Submitted by Patrick Watson via MauldinEconomics.com, Central bankers use low or negative interest rates so that it leads to more investment. For them interest rates are a consequence of the currently very low inflation rates. Patrick Watson argues in the exactly opposite way: Falling prices are a consequence of low interest rates and not the opposite: We see two reasons why this can be true: High, maybe excessive investment is happening in China (alas not in Europe). Cheap costs of...

Read More »Greek Debt: Now and Then

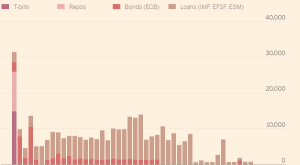

In the FT, Mehreen Khan offers a “Greek debt dilemma cheat sheet.” Face value: EUR 321 billion, thereof EUR 248 billion owed to official creditors. Official creditors: Eurozone countries (Greek loan facility), eurozone rescue funds (EFSF and ESM), IMF, ECB. Maturity profile: IMF proposal for restructuring:

Read More »Veritaseum Blockchain-based Bank Research Hits Another Home Run – Banco Popular Shown to be Bear Stearns Redux!

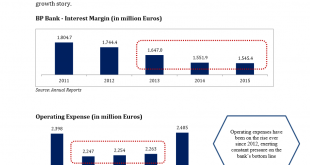

During the months of March and April of 2016 we released a series of proprietary research reports indicating signficant weakneses that we found in the European banking system and released it for sale through the blockchain (reference The First Bank Likely to Fall in the Great European Banking Crisis). This was performed by the same macro forensic and fundamental analysis team that first warned about the pan-European sovereign debt crisis in 2009 and 2010 (reference Pan-European...

Read More »The Twilight Of The Gods (aka Central Bankers)

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers. First, the measures implemented since 2009 created an artificial stability and an asset price boom in many markets. But the absolute rate of GDP expansion and level of price changes is inadequate to solve global debt problems. Second, new initiatives seem the risky response of clever...

Read More »St. Louis Fed Slams Draghi, Kuroda – “Negative Rates Are Taxes In Sheep’s Clothing”

“At the end of the day, negative interest rates are taxes in sheep’s clothing. Few economists would ever claim that raising taxes on households will stimulate spending. So why would they think negative interest rates will?” Those are the shocking words of St.Louis Fed Director of Research Christopher Waller whose brief note today will be required reading for everyone at The Bank of Japan, The ECB and every other central banker on the verge of NIRP… If you pick up any principles of...

Read More »Financial Revolution: ECB Blames You For Negative Interest Rates

Just after sunrise on April 19, 1775, a large contingent of British military troops arrived to the town of Lexington, Massachusetts. They were under orders to search for and confiscate all weapons and munitions from the colonials– something the British army had done countless times before. In many ways it was a routine operation. And yet, that morning, roughly 80 local militiamen stood blocking their path. Paul Revere had ridden through Lexington only hours before to warn residents of the...

Read More »Gold And Negative Interest Rates

The Inflation Illusion We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed has left to support the economy and inter alia discusses the use of negative rates. We first have to define what we mean by negative interest rates. For nominal rates it’s simple. When the interest rate charged goes negative we have negative nominal rates. To get the real rate of interest we have...

Read More »Interest Rates: How Low Can They Go?

When Denmark introduced negative interest rates in 2012, it was a pioneer. But the policy has become such an accepted part of central banks’ toolbox in the years since that financial pundits hardly batted an eyelash when Hungary became the world’s sixth central bank to introduce negative rates in March 2016. As the practice becomes more widespread, the question of how low interest rates can go has become increasingly relevant for investors. While every country (or region, in the case...

Read More »INTERACTIVE: How Do Negative Interest Rates Work?

Charles Wyplosz on the Euro Area Crises

In his slides, Charles Wyplosz presents a narrative that emphasizes vulnerabilities and institutional failures.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org