James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

Year-end rate hike once again proves to be launchpad for gold price – FOMC follows through on much anticipated rate-hike of 0.25%– Spot gold responds by heading for biggest gain in three weeks, rising by over 1%– Final meeting for Federal Reserve Chair Janet Yellen– Yellen does not expect Trump’s tax-cut package to result in significant, strong growth for US economy– No concern for bitcoin which ‘plays a very small...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

Authored by Christoph Gisiger via Finanz und Wirtschaft, James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels and...

Read More »BoJ Briefs Reuters: We’ll Let 10-Year Yield Rise Above Zero Percent Target Around 1Q 2018

It looks like BoJ Governor, Haruhiko Kuroda’s, minions are getting out and about to brief the financial news services that the biggest stimulator of all the central banks might reduce stimulus earlier than expected. The recipient of the unofficial briefings by BoJ officials is Reuters, which has this to say. The Bank of Japan is dropping subtle, yet intentional, hints that it could edge away from crisis-mode stimulus earlier than expected, through a future hike in its yield target,...

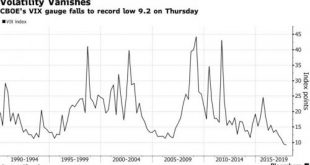

Read More »SNB: It’s A Bonfire Of The Absurdities

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

Read More »SNB: It’s A Bonfire Of The Absurdities

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

Read More »Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe Show Why Physical Gold Is Ultimate Protection

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe – Real inflation in Zimbabwe is 313 percent annually and 112 percent on a monthly basis – Venezuela’s new 100,000-bolivar note is worth less oday thehan USD 2.50 – Maduro announces plans to eliminate all physical cash – Gold rises in response to ongoing crises One Hundred Trillion Dollars Zimbabwe - Click to enlarge A military coup-de-grace in Zimbabwe...

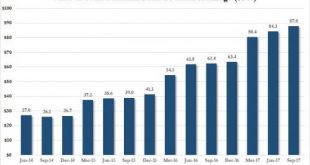

Read More »The Swiss National Bank Now Owns A Record $88 Billion In US Stocks

In the third quarter of 2017, one in which the global economy was supposedly undergoing an unprecedented “coordinated growth spurt”, and in which central banks were preparing to unveil their QE tapering intentions, in the case of the ECB, or raising rates outright, at the Fed, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using “money”...

Read More »Dollar Surge Continues Ahead Of Jobs Report; Europe Dips As Catalan Fears Return

World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red – as they have been every day this week before levitating to record highs – ahead of hurricane-distorted nonfarm payrolls data (full preview here)....

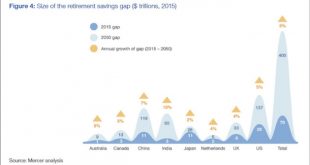

Read More »“This Is A Crisis Greater Than Any Government Can Handle”: The $400 Trillion Global Retirement Gap

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org