Commodities King Gartman Says Gold Soon Reach $1,400 As Drums of War Grow Louder - 'Commodities King' Gartman sees $1,400 gold surge in months- "Gold is the one currency that will do the best of all..."- Pullback below $1300 "is relatively inconsequential"- Use gold price weakness to be a buyer "no question"- Bullish on gold due to central banks and easy monetary policy and gold will be even higher in euro terms- Gold will be the best of all, as a result of QE and expansionary policies-...

Read More »Fed’s Asset Bubbles Now At The Mercy Of The Rest Of The World’s Central Bankers

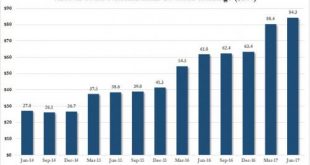

“Like watching paint dry,” is how The Fed describes the beginning of the end of its experiment with massively inflating its balance sheet to save the world. As former fund manager Richard Breslow notes, however, Yellen’s decision today means the risk-suppression boot is on the other foot (or feet) of The SNB, The ECB, and The BoJ; as he writes, “have no fear, The SNB knows what it’s doing.” As we reported previously, In...

Read More »Swiss Mystery: Someone Keeps Flushing €500 Bank Notes Down The Toilet

While there are several comments one can make here, “dirty money”, “flush with cash” and “flushing money down the toilet” certainly coming to mind, perhaps the ECB was on to something when it warned that €500 “Bin Laden” bills (which it has since discontinued to print) tend to be used by criminals. The reason for this is that in recent weeks, Swiss prosecutors have been gripped by a mystery, trying to figure out why...

Read More »Key Events In The Coming Week: All Eyes On Fed Balance Sheet Announcement

This week attention will fall on US FOMC rate decision, BoJ policy rate announcement, German and NZ elections. Economic data releases include PMI in the Euro area, retail sales in the UK and existing home sales in US. In Emerging Markets, there are monetary policy meetings in South Africa, Indonesia, Hungary, Taiwan and Philippines. BofA highlights the week's key global events: Central bank meetings: US FOMC and BoJ The Fed will make policy announcement on Wednesday. Balance sheet...

Read More »Distributed-Ledger Based Payment Systems Could Work

The ECB has published a first report on Stella, a joint research project with the Bank of Japan. The two banks are interested in potential roles that distributed ledger technology could play to support the financial market infrastructure. The report assesses whether existing payments systems could be safely and efficiently run on a distributed ledger. It concludes that a distributed-ledger-based system could meet the performance needs of real-time gross settlement systems, up to some...

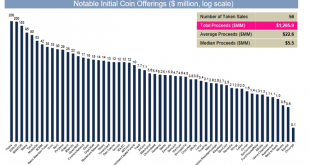

Read More »Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver

Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver Latest developments show risks in crypto currencies Confusion as bitcoin may split tomorrow SEC stepped into express concern over ICOs ICOs have so far raised $1.2 billion in 2017 ICOs preying on lack of understanding from investors Physical gold not vulnerable to technological risk Beauty and safety in simplicity of gold and silver Forks and ICOs solves bitcoin v...

Read More »German Federal Constitutional Court vs. European Central Bank

In the FT, Claire Jones reports about the German Federal Constitutional Court’s decision to refer a case against the European Central Bank’s PSPP program to the European Court of Justice. “In the view of the [court] significant reasons indicate that the ECB decisions governing the asset purchase programme violate the prohibition of monetary financing and exceed the monetary policy mandate of the European Central Bank.” … While Germany’s constitutional court said the OMT programme was...

Read More »The Secret History Of The Banking Crisis

Accounts of the financial crisis leave out the story of the secretive deals between banks that kept the show on the road. How long can the system be propped up for? - Click to enlarge It is a decade since the first tremors of what would become the Great Financial Crisis began to convulse global markets. Across the world from China and South Korea, to Ukraine, Greece, Brexit Britain and Trump’s America it has shaken...

Read More »Risk Off: Global Stocks Slide As “Fire And Fury” Results In “Selling And Fear”

US futures are set for a sharply lower open (at least in recent market terms) following a steep decline in European stocks and a selloff in Asian shares, following yesterday’s sharp escalation in the war of words between the U.S. and North Korea. In a broad risk-off move U.S. Treasuries rose, the VIX surged above 12 overnight, while German bund futures climbed to the highest level in six weeks. The Swiss franc gained...

Read More »When Do We Know These Are Delusional Markets

Latest Investment Outlook In his latest investment outlook, Fasanara Capital’s Franceso Filia, who two months ago explained in one chart how the “fake market” operates… … discuss what happens when a “Twin Bubble meets quantitative tightening” and answers why record-low volatility breeds market fragility and precedes system instability. We’ll have more to share on that shortly, but for now, here is Filia with his take...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org