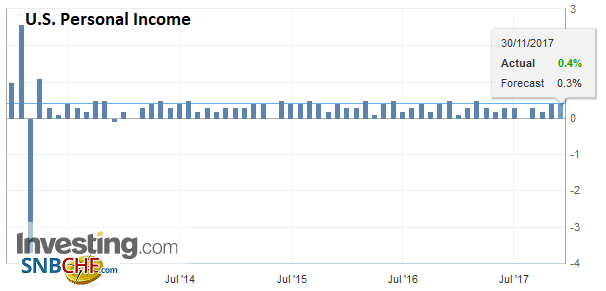

| Second are the data. The US reports personal income and consumption figures that will be used to calculate Q4 GDP. Yesterday investors learned that Q3 rose to 3.3% from 3.0% of the initial estimate. Consumption was revised lower (2.3% from 2.5%), but spending on business equipment rose 10.4% ( a three-year high) from the initial estimate of 8.6%. |

U.S. Personal Income, Oct 2017(see more posts on U.S. Personal Income, ) Source: Investing.com - Click to enlarge |

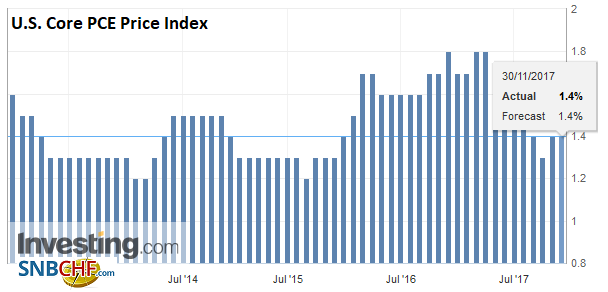

| The US also reports the core PCE deflator, which is what the Fed targets. The deflator has begun to recover from the slide earlier this year (from nearly 1.9% in January to a little below 1.3% in September. |

U.S. Core PCE Price Index YoY, Oct 2017(see more posts on U.S. Core PCE Price Index, ) Source: Investing.com - Click to enlarge |

| It is expected to rise to 1.4%. We suspect there is a greater risk of the surprise coming to the upside rather than the downside. |

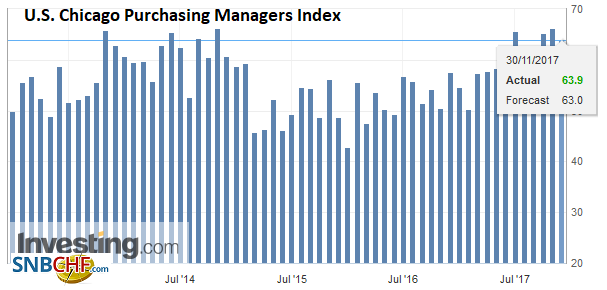

U.S. Chicago Purchasing Managers Index (PMI), Nov 2017(see more posts on U.S. Chicago Purchasing Managers Index, ) Source: Investing.com - Click to enlarge |

Japan |

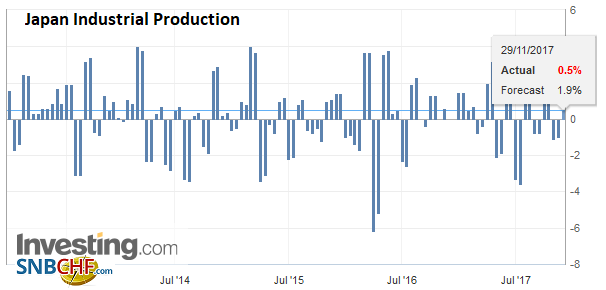

Japan Industrial Production, Oct 2017(see more posts on Japan Industrial Production, ) Source: Investing.com - Click to enlarge |

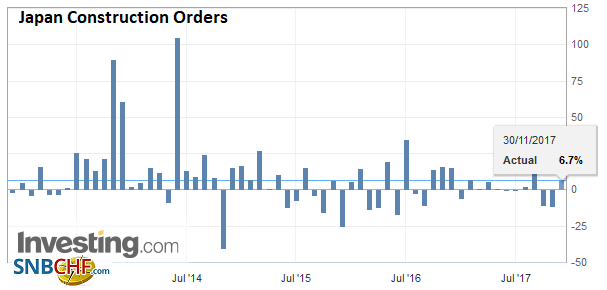

Japan Construction Orders YoY, Oct 2017(see more posts on Japan Construction Orders, ) Source: Investing.com - Click to enlarge |

|

Germany |

Germany Retail Sales YoY, Oct 2017(see more posts on Germany Retail Sales, ) Source: Investing.com - Click to enlarge |

Germany Unemployment Change, Nov 2017(see more posts on Germany Unemployment Change, ) Source: Investing.com - Click to enlarge |

|

Germany Unemployment Rate, Nov 2017(see more posts on Germany Unemployment Rate, ) Source: Investing.com - Click to enlarge |

|

Germany Unemployment n.s.a., Nov 2017(see more posts on Germany Unemployment n.s.a., ) Source: Investing.com - Click to enlarge |

|

Eurozone |

Eurozone Core Consumer Price Index (CPI) YoY, Nov 2017(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Eurozone Consumer Price Index (CPI) YoY, Nov 2017(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

|

Eurozone Unemployment Rate, Oct 2017(see more posts on Eurozone Unemployment Rate, ) Source: Investing.com - Click to enlarge |

|

Spain |

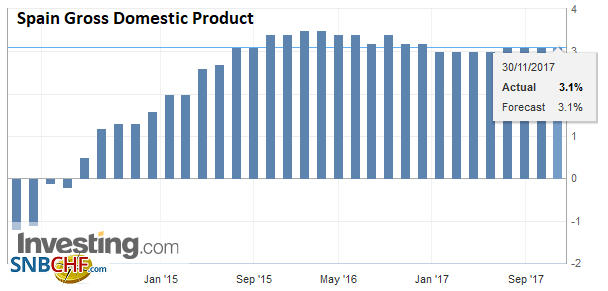

Spain Gross Domestic Product (GDP) YoY, Q3 2017(see more posts on Spain Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

France |

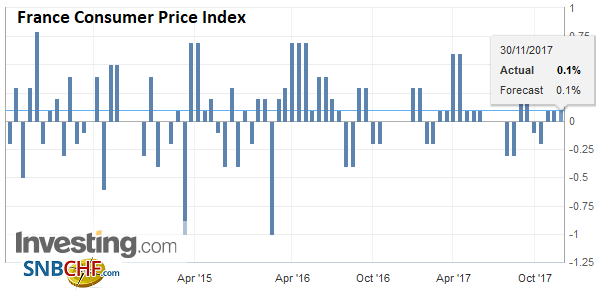

France Consumer Price Index (CPI), Nov 2017(see more posts on France Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Italy |

Italy Consumer Price Index (CPI) YoY, Nov 2017(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

There were two notable developments in Asia earlier today. First, Korea’s central bank hiked the seven-day repo rate to 1.50% from the record low 1.25% set in June 2016. It is the first hike in six years and was largely anticipated. The dollar rose a little more than 1% against the won, the largest advance since March. Korean shares fell nearly 1.5%, while the MSCI Asia Pacific Index shed 1% for it fourth consecutive loss.

OPEC and non-OPEC countries appear set to agree on a nine-month extension. There had been reports that Russia was wavering and seemed to be favoring a six-month extension over a nine-month extension. The appreciation in price is welcome, of course, by producers, but there is some discussion that the cartel could overdo it, and set the stage for a surge in US output.

Late yesterday, President Trump nominated Goodfriend to the Fed’s board of Governors. It is widely regarded as a solid choice and one that has been talked about for nearly six months. Goodfriend is a mainstream macro-economist who is sensitive to the international context. His past criticism of the Federal Reserve suggests he may be more sympathetic to hiking rates earlier in the cycle that has typically been the case. He also seems somewhat less interested in activist fiscal policy. He may be more interested in negative interest rates than Bernanke or Yellen.

Lastly, we note that the Canadian dollar is weakening for the fourth consecutive session. The US dollar is approaching the late October highs near CAD1.2915. Recall in the larger picture; we have been looking for a test on the CAD1.2930, which is a 50% retracement of the year’s decline. Our next target is near CAD1.3130. After a strong Q4 16-Q217 performance, the Canadian economy is slowing markedly. Tomorrow Q3 GDP will be reported. It is expected to have slowed to 1.6% (annualized) from 4.5% in Q2.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CAD,$EUR,$JPY,China Manufacturing PMI,China Non-Manufacturing PMI,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Eurozone Unemployment Rate,Featured,France Consumer Price Index,Germany Retail Sales,Germany Unemployment Change,Germany Unemployment n.s.a.,Germany Unemployment Rate,Italy Consumer Price Index,Japan Construction Orders,Japan Industrial Production,newsletter,Spain Gross Domestic Product,U.S. Chicago PMI,U.S. Core PCE Price Index,U.S. Initial Jobless Claims,U.S. Personal Income,USD/CHF,yuan