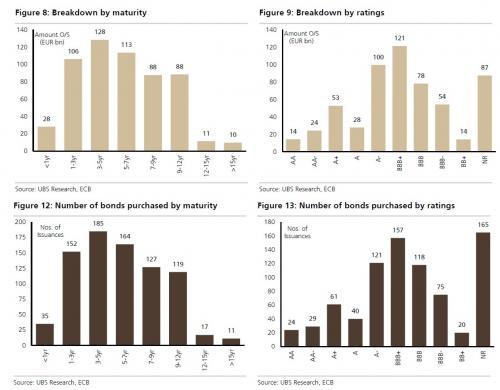

The ECB’s nationalization of the European corporate bond sector continues. In the ECB’s latest update, the six central banks acting on behalf of the Euro system provided an update on the list of corporate bonds they bought. They bought into 810 issuances with a total of €573bn in amount outstanding. For the week ending 27th January, the bond purchases stood at €1.9bn across sectors. This increases the number of securities held by the ECB to 813, and lift the ECB’s total corporate bond holdings to €58.82b, which means that as of the latest weekly data, the ECB now owns 10.2% of the total €575.42BN in European corporate debt outstanding. Since one month ago, the ECB owned 9.2% of the corporate bond market, the rate of nationalization of the private, outstanding corporate bonds is roughly 1% per month. Tangentially, 52 or 6.4% of the 813 securities held by the ECB are negative yielding. Which corporate bonds did Mario Draghi generously subsidize this week? According to the ECB’s holdings, utilities remain the largest industry group with 215 securities, while according to Bloomberg, in the latest week the ECB bought bonds issued by Atlantia, BASF, Carmila, Enel, Fresenius, Italgas, LEG Immobilien, Linde, Legrand, RTE, Snam and Telefonica Emisiones.

Topics:

Tyler Durden considers the following as important: Across the Curve, Bond, Business, Central Banks, Corporate bond, economy, Economy of the European Union, Euro, Eurogroup, Europe and Euro Crisis, European Central Bank, European Union, Eurozone, Featured, France, Group of Thirty, Mario Draghi, Nationalization, newslettersent, Policy reactions to the Eurozone crisis, Primary Market, Switzerland

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| The ECB’s nationalization of the European corporate bond sector continues. In the ECB’s latest update, the six central banks acting on behalf of the Euro system provided an update on the list of corporate bonds they bought. They bought into 810 issuances with a total of €573bn in amount outstanding. For the week ending 27th January, the bond purchases stood at €1.9bn across sectors. This increases the number of securities held by the ECB to 813, and lift the ECB’s total corporate bond holdings to €58.82b, which means that as of the latest weekly data, the ECB now owns 10.2% of the total €575.42BN in European corporate debt outstanding.

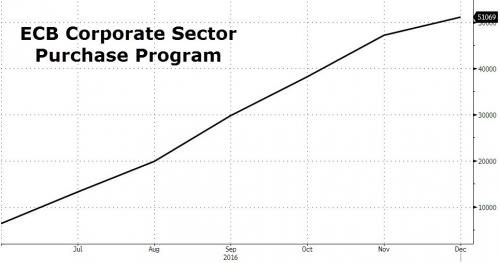

Since one month ago, the ECB owned 9.2% of the corporate bond market, the rate of nationalization of the private, outstanding corporate bonds is roughly 1% per month. Tangentially, 52 or 6.4% of the 813 securities held by the ECB are negative yielding. Which corporate bonds did Mario Draghi generously subsidize this week? According to the ECB’s holdings, utilities remain the largest industry group with 215 securities, while according to Bloomberg, in the latest week the ECB bought bonds issued by Atlantia, BASF, Carmila, Enel, Fresenius, Italgas, LEG Immobilien, Linde, Legrand, RTE, Snam and Telefonica Emisiones. The complete list of ECB holdings by ISINs can be found here. While there was some market concern in December that the ECB may be tapering its CSPP program, when it purchased just €4 billion in corporate bonds in the month, less than half the recent runrate from the September-November period, this appears to have been calendar driven, as in January the ECB is back to its aggressively purchases and through the last week, it purchased €7.8 billion in corporate bonds for January, nearly a 100% increase from the prior month. |

ECB Corporate Sector |

| Corporate purchases began on June 8, 2016, with the weekly average of ~€1.7bn per week and total corporate bond holdings of €58.8bn (as of 27-Jan-17), or roughly €6.8bn a month. ECB purchased bonds have gained 0.60% in Dec vs -1.25% in Nov. The bonds purchased under CSPP have marginally outperformed the broad index that gained 0.57% in December. Last week, total EUR issuances worth €21.2bn were issued in the primary market, of which ~ €5.2bn were CSPP eligible. For the month ending December, total CSPP holdings stood at €51.1bn, with 86% of the purchased amount coming from the secondary market.

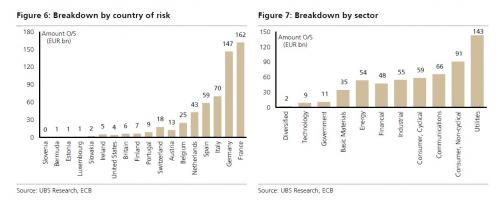

A breakdown of which countries’ bonds the ECB bought into: Looking at the break up country wise, French and German issuers continue to dominate the ISIN count (417 issuances worth €309bn in amount outstanding). Bonds from non- Eurozone corporates were also on the list, with the bulk from Switzerland (25 issuances worth €18bn). |

ECB Country and sectors |

| When looking at the purchases by sector, Utilities remains at the top (215 issuances worth €143bn), while non-cyclical consumer is a distant second (118 issuances, €91bn in amount outstanding). |

Bonds purchased by country and sectors |

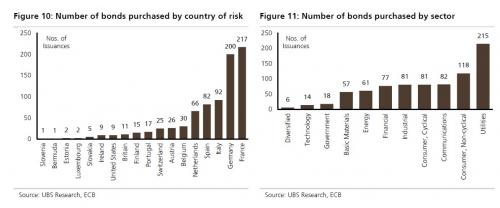

| Mostly belly of the curve, not averse to negative yields

In terms of duration, while the ECB has bought across the curve, it has avoided going very long (12+yr). Bulk of the purchases has occurred in 3-7yrs region (349 issuances worth €242bn). By rating, it’s clear that the ECB hasn’t been reluctant from taking credit risk as they have bought into overall 185 BB rated and non-rated bonds. By yield, the ECB has already bought into 96 negative yielding bonds (€75bn, average yield of – 0.09%). By issuer, the ECB has bought into 810 bonds from 233 issuing entities. The bond with the longest maturity that was purchased was the 20 year EDF 1.875% 13/10/36 from the Electricite De France. |

Breakdown by maturity and ratings |

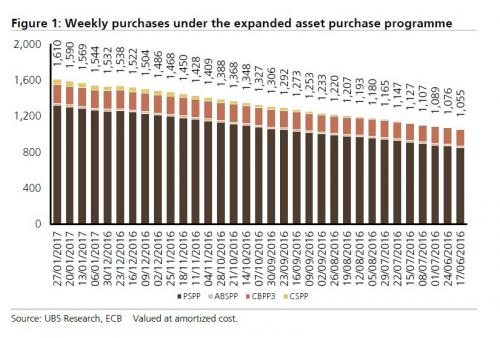

| Finally, stepping back from just the CSPP program, as of the latest week, total purchases under the ECB’s various asset purchase programmes rose to €1,610 billion… |

ECB total purchases |

| … bring the ECB’s balance sheet to over €3.72 trillion, or over 36% of the total Eurozone GDP. |

ECB Balance Sheet |

Tags: Across the Curve,Bond,Business,central banks,Corporate bond,economy,Economy of the European Union,Euro,Eurogroup,European central bank,European Union,Eurozone,Featured,France,Group of Thirty,Mario Draghi,Nationalization,newslettersent,Policy reactions to the Eurozone crisis,Primary Market,Switzerland