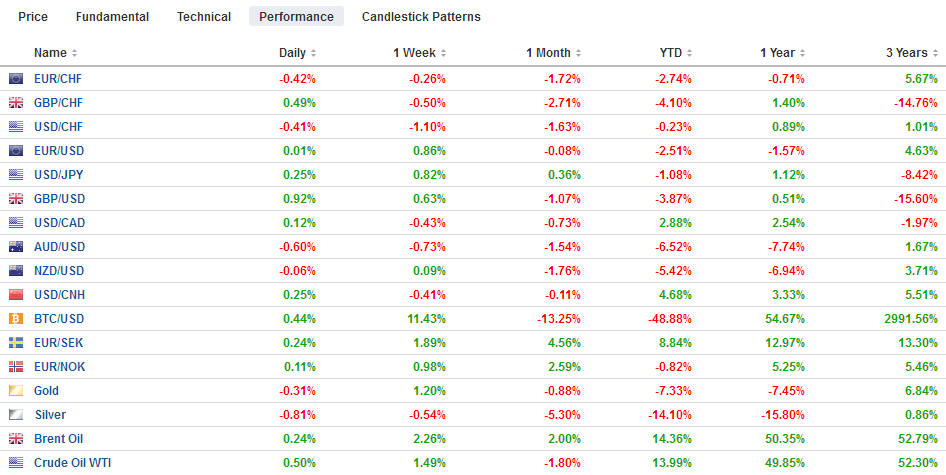

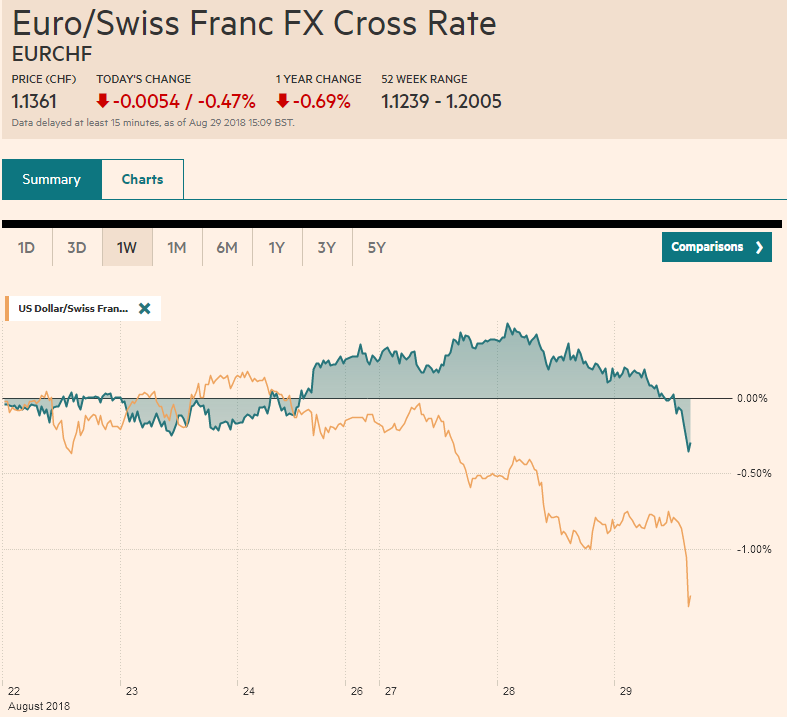

Swiss Franc The Euro has risen by 0.47% at 1.1361. EUR/CHF and USD/CHF, August 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has steadied after pulling back in recent days, but the downside correction does not appear complete, and month-end flows are still a risk to picking a dollar-bottom. The Australian dollar is the weakest of the majors. The main drag is paradoxically Westpac, one of Australia’s largest banks, raised the variable rate mortgage by 14 bp to 5.38%. Others are expected to follow. The reasons the Aussie was sold on the news was that it makes an RBA hike less likely. Interest rates eased a couple of basis points on the

Topics:

Marc Chandler considers the following as important: $TRY, 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, newsletter, Taiwan, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.47% at 1.1361. |

EUR/CHF and USD/CHF, August 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar has steadied after pulling back in recent days, but the downside correction does not appear complete, and month-end flows are still a risk to picking a dollar-bottom. The Australian dollar is the weakest of the majors. The main drag is paradoxically Westpac, one of Australia’s largest banks, raised the variable rate mortgage by 14 bp to 5.38%. Others are expected to follow. The reasons the Aussie was sold on the news was that it makes an RBA hike less likely. Interest rates eased a couple of basis points on the announcement. The RBA has held the cash rate steady at 1.5%, but Australian banks rely on offshore funding and rates have risen. Last week, Westpac reported that its net interest rate margin had fallen last quarter and the shares suffered the biggest weekly loss in about six years. The Australian dollar is off about 0.4% to nearly $0.7300, the bottom of the previous trading range that it re-entered last week. A break of $0.7280 could signal a return toward the recent lows, first $0.7280 and then $0.7240. |

FX Performance, August 29 |

In Asia, the dollar has forged a base against the Chinese yuan near CNY6.80 as the area held for a fourth consecutive session. The dollar firmed about 0.3% to CNY6.8250. While the MSCI Asia Pacific Index rose 0.3%, the fourth consecutive advancing sessions and the eighth in the past nine. It held yesterday’s gap higher opening. Chinese A (mainland) and H (Hong Kong listed) shares fell. The Shanghai Composite slipped 0.3%. An index of H shares edged 0.15% lower, barely shaving the 3% gains scored in the past two sessions.

The big equity story in Asia today comes from Taiwan where the Taiex gapped higher to test a two-month high. Foreign investors bought an estimated $435 mln of Taiwan shares, the most in over a year. The leading stock was Taiwan Semiconductor Manufacturing (TSCM +3.8%) anticipation of Apple’s new products.

Meanwhile, the Nikkei extended its rally for a seventh consecutive session. It traded inside Tuesday’s range. The challenge appears technical. It is bumping up against the 23,000 level which has stymied the rallies since the middle of May. The dollar, for its part, has been confined to exceptionally narrow ranges against the yen. It is in a roughly 10 tick range on either side of JPY111.20, which houses a $1 bln option that expires today. It is difficult to get excited while the greenback is in a JPY111.00 to JPY111.40-50 range.

European shares lost momentum yesterday after reaching its best level in a couple of weeks. The Dow Jones Stoxx 600 is off fractionally. Only real estates and industrials sectors are higher. Core bond yields are a bit firmer, while the peripheral yields are softer, with Italy’s 10-year yield off three basis points. We do not put much stock in the local press story that Italy is proposing a new bond-buying program that would aim to counter speculation and the risk of a downgrade. This seems more like wishful thinking than a politically realistic proposal.

The euro rallied more than four cents off the August 15 low near $1.13. Our initial target for the correction was near $1.1750, and before stalling yesterday, it had reached $1.1730. The euro has slipped to $1.1660 today, mostly in Asia. Short-term participants in Europe appear to be testing the waters to buy this pullback. A break below $1.1635-$1.1640 would be more important technically. Several chunky options that are expiring today. There are about 750 euros at $1.1640 and 1.4 bln at $1.1675, and another 550 mln euros are $1.17 that will be cut.

For more than a week, sterling has been confined to a fairly narrow range of $1.2800 to about $1.2930. It tested the upside yesterday before pulling back. It has mostly traded in a 15 tick range around $1.2860 today. There appears to be further confirmation that officials in the UK and EU have all but given up on a deal by the mid-October heads of state summit. The fallback option is the middle of November. It seems to be as clear of a sign as imaginable that progress has been slow. It is seen lending confirmation to the elevated risk of an exit without an agreement. Prime Minister May’s attempt to soften the blow and nearly try to make a virtue out of necessity may not have swayed many. Note that there is a GBP420 mln option at $1.2880 that expires today.

Most emerging market currencies are lower with the exception of the Mexican peso and Taiwanese dollar. The Turkish lira once again has the dubious honor of being the weakest currency. It is off 1.8% after losing 4.4% over the past two sessions. The dollar finished last week, during which local markets were on holiday, near TRY6.0. Today it has reached TRY6.40. The decision by the central bank to tighten liquidity by reintroducing borrowing caps on the overnight transactions with the central bank, which had been lifted on August 13 is a minor attempt to steady the currency. The limits are twice as large as were previously in place (now TRY44 bln, roughly ~$7 bln). This is a poor substitute for a rate hike. While odds of direct assistance by Germany was always stretch, some kind of help to avoid a new refugee problem should not surprise.

The closer the market looked at the US trade deal with Mexico, fewer participants seemed to like it and the Mexican peso sold off. The US dollar, which had fallen to MXN18.60 on the initial optimism, recovered to almost MXN19.12 on Tuesday. The dollar rose nearly 1.6% against the peso, the most in two months. The aggressive US stance coupled with a lame duck Mexican President and significant asymmetries of power seemed to favor Mexican concessions and/or adopting the provisions of the previously negotiation Trans-Pacific Partnership.

In any event, we think that Canada’s role is considerably more significant that President Trump has let on. The trade-promotion authority he was granted by Congress was the renegotiation of a trilateral agreement. It is not clear to Washington insiders that Congress would approve a deal that excluded Canada, which is the main foreign trading partner of 36 of the 50 US states.

The US is putting pressure on Canada to reach an agreement over the next couple of days. The schedule is not very flexible. AMLO takes office December 1. If Congress can be notified on August 31, that means that a revised NAFTA bill Congress can vote on is November 30. The 115th Congress is likely to conclude in early December. A lame-duck session of Congress could be called to vote on it, but this seems less probable, especially after the first week or so of the December. That could leave it in the hands of the 116th Congress, which will be decided in November, and as is typically the case, the polls show the party occupying the White House will lose seats in both chambers. It seems more likely that the Democrats win a majority in the House than the Senate, but it is still not clear.

Moreover, while US and Mexican politics have shaped the process, Canadian politics seem less understood. Quebec, which is a major supporter of the “supply management” that is used to protect Canada’s dairy industry, holds provincial elections on October 1. There is room to compromise, as Canada has shown, for example, in its trade agreement with the EU to grant a concession.

The US dollar has fallen against the Canadian dollar for the past three sessions and is straddling unchanged levels now. The greenback traded below CAD1.29 for the first time since early June. The market may be reluctant to push it out of a CAD1.2880-CAD1.2980 range until there is greater clarification about the new NAFTA talks.

A crucial point for many investors is not simply the timing of Fed hikes, with a September hike nearly inevitable, and a December move increasingly likely (67.5% now vs. 55.3% August 17) but also the neutral rate. The idea is that the Fed may pause near the neutral rate. What is the neutral rate? Fed watchers assume the neutral rate is the Fed’s long-term forecasts for fed funds. The median of the June forecasts put long-term fed funds rate at 2.875%. This is consistent with the signals from Fed officials in recent weeks of two-three more rate hikes.

However, Clarida, confirmed by the Senate yesterday, as the new Vice Chairman of the Fed (leaving still three vacancies on the seven-member board), suggested at his confirmation hearing that the new neutral may be closer to 2% than 3%. The US tax cuts and spending increases may encourage Clarida to support the 2-3 rate hike scenario that has been suggested. If this is beyond neutrality may not be so important, especially in light of Powell’s disdain for emphasizing non-observable constructs, like r*.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,$TRY,Featured,newsletter,Taiwan