Bank Indonesia will use the 7-day reverse repo rate as its new benchmark policy rate The ruling party in South Korea unexpectedly lost parliamentary elections The Monetary Authority of Singapore eased monetary policy to recession settings Turkey has nominated its next central bank chief The Brazilian special lower house committee voted 38-27 in favor of impeachment The first round of Peru’s presidential election was inconclusive In the EM equity space, Brazil (+5.4%), UAE (+4.9%), and...

Read More »Emerging Markets: Preview of the Week Ahead

Some dovish signals from the Fed and a bounce in oil prices helped EM end last week on a firm note. This week, the US retail sales report could be important, and the same goes for CPI and PPI data too. The Fed’s Dudley, Kaplan, Harker, Williams, Lacker, Lockhart, Powell, and Evans all speak this week. The Fed releases its Beige Book Wednesday for the upcoming FOMC meeting April 27. Within specific EM countries, risks remain in place. We continue to feel that markets are too...

Read More »Emerging Markets: What has Changed

Bank Indonesia signaled it may pause its easing cycle Vietnam undertook a massive cabinet shuffle MSCI is reviewing Nigeria’s standing in its equity indices due to the impact of ongoing FX controls Russia’s central bank tilted a bit more dovish South Africa’s parliament voted down President Zuma’s impeachment proposal by a vote of 233-143 The impeachment process in Brazil moved forward another step Brazil’s Prosecutor General submitted a report to the Supreme Court saying that Lula’s...

Read More »Emerging Market Consumers: Down, but Not Out

How have weak markets and weak currencies affected consumer sentiment in emerging markets? To find out, the Credit Suisse Research Institute interviewed nearly 16,000 people in nine emerging economies. The result? Not surprisingly, CSRI generally found less optimism among survey respondents than last year, but consumer sentiment proved more resilient to economic headwinds in certain countries than in others. Watch the video to hear Richard Kersley, Head of Global Research Product, explain...

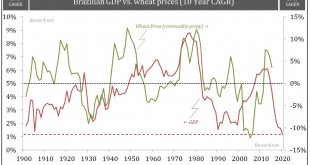

Read More »Latin America – Seven Ugly Sisters in Deep Political Trouble

Get beyond endless Latin American headlines burning column inches and you come to far broader strategic conclusion: The seven ‘ugly Latino sisters’, namely Brazil, Venezuela, Ecuador, Bolivia, Colombia, Mexico and Argentina are all deep political trouble from collapsed benchmark prices. It’s merely a case of who’s in more advanced states of political decay where left leaning governments’ can’t hang on much longer vs. those trying to buy a bit of time with more ‘centrist’ positions. In...

Read More »Emerging Markets: Preview of the Week Ahead

EM ended the week on a mixed note after posting strong post-FOMC gains. The bounce in risk seems likely to continue this week, with little on the horizon to derail it. Specific country risk remains in play, however, with heightened political concerns in Brazil and South Africa. Taiwan reports February export orders Monday, which are expected at -10% y/y vs. -12.4% in January. It reports February IP Wednesday, which is expected at -5.45% y/y vs. -5.65% in January. The central bank then...

Read More »Emerging Markets: What has Changed

(from my colleague Dr. Win Thin) China press is reporting that policymakers are drafting rules for a so-called Tobin tax on yuan transactions Former President Lula was named to the cabinet post of Chief of Staff by his protégé, President Rousseff The Brazilian central bank said it “sees room” to partially unwind the FX swaps program Egypt devalued the pound by almost 13% and said it would adopt a “more flexible exchange rate” The National Executive Committee of the ruling African...

Read More »Emerging Market Preview: Week Ahead

EM enjoyed an extended rally last week, and it should carry over to the early part of the week. The Wednesday FOMC meeting poses a risk to EM, especially if markets continue to price in a more hawkish Fed. The dot plots and press conference will be very important. BOE and the Norges Bank also meet this week, with the latter expected to deliver a 25 bp rate cut to 0.5%. Firm commodity prices are helping sentiment, with WTI making new highs for 2016 and approaching the $40 area. While weaker...

Read More »Emerging Markets Preview: Week Ahead

Risk sentiment ended last week on a strong note, and that should carry over into this week. The global liquidity backdrop remains positive for EM, with the ECB widely expected to add more stimulus on Thursday. In a similar vein, the Fed is widely expected to remain on hold until June. China is doing its part to prevent negative market impact from developments there, including reports of intervening to support the equity markets last week. Lastly, commodities remain bid and WTI oil made...

Read More »Emerging Markets: What has Changed

(from my colleague Dr. Win Thin) 1) China’s central bank announced a 0.5% cut in the required reserve ratio2) Moody's cut the outlook on China's Aa3 rating to negative from stable3) Argentina and the main holdouts agreed to a debt restructuring deal4) Brazilian press reported that a senator implicated both Rousseff and Lula in the corruption probe as part of a plea bargain5) Chile is cutting back government spending this year in response to low copper prices In the EM equity space,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org