It’s a common misconception that the world’s major central banks and monetary authorities own large quantities of gold bars. Most of them do not. Instead, this gold is owned by the sovereign states that have entrusted it to the respective nation’s central bank, and the central banks are merely acting as guardians of the gold. Tracing the ownership question a step further, what are sovereign states? A sovereign state is...

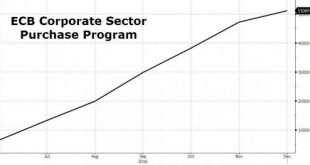

Read More »ECB Assets Rise Above 36 percent Of Eurozone GDP; Draghi Now Owns 10.2 percent Of European Corporate Bonds

The ECB’s nationalization of the European corporate bond sector continues. In the ECB’s latest update, the six central banks acting on behalf of the Euro system provided an update on the list of corporate bonds they bought. They bought into 810 issuances with a total of €573bn in amount outstanding. For the week ending 27th January, the bond purchases stood at €1.9bn across sectors. This increases the number of...

Read More »Collateral Values in ECB Operations

In the NZZ, Kjell Nyborg questions whether the collateral values of the securities the ECB accepts in monetary policy operations reflect market values. He argues that the valuation is discretionary and politicized. Meine Analyse macht deutlich, dass der Besicherungsrahmen in der Euro-Zone in unterschiedlicher Ausprägung unter all diesen Problemen leidet. Das öffentliche Verzeichnis der zulässigen notenbankfähigen Sicherheiten enthält 30 000 bis 40 000 verschiedene Wertpapiere, von...

Read More »These Are The 3 Main Issues For Europe In 2017

Submitted by George Friedman and Jacob Shapiro via MauldinEconomics.com, What will the year ahead look like for Europe? 2017 will be another chapter in the European Union’s slow unraveling… a process that has been underway for over a decade. The EU is a union in name only. The transfer of sovereignty to Brussels was never total, and member states are independent countries… each with their own interests at stake....

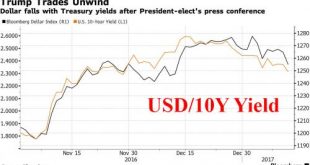

Read More »Dollar, Futures Slump; Gold Spikes Over $1,200 After Trump Disappoints Markets

Risk assets declined across the globe, with European, Asian shares and S&P 500 futures all falling, while the dollar slumped against most currencies after a news conference by President-elect Donald Trump disappointed investors with limited details of his economic-stimulus plans, and the Trumpflation/reflation trade was said to be unwinding. "The risk was always that a president like Trump would end up upsetting that consensus (of faster U.S. growth, stronger dollar) view by introducing...

Read More »Gold Rises In All Currencies In 2016 – 9 percent In USD, 13 percent In EUR and 31.5 percent In GBP

– Gold gains in USD, GBP, EUR, CAD, AUD, NZD, JPY – Gold gains in CNY, INR & most emerging market currencies– Gold surges 31.5% in British pounds after Brexit shock– Gold acted as hedge and safe haven in 2016 … for those who need safe haven– Furthers signs of market having bottomed and bodes well for 2017 – What drivers will gold respond to in 2017? – EU elections and contagion risk, Geo-politics, terrorism, war...

Read More »Gold Rises In All Currencies In 2016 – 9 percent In USD, 13 percent In EUR and 31.5 percent In GBP

– Gold gains in USD, GBP, EUR, CAD, AUD, NZD, JPY – Gold gains in CNY, INR & most emerging market currencies– Gold surges 31.5% in British pounds after Brexit shock– Gold acted as hedge and safe haven in 2016 … for those who need safe haven– Furthers signs of market having bottomed and bodes well for 2017 – What drivers will gold respond to in 2017? – EU elections and contagion risk, Geo-politics, terrorism, war...

Read More »Nomi Prins’ Political-Financial Road Map For 2017

As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet. My prognosis is...

Read More »Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017’s ‘known unknowns’ suggest a year of more mayhem awaits… Here’s a selection of key events in the year ahead (and links to Bloomberg’s quick-takes on each). January Donald Trump will be sworn in as U.S. president on Jan. 20.QuickTakes: Immigration Reform, Free Trade and Its Foes, Supreme Court, Oil Sands, Confronting Coal, Climate Change,...

Read More »A Biased 2017 Forecast, Part 1

“The idea that the future is unpredictable is undermined every day by the ease with which the past is explained.” – Daniel Kahneman, Thinking, Fast and Slow A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org