Swiss Franc The Euro has risen by 0.47% at 1.1361. EUR/CHF and USD/CHF, August 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has steadied after pulling back in recent days, but the downside correction does not appear complete, and month-end flows are still a risk to picking a dollar-bottom. The Australian dollar is the weakest of the majors. The main...

Read More »Here’s How We Ended Up with Predatory, Parasitic Elites

Combine financialization, neoliberalism and moral bankruptcy, and you end up with predatory, parasitic elites. How did our financial and political elites become predatory parasites? Some will answer that elites have always been predatory parasites; as tempting as it may be to offer a blanket denunciation of elites, this overlooks the eras in which elites rose to meet existential crises.Following in Ancient Rome’s...

Read More »Anticipating How Welcome This Second Deluge Will Be

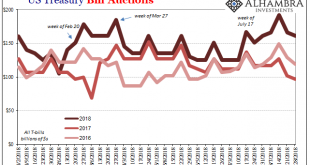

Effective federal funds (EFF) was 1.92% again yesterday. That’s now eight in a row just 3 bps underneath the “technically adjusted” IOER. If indeed the FOMC has to make another one to this tortured tool we know already who will be blamed for it. The Treasury Department announced yesterday that it will be auctioning off $65 billion in 4-week bills this week (today). The results showed that dealers submitted $152 billion...

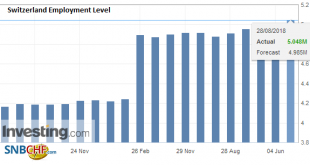

Read More »Employment Barometer in the Q2 2018: Sharp Rise in Employment in Switzerland

Neuchâtel, 28 August 2018 (FSO) – In the 2nd quarter 2018, total employment (number of jobs) rose by 2.1% in comparison with the same quarter a year earlier (+0.4% with previous quarter). In full-time equivalents, employment in the same period rose by 2.0%. The Swiss economy counted 14 000 more vacancies than in the corresponding quarter of the previous year (+22.6%) and the employment outlook indicator is also...

Read More »FX Daily, August 28: Greenback Remains On Defensive

Swiss Franc The Euro has risen by 0.07% at 1.143. EUR/CHF and USD/CHF, August 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Corrective forces continue to weigh on the US dollar. Sometimes the narratives drive the price action and sometimes the price action drives the narratives. Currently the latter appears to hold sway. The dollar’s downside correction began around...

Read More »Government Reinforces Critical Infrastructure against Cyber Attacks

Increasing use of digital technology can unlock many opportunities but also present new threats to countries’ vital health and energy systems and infrastructure. (Keystone) In the wake of several major cyber security attacks, the government has released minimum standards for companies and organisations to help protect the country’s critical energy, food, and water infrastructure. Some critics question whether a minimum...

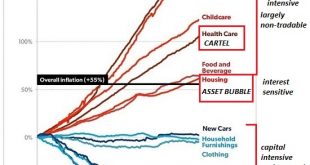

Read More »To Understand America’s Neofeudal Economy, Start with Extortion

Here is the result of America’s neofeudalism: soaring wealth and income inequality. Let’s spin the time machine back to the late Middle Ages, at the height of feudalism, and imagine we’re trying to get a boatload of goods to the nearest city to sell. As we drift down the river, we’re constantly being stopped and charged a fee for transiting one small fiefdom after another. When we finally reach the city, there’s an...

Read More »Another Gold Bearish Factor, Report 26 August 2018

Last week, we said that the consensus is that gold must go down (as measured in terms of the unstable dollar) and then will rocket higher. We suggested that if everyone expects an outcome in the market, the outcome is likely not to turn out that way. We also said that this time, there is likely less leverage employed to buy gold and that gold is less leveraged as well. And this, combined with a contrarian perspective on...

Read More »FX Daily, August 27: A Dog Day of Summer

Swiss Franc The Euro has risen by 0.03% at 1.1439. EUR/CHF and USD/CHF, August 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Last week’s dollar losses were initially extended in Asia before it came back bid. The euro briefly poked through $1.1650 for the first time in three weeks. However, the gains were sold into, and the euro finished the Asian session near $1.16,...

Read More »FX Weekly Preview: Macroeconomic Considerations

The force that had pushed the US 10-year Treasury yield to 3% and the dollar above JPY113 at the start of the month, and the euro to $1.13 a couple of weeks ago has dissipated. The 10-year yield is near 2.80%. The dollar was near two-month lows against the yen a week ago, and the euro was back toward the middle of its previous $1.15-$1.18 trading range. Even the Australian dollar, the worst performing of the major...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org