Now it’s the Russian’s fault. Belligerence surrounding Donbas and Ukraine, raw materials and energy supplies to Europe threatened by Putin’s coiled bear. Why wouldn’t markets grow worried? There’s always a reason why we shouldn’t take these things seriously, or quickly dismiss them out of hand as the temporary product of whichever political fear-of-the-day. This isn’t to write that these things aren’t important in any sense; no doubt anyone in or near Ukraine right now would have something powerful to say about these implications. . . When the eurodollar futures curve first inverted back on December 1, it was quickly cast into the same light as oil prices then crashing, each alleged to be a reaction to the sudden appearance of omicron. The successor to

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, currencies, Deflation, economy, eurodollar futures, Featured, Federal Reserve/Monetary Policy, FOMC, inflation, inversion, jay powell, Markets, newsletter, rate hikes, Russia

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Now it’s the Russian’s fault. Belligerence surrounding Donbas and Ukraine, raw materials and energy supplies to Europe threatened by Putin’s coiled bear. Why wouldn’t markets grow worried?

There’s always a reason why we shouldn’t take these things seriously, or quickly dismiss them out of hand as the temporary product of whichever political fear-of-the-day. This isn’t to write that these things aren’t important in any sense; no doubt anyone in or near Ukraine right now would have something powerful to say about these implications. |

|

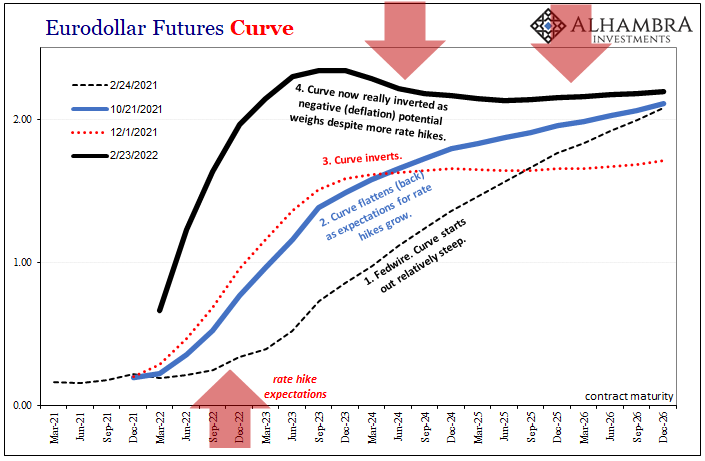

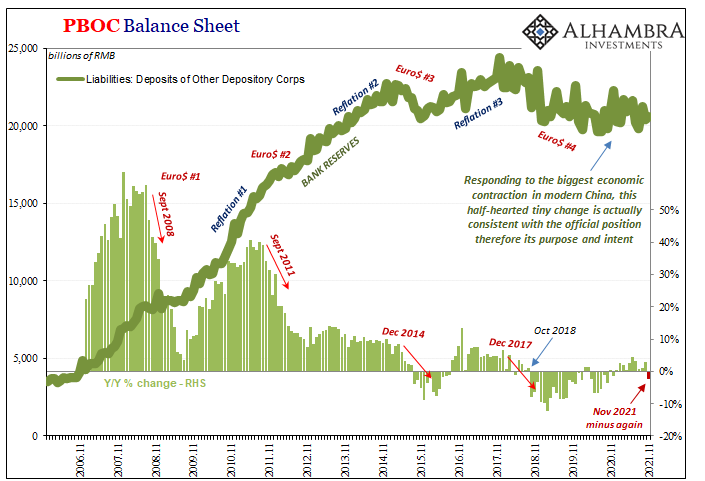

| When the eurodollar futures curve first inverted back on December 1, it was quickly cast into the same light as oil prices then crashing, each alleged to be a reaction to the sudden appearance of omicron. The successor to devilish delta, the new variant was immediately declared the next big potential world-tanking coronavirus disruption.Yet, here we are at almost the end of February, closing in on three months later. Omicron is nearly forgotten, never having come anywhere close to “achieving” its disruptive promise. Eurodollar inversion, on the other hand, it has only gotten more antagonistically uncomfortable as the weeks slide by.

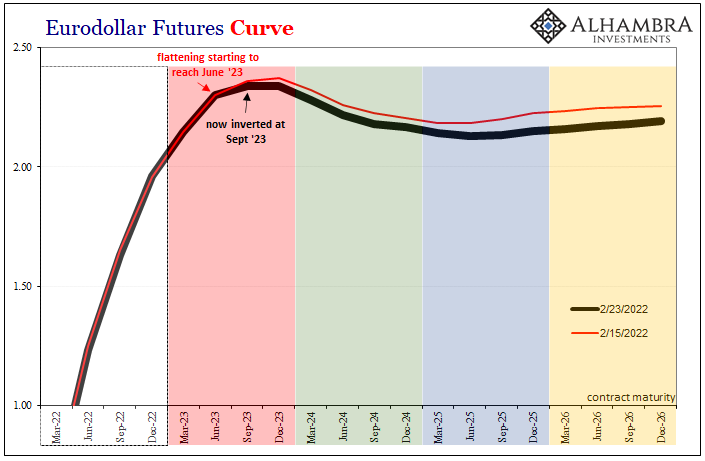

Notable now this week, not Red Russia rather inversion has taken hold of the reds. Remember, the reds are supposed to be Fed and unbroken rate hikes. So, not only is this distortion and upset upsetting for what it means in the world, it is equally in-your-face for the rate hikers at the FOMC facing, they still believe, more inflationary pressures than any others. |

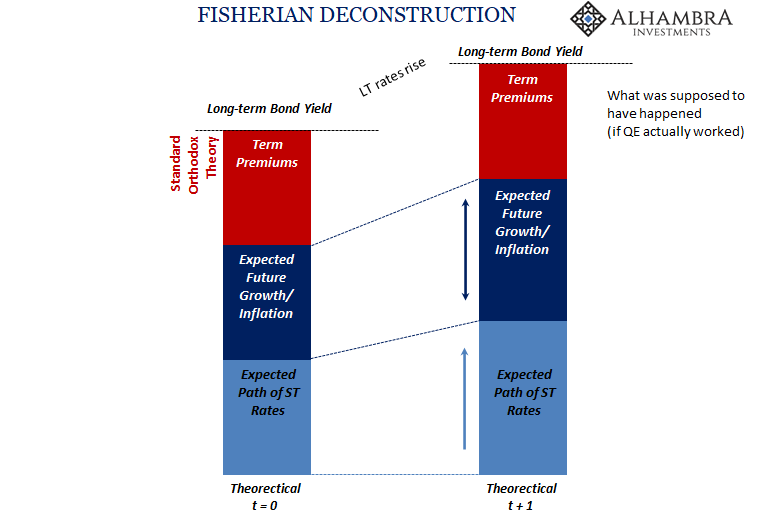

What these chromodynamics mean is a growing perceived likelihood that Powell’s rate hike intentions get spoiled somewhere along the way, and maybe not too far into the otherwise indeterminable stretch of distant future. While Wall Street’s mouthpieces rush to outdo each other forecasting more and more aggressive rate hikes because, they uniformly say, inflation is just out of control, and the public lulled into believing those the only possibilities, the real stuff in the real markets is already wondering just how few the Fed gets done before the “surprise” cut-off.

Not only that, this broadening, deepening inversion is verging on implying the “unthinkable”; that once the FOMC is shaken out of its rate hikes by a starkly different and unavoidable reality, policymakers might even get pressed into, gasp, rate cuts perhaps only a little further on into the time ahead.

But it’s not unthinkable, is it? We just did all this and it wasn’t all that long ago, 2019 barely three years past. The problem, mostly, is hardly anyone knows the details, the markets, or even what truly happened.

Powell’s FOMC right now, today, is setting itself up for that same kind of embarrassing failure. If it comes, it won’t be because of omicron or delta, nor would it be the next Greek letter which will almost certainly speedily enter the public pandemic discourse.

It’s not Russia and Ukraine.

Instead, it’s the same reason why I just wrote a review of what should have already been long forgotten, the Fedwire anniversary.

The absolutely crucial Euro$ futures market is seriously inverted. What must it be thinking? @EmilKalinowski and I ponder the near-term contracts and the still-pretty-near-term contracts that appear to be rejecting the reasoning behind rate hikes.https://t.co/Je7BdoAwrn pic.twitter.com/CXmP65yUrC

— Jeffrey P. Snider (@JeffSnider_AIP) February 23, 2022

The world is always full of geopolitical noise, with the pandemic environment only too fertile from which to harvest a whole bunch more. Remember the North Koreans in 2018 were about to start WW3, before then “trade wars” succeeding in taking over as the primary distraction.

No, it actually takes a whole lot more than the “prospects” for war, war, war to get the curves down and keep them there for this long. That much perfectly consistent, straightforward, and easy to understand once you cover your ears up to filter out all those distracting sounds.

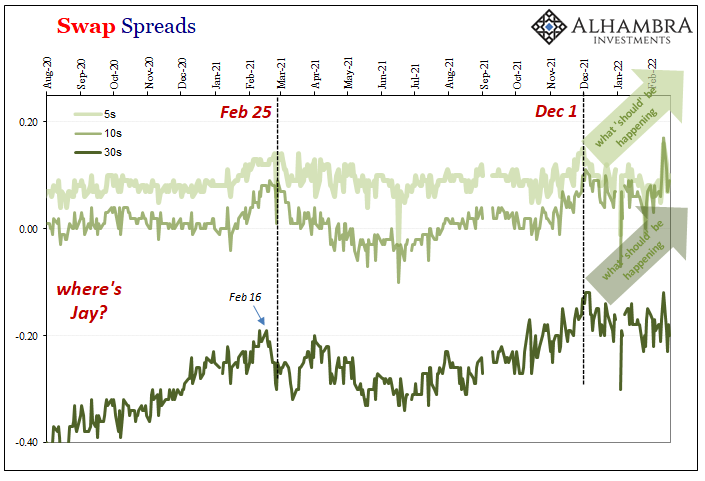

Pity Ukraine, too, there is actually today another kind of red warning spreading over the entire eurodollar’s world.

Tags: Bonds,currencies,Deflation,economy,eurodollar futures,Featured,Federal Reserve/Monetary Policy,FOMC,inflation,inversion,jay powell,Markets,newsletter,rate hikes,Russia