„Die Devisenreserve der SNB sind keine Zeitbombe, die uns einmal um die Ohren fliegt, sondern eine Art Volksvermögen“. Das behauptet die SNB-freundliche NZZ am Sonntag. Das Blatt bedient ein SNB-Klischee nach dem anderen und hat den Ernst der Lage unserer Schweizerischen Nationalbank (SNB) offensichtlich nicht begriffen. - Click to enlarge Die SNB habe „Geld aus dem Nichts geschaffen“ – einen „gigantischen...

Read More »Minister says state-guaranteed cantonal banks complicate EU talks

The cantonal banks are 24 Swiss government-owned commercial banks. (Keystone) Swiss finance minister Ueli Maurer says state-guaranteed cantonal banks are an obstacle in ongoing negotiations with the European Union. “This point still needs to be clarified before a framework agreement can be accepted,” the minister is quoted as saying in an interview published on Saturday. The European Union does not permit the kind of...

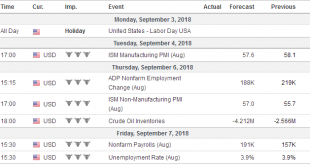

Read More »FX Weekly Preview: Trade Trumps US Jobs and Rising Stress in Spain and Italy is More Important than the PMI

The first week of a new month features the US jobs data. It is the most important economic report of a new month. It sets the broad tone for much of the economic data over the next several weeks, including consumption, industrial production, and construction spending. However, there are two reasons why it may not pack the punch it has in the past. First, the bar to dissuade the market against a 25 bp rate hike on...

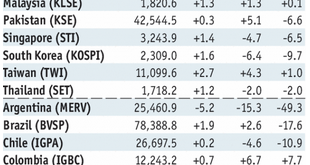

Read More »Emerging Markets: What Changed

Summary China stepped up efforts to attract more foreign inflows to the onshore bond market. Russia has softened its unpopular pension reform proposal. The African National Congress withdrew an existing land expropriation bill. Moody’s downgraded twenty Turkish financial institutions. Turkey central bank Deputy Governor Erkan Kilimci has reportedly resigned. Moody’s moved the outlook on Egypt’s B3 rating from stable to...

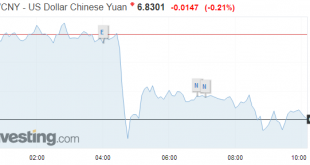

Read More »As Emerging Market Currencies Collapse, Gold is being Mobilized

In recent weeks, global financial markets have been increasingly spooked by an intensifying crisis in emerging market currencies including those of Turkey and Argentina. Add to this the ongoing currency crisis in Venezuela and the currency problems of Iran. While all of these countries have economy specific reasons that explain at least some of their currency weakness, there are some common themes such as a stronger US...

Read More »Swiss cantons forced to fish for multinationals with non-tax lures

When multinationals google “the best Swiss canton” in future, the results may show markedly different results. (Keystone) Proposed changes to Switzerland’s tax rules could have a dramatic effect on which cantons remain attractive locations for multinational companies in future. As a result, factors such as the cost of premises or concentration of high tech facilities, will play a greater role, according to UBS bank....

Read More »SkyWork lands its last ever plane in Bern Airport

End of the runway: financial problems have forced SkyWork to wind down. (© KEYSTONE / PETER KLAUNZER) The last SkyWork flight landed in Bern Airport on Wednesday night, as ongoing financial difficulties forced the company to declare itself bankrupt. Some 11,000 passengers are affected. The company, founded in 1983, cited the failure of negotiations with a potential partner to pull the company from recurring funding...

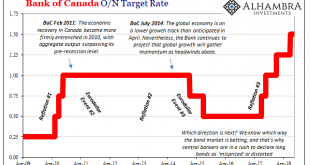

Read More »‘Mispriced’ Bonds Are Everywhere

The US yield curve isn’t the only one on the precipice. There are any number of them that are getting attention for all the wrong reasons. At least those rationalizations provided by mainstream Economists and the central bankers they parrot. As noted yesterday, the UST 2s10s is now the most requested data out of FRED. It’s not just that the UST curve is askew, it’s more important given how many of them are. Look to our...

Read More »The Big Picture 18-24-Month Outlook: Some Preliminary Projections

The winding down of the North’s summer provides a suitable time to consider not the near-term outlook, which many investors do on a daily basis, but to reflect on where we are heading down the road a bit. What will the next 18-24 months hold? Of course, we harbor no illusions of prescient vision and accept the hazards of the assignment and so should the reader. The effect of monetary tightening and fiscal stimulus...

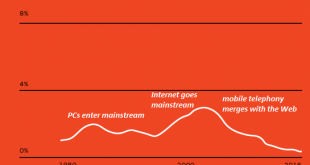

Read More »Why Is Productivity Dead in the Water?

The only possible output of this system is extortion as a way of life. As the accompanying chart shows, productivity in the U.S. has been declining since the early 2000s. This trend mystifies economists, as the tremendous investments in software, robotics, networks and mobile computing would be expected to boost productivity, as these tools enable every individual who knows how to use them to produce more value. One...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org