Most EM currencies were up last week, once again taking advantage of broad dollar weakness. In addition, EM equities also performed well, with MSCI EM up for the third week in a row and for seven of the past eight. We expect EM assets to continue benefiting from the global liquidity story as well as the weak dollar trend. AMERICAS Brazil reports mid-November IPCA inflation Tuesday. Inflation is expected at 4.15% y/y vs. 3.52% in mid-October. If so, this would be the...

Read More »Turkey Central Bank Preview

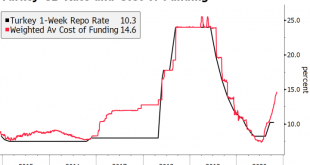

We expect the Turkish central bank (CBRT) to deliver a substantial rate hike at Thursday’s meeting but not as aggressive as consensus. Bloomberg’s median expectation is for a 475 bp hike. Our call is for a somewhat less aggressive move (perhaps around 400 bp) because the recent price action is likely to afford the new CBRT administration the confidence not to have to surprise on the upside. We think this makes sense. A large enough move to reaffirm the change of...

Read More »Roadblocks and Opportunities for International Trade in 2021

We see significant upside risk for global trade coming from “top down” forces (such as politics), but at the same time we expect the undercurrent reconfiguring many of the existing relationships to intensify. The “Peak Globalization” narrative (at least regarding trade) is being challenged by hopes of a revival of multilateral cooperation under Biden and the latest Asian trade agreement. But this doesn’t change our long-term view that the US and China are in an...

Read More »EM Preview for the Week Ahead

EM FX took advantage once again of broad dollar weakness. Most EM currencies were up last week against the dollar, with the only exceptions being ARS, TRY, INR, THB, PEN, and MYR. We expect the dollar to remain under pressure this week and so EM should remain bid. However, the growing spread of the virus in Europe and the US supports our view that Asia is likely to continue outperforming. AMERICAS Chile held a referendum Sunday on whether to draft a new constitution....

Read More »EM Preview for the Week Ahead

Risk assets are coming off a tough week. The dollar was bid across the board except for the yen, which outperformed slightly. The only EM currencies to gain against the dollar were KRW and CLP. The major US equity indices somehow managed to eke out very modest gains but stock markets across Europe sank as the viral spread threatens to slam economic activity again. Yet we have seen time and time again that the safe haven bid for the dollar eventually gives way to...

Read More »EM Preview for the Week Ahead

Persistent risk-off impulses weighed on EM last week and that may continue this week. The Asian currencies outperformed last week while MXN, ZAR, and COP underperformed, and we expect these divergences to continue. Despite optimism about a stimulus package in the US, we think it remains a long shot. Meanwhile, virus numbers are rising in Europe and the US, with data from both regions likely to continue weakening. AMERICAS Mexico reports August trade Monday. A...

Read More »EM Preview for the Week Ahead

EM performance this week will hinge crucially on whether US equity markets can find some traction. If sustained, last week’s equity rout could lead to a deeper generalized risk-off trading environment this week that would weigh on EM FX and equities. As it is, markets are already digesting weaker economic data and rising virus numbers in countries that had crushed the curve. ECB meeting this week may hint at further easing to come, which could help risk assets...

Read More »EM Preview for the Week Ahead

This is likely to be one of the most eventful weeks we’ve had in a while. Not only do three major central banks meet, but four EM central banks also meet, and we get important June and July data from the US, the first Q2 GDP reading from China, an OPEC+ meeting, and an EU summit. This comes as markets are grappling with still-rising virus numbers in the US and resurgent numbers in many other countries that call into question the durability of the economic recovery....

Read More »EM Preview for the Week Ahead

Risk assets remain hostage to swings in market sentiment. Stronger than expected US jobs data last week was welcome news. However, the tug of war between improving economic data and worsening viral numbers is likely to continue this week, with many US states reporting record high infection rates. AMERICAS Brazil reports May retail sales Wednesday. Sales are expected to contract -13.5% y/y vs. -16.8% in April. June IPCA inflation will be reported Friday, which is...

Read More »EM Preview for the Week Ahead

Risk assets came under pressure last week as the virus news stream worsened. It’s clear that large parts of the US will be forced to delay reopening until their virus numbers improve. Markets had gotten too bullish on the US recovery story and so this reality check soured sentiment. This is a very important week for US data, and we think risk sentiment will remain under pressure ahead of what we think will be a likely downside surprise in the US jobs number Thursday....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org