The ECB launches its Target Instant Payment Settlement (TIPS) system, which facilitates instant money transfers between banks and allows end users connected to those banks to make instant retail payments across the Euro zone. Report in the FAZ. Last year’s report by Mehreen Khan in the FT. From the ECB’s website: TIPS was developed as an extension of TARGET2 and settles payments in central bank money. TIPS currently only settles payment transfers in euro. However, in case of demand other...

Read More »A successful bank should be boring

The main risk facing ECB watchers is that the next few meetings of the Governing Council will be increasingly boring and predictable. However, from the central bankers’ perspective, this may considered a sign of success, “like a referee whose success is judged by how little his or her decisions intrude into the game itself”, to quote former BoE Governor Mervyn King. Back to the economy, downside risks stemming from...

Read More »A successful bank should be boring

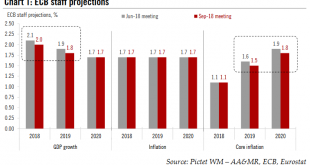

No changes to the ECB’s monetary stance and policy guidance mean we are holding to our forecasts for quantitative easing and rate hikes.The ECB made no change to its monetary stance and policy guidance at its 13 September meeting. The end of quantitative easing (QE) was confirmed for after December, following a final reduction in the pace of net asset purchases to EUR15bn per month in Q4 2018.Much of the focus was on the updated ECB staff projections. In the end, downward revisions were...

Read More »Financial Sanctions, the USD, and the EUR

On Moneyness, JP Koning discusses the ability or not of the U.S. treasury to enforce financial sanctions overseas. Focusing on the Iran sanctions that ran from 2010 to 2015 (with strong international support) and are scheduled to be reimposed soon (without such support) Koning compares the U.S. sanctions regime to an exclusivity agreement that a large retailer imposes on a manufacturer. Foreign banks in places like Europe were free to continue providing transactions services to Iran, but...

Read More »Redenomination Risk in the Eurozone

In a CEPR discussion paper Christian Bayer, Chi Kim, Alexander Kriwoluzky analyze redenomination risk during the European debt crisis and how the European Central Bank’s interventions affected this risk. They conclude that the risk fell in the case of Italy but increased for France and Germany. From the abstract: … first estimate daily default-risk-free yield curves for French, German, and Italian bonds that can be redenominated and for bonds that cannot. Then, we extract the compensation...

Read More »Weakening franc approaches symbolic mark

The SNB conducts a difficult balancing act to stabilise the national economy. (Keystone) - Click to enlarge As the Swiss franc weakens towards the threshold CHF1.20 exchange rate, the likelihood remains slim that Switzerland’s central bank will alter monetary policy any time soon. On Thursday morning a euro cost CHF1.198 francs. In February, the price of a single euro fell to under CHF1.150. The greater the...

Read More »ECB Bond Purchases: Fiscal or Monetary Policy?

In an NBER working paper, Arvind Krishnamurthy, Stefan Nagel, and Annette Vissing-Jorgensen analyze which components of bond yields were affected by the European Central Bank’s government bond purchasing programs. Given the institutional restrictions on monetary policy in the Euro area, the ECB had to carefully argue why it intervened in the first place. (To many, the case was obvious; the ECB intervention amounted to quasi-fiscal policy. But an intervention with this objective would not...

Read More »Price Effects of Purchases of Greek Sovereign Debt by the ECB

In a CEPR discussion paper, Christoph Trebesch and Jeromin Zettelmeyer argue that ECB bond buying had a large impact on the price of short and medium maturity bonds … However, the effects were limited to those sovereign bonds actually bought. We find little evidence for positive effects on market quality, or spillovers to close substitute bonds, CDS markets, or corporate bonds. A multiple equilibria view of the crisis would probably suggest otherwise.

Read More »Bubble Watch: Warning Signs That The Everything Bubble Will Burst in 2018

I believe 2018 will be the year inflation arrives. The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well. All told, in 2017 alone, these Central Banks will printed over...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org