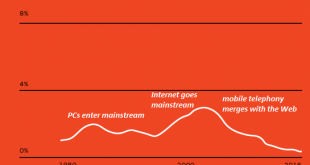

The only possible output of this system is extortion as a way of life. As the accompanying chart shows, productivity in the U.S. has been declining since the early 2000s. This trend mystifies economists, as the tremendous investments in software, robotics, networks and mobile computing would be expected to boost productivity, as these tools enable every individual who knows how to use them to produce more value. One...

Read More »Italian 2019 draft budget: a bumpy road ahead

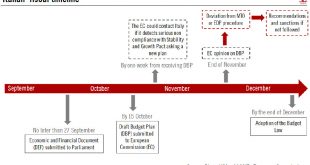

Tensions between Rome and Brussels could lead to significant market volatility before an agreement is found. September will be a key month for gauging the Italian government’s budgetary plans for 2019. The government has communicated neither a precise timeline for implementing the measures announced in its ‘contract for government’ nor a precise cost analysis for these measures. In this contract, the governing...

Read More »Costs of owning a home in Switzerland set to rise for some

Currently, home owners in Switzerland must pay tax on fictional rent, calculated based on a home’s size and location. At the same time home owners get to deduct mortgage interest and home maintenance costs from their taxable income. ©-Stefano-Ember-_-Dreamstime.com_ - Click to enlarge The system was designed to bring the taxation of home owners into line with that of renters. The logic is sound. Renters must pay rent...

Read More »FX Daily, August 31: Month-End Adjustments and Tentative Stabilization in Emerging Markets Ease Demand for Dollars but Not Yen

Swiss Franc The Euro has risen by 0.29% at 1.1275. EUR/CHF and USD/CHF, August 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dramatic price action seen yesterday among several emerging market currencies is eased today, but here at month-end, demand for risk-assets is tentative at best. The macro backdrop, including the increase in US core inflation, expectations...

Read More »Why Am I Fighting for the Gold Standard?

Life is good. They could not have imagined what we have now, back in the dark ages. So I have never understood why people prep for a return to the dark ages. The only thing I can think of is that they don’t really picture what life is like. 14 hours a day of back-breaking labor to eke out a subsistence living. Subject to the risks of rain, sun, and insects. Prepping makes no sense to me. I don’t know if I would choose...

Read More »KOF Economic Barometer: Falling

In August 2018, the KOF Economic Barometer fell slightly by 1.4 points to a new reading of 100.3. It thus now pints to a level that is only marginally above its long-term average. Accordingly, in the near future Swiss growth should hover around its average over the last ten years. In August 2018, the KOF Economic Barometer fell from 101.7 in the previous month (revised up from 101.1) by 1.4 points to a...

Read More »FX Daily, August 30: Brexit Optimism Underpins Sterling

Swiss Franc The Euro has risen by 0.40% at 1.1315. EUR/CHF and USD/CHF, August 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is mostly firmer, while global equities are softer and bonds little changed. The Turkish lira and South African rand remain under pressures. However, there does not appear to be an overall theme in today’s markets. Disappointing...

Read More »A Fake Brexit and the “Noble Dream” – Claudio Grass Speaks With Godfrey Bloom

Introductory Remarks: The “Anti-Politician” Godfrey Bloom, by PT Most of our readers will probably remember former UKIP chief whip and European Parliament representative Godfrey Bloom. As far as we know, he is the only politician who ever raised the issue of the workings of the fractionally reserved central bank-directed monetary system in the EU parliament. This system is of course central to the phenomenon of the...

Read More »COMCO declines to investigate watchmakers over cartel claims

Small watchmakers had complained about restrictions to the supply of spare parts by major watch firms (Keystone) The Swiss Competition Commission (COMCO) has decided not to open a formal investigation into watchmakers including Swatch, LVMH and Richemont over the supply of spare parts for independent watch repair shops. Citing a separate European Commission decision about the same firms, COMCO said in a statement on...

Read More »Swiss Job Numbers Up but too Few Qualified Workers

In the second quarter of 2018, the number of jobs in Switzerland rose to 5.048 million, a 2.1% increase on the second quarter of 2017. ©-Catalin205-_-Dreamstime.com_ - Click to enlarge Regions rising the most were Lake Geneva (+3.0%), north west Switzerland (+3.0%), central Switzerland (+2.4%) and Zurich (+2.1%). Rises in job numbers in eastern Switzerland (+1.6%), Mittelland (+1.3%) and Ticino (0%) were lower. Sectors...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org