According to a BIS press release, several leading central banks collaborate with the BIS on matters relating to the introduction of CBDC: The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Sveriges Riksbank and the Swiss National Bank, together with the Bank for International Settlements (BIS), have created a group to share experiences as they assess the potential cases for central bank digital currency (CBDC) in their home...

Read More »Central Banks Zoom In on CBDC

According to a BIS press release, several leading central banks collaborate with the BIS on matters relating to the introduction of CBDC: The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Sveriges Riksbank and the Swiss National Bank, together with the Bank for International Settlements (BIS), have created a group to share experiences as they assess the potential cases for central bank digital currency (CBDC) in their home jurisdictions. The group...

Read More »ECB preview – so close, yet so far away

The European Central Bank’s meeting on 6 June is unlikely to result in major policy changes, but instead will focus on risk assessment and TLTRO-III. The press conference could set the stage for a policy response should downside risks materialise.Long story short, the ECB should continue to err on the side of caution, while preparing for dovish contingencies, which could range from the easy to the scary. The easy plan would follow if risks to the outlook remain firmly tilted to the downside....

Read More »Climate Risk, Credit Risk, and ECB Collateral

In a CEP Discussion Note, Pierre Monnin argues that financial markets mis-price climate related credit risk. If this were corrected some securities held by the ECB would loose their investment grade credit rating. Assessing climate risks requires methodologies based on forward-looking scenarios, on complex cause-and-effect linkages and on data that has not been observed in the past. Such models are at their infancy, but already offer meaningful insights. This note provides an overview of...

Read More »Climate Risk, Credit Risk, and ECB Collateral

In a CEP Discussion Note, Pierre Monnin argues that financial markets mis-price climate related credit risk. If this were corrected some securities held by the ECB would loose their investment grade credit rating. Assessing climate risks requires methodologies based on forward-looking scenarios, on complex cause-and-effect linkages and on data that has not been observed in the past. Such models are at their infancy, but already offer meaningful insights. This note provides an overview of...

Read More »Core Euro Sovereign Bonds 2019 Outlook

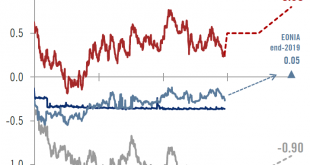

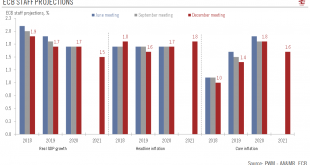

It’s all about the European Central Bank’s hiking cycle. In our central scenario, we expect the 10-year Bund yield to rise gradually to 0.8% by the end of next year from 0.26% on 17 December. Underpinning this upward movement is our expectation of a cumulative deposit rate hike of 40 basis points (bps) by the ECB, against current market expectations of only 10 bps. The euro area economic activity has been decelerating...

Read More »Core euro sovereign bonds 2019 outlook

It’s all about the European Central Bank’s hiking cycle.In our central scenario, we expect the 10-year Bund yield to rise gradually to 0.8% by the end of next year from 0.26% on 17 December. Underpinning this upward movement is our expectation of a cumulative deposit rate hike of 40 basis points (bps) by the ECB, against current market expectations of only 10 bps.The euro area economic activity has been decelerating this year and the latest prints are not showing encouraging signs going into...

Read More »ECB: Still Broadly Confident, but Caution Increasing

First rate hike still expected in September 2019, although downside risks are growing. The ECB kept its key rates unchanged (i.e. the main refinancing at 0.00%; the marginal lending facility rate at 0.25% and the deposit rate at -0.4%), in line with consensus. The ECB’s forward guidance on interest rates was kept unchanged. The ECB expects its policy rates to “remain at their present levels at least through the summer...

Read More »ECB: still broadly confident, but caution increasing

First rate hike still expected in September 2019, although downside risks are growing.The ECB kept its key rates unchanged (i.e. the main refinancing at 0.00%; the marginal lending facility rate at 0.25% and the deposit rate at -0.4%), in line with consensus. The ECB’s forward guidance on interest rates was kept unchanged. The ECB expects its policy rates to “remain at their present levels at least through the summer of 2019”.Given the tone of today’s meeting, we see no reason to contradict...

Read More »TIPS Goes Online

The ECB launches its Target Instant Payment Settlement (TIPS) system, which facilitates instant money transfers between banks and allows end users connected to those banks to make instant retail payments across the Euro zone. Report in the FAZ. Last year’s report by Mehreen Khan in the FT. From the ECB’s website: TIPS was developed as an extension of TARGET2 and settles payments in central bank money. TIPS currently only settles payment transfers in euro. However, in case of demand other...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org