Latest business surveys surprise on the downside, but still indicate that economic expansion remains strong.There was a broad-based setback in euro area business surveys in February, whether in terms of country or of sector. The Flash composite PMI slipped to 57.5 in February from 58.8 in January. The month-to-month dip was the biggest since 2014.National business surveys painted a similar picture. In Germany, the Ifo business climate index dropped by 2.2 points to 115.4 in February, from an all-time high of 117.6 in January. A pullback was expected albeit not that strong. The index suffered from both the weaker business assessment (-1.5 points to 126.3) and a noticeable 2.9 point decline in business expectations to 105.4 in February. This was the third consecutive month-on-month decline

Topics:

Nadia Gharbi considers the following as important: Euro area business survey, euro area economic activity, Euro area PMI, Macroview, PMI surveys

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Latest business surveys surprise on the downside, but still indicate that economic expansion remains strong.

There was a broad-based setback in euro area business surveys in February, whether in terms of country or of sector. The Flash composite PMI slipped to 57.5 in February from 58.8 in January. The month-to-month dip was the biggest since 2014.

National business surveys painted a similar picture. In Germany, the Ifo business climate index dropped by 2.2 points to 115.4 in February, from an all-time high of 117.6 in January. A pullback was expected albeit not that strong. The index suffered from both the weaker business assessment (-1.5 points to 126.3) and a noticeable 2.9 point decline in business expectations to 105.4 in February. This was the third consecutive month-on-month decline in German business expectations and the largest monthly fall in two years. All sectors registered a decline. In France, the Insee business sentiment indicator edged down by 1.7 points to 109.1 for the second consecutive month. However, the index level remains close to its 2011 peak (109.7) and above its long-term mean (100).

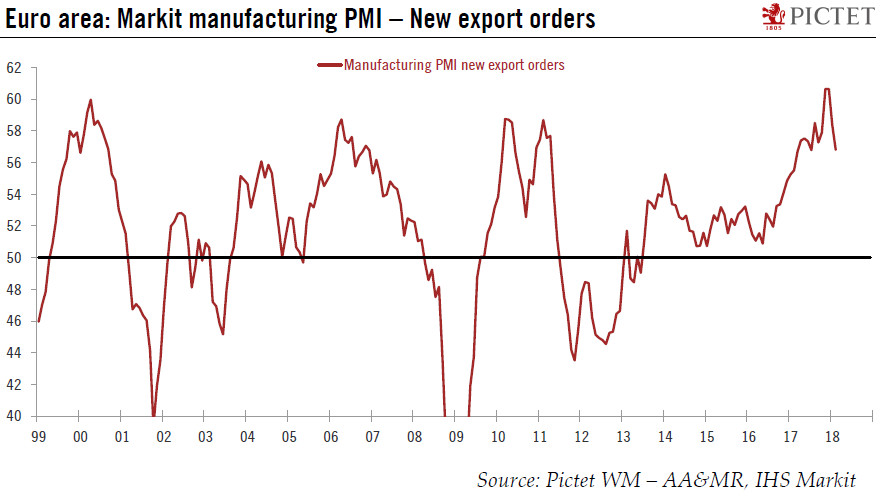

In spite of the drop in February, euro area business surveys are still at very high levels and are signalling continued economic expansion. Q1 2018 growth should remain solid. But the fall in some forward-looking sub-indices, in particular PMI new orders, new export orders and Ifo business expectations, is consistent with our own forecast for a gradual slowdown in the quarterly pace of GDP growth to around 2% (annualised rate) by end-2018. Still, February surveys confirm that growth is improving in terms of quality, with job creation and investment continuing to improve.