Summary: Spain and Portugal need to make some relatively small budget adjustments or will be denied some transfer payments. Spain’s political situation is fluid, but another window of opportunity to break the logjam is at hand. The euro seems immune to these fiscal developments; some retracement objectives are in sight. The eurozone finance ministers have accepted the EC’s recommendation that Spain and...

Read More »European Court of Justice Ruling Weighs on Italian Banks

Summary: ECJ uphold principle of bailing in junior creditors before the use of public funds. Italian banks shares snap a three-day advance. The EBA/ECB stress test results at the end of next week are the next big event. The European Court of Justice upheld the principle of making creditors bear the burden for investment in banks that sour before government funds can be used. Italian banks are particularly...

Read More »Hans-Hermann Hoppe: “Put Your Hope In Radical Decentralization”

Via The Mises Institute, [An interview with Hans-Herman Hoppe in the Polish weekly Najwy?szy Czas!] What is your assessment of contemporary Western Europe, and in particular the EU? All major political parties in Western Europe, regardless of their different names and party programs, are nowadays committed to the same fundamental idea of democratic socialism. They use democratic elections to legitimize the taxing...

Read More »Central Bank Wonderland is Complete and Now Open for Business — The Epocalypse Has Fully Begun

The following article by David Haggith was first published on the Great Recession Blog. Summer vacation is here, and the whole global family has arrived at Central-Bank Wonderland, the upside-down, inside-out world that banksters and their puppet politicians call “recovery.” Everyone is talking about it as wizened traders puzzle over how stocks and bonds soared, hand-in-hand, in face of the following list of economic...

Read More »Next Up for Central Banks: Infrastructure Investments?

In the years following the global financial crisis, the world’s leading economies have found relief through aggressive monetary policy. But with interest rates slashed to historic lows and central bank balance sheets significantly larger as a percent of GDP than they were before the financial crisis, policymakers will need alternatives to interest rate cuts and conventional quantitative easing when the next recession comes along. U.S. central bankers have cut real interest rates between...

Read More »Central Bankers Around The Globle Scramble To Defend Markets: BOE Pledges $345BN; ECB, Others Promise Liquidity

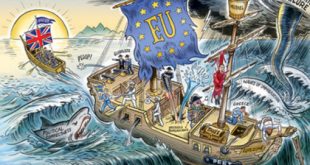

There was a reason why we warned readers two days ago that "The World's Central Bankers Are Gathering At The BIS' Basel Tower Ahead Of The Brexit Result": simply enough, it was to facilitate an immediate response when a worst-cased Brexit vote hit. And that is precisely what has happened today in the aftermath of the historic British decision to exit the EU. It started, as one would expect, with Mark Carney who said the Bank of England is ready to pump billions of pounds into the financial...

Read More »Who Is The “European Movement” And Why The Answer May Change How You Vote On “Brexit”

Werner’s main points: The “EU Movement” has been created by the US Government and their secret services in order centralise their influence over Europe. Big business, banks, central banks and the IMF want to excercise their power through unelected officials. The free trade area with the EU is beneficial and will surely be maintained, even in the Brexit case. The election outcome is not so clear as it seems to the...

Read More »The British Referendum And The Long Arm Of The Lawless

Submitted by Danielle DiMartino Booth via DiMartinoBooth.com, “Kings have long arms, many ears, and many eyes.” So read an English proverb dated back to the year of our Lord 1539. And thus was born an idiom that today translates to the very familiar Long Arm of the Law. It stands to reason that such a warning was born of feudal times when omnipotent and seemingly omnipresent monarchs personified the law, possessed...

Read More »OMT Does Not Manifestly Exceed ECB Competences

The German Federal Constitutional Court has decided that the policy decision on the OMT program does not “manifestly” exceed the competences attributed to the European Central Bank: If the conditions formulated by the Court of Justice of the European Union in its judgment of 16 June 2015 (C-62/14) and intended to limit the scope of the OMT programme are met, the complainants’ rights under Art. 38 sec. 1 sentence 1, Art. 20 secs. 1 and 2 in conjunction with Art. 79 sec. 3 of the Basic Law...

Read More »Sovereign Debt in Bank Balance Sheets

In the FT, Martin Arnold reports about estimates by Fitch according to which European banks would have to raise up to €170bn of extra capital or sell almost €500bn of sovereign debt if regulators push ahead with plans to break the “doom loop” tying lenders to their governments … The European Commission and the European Central Bank support steps in that direction while some European governments oppose them.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org