The Brexit vote is a game-changer for EM. While the direct impact on EM is limited, the damage to market sentiment is undeniable. And to make matters worse, there will be a protracted period of uncertainty as the UK and the EU negotiate the divorce proceedings. We do not think individual country stories will matter much in this new investment climate, where risk assets are likely to remain under broad-based...

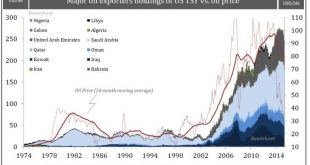

Read More »China the lender of last resort for many oil producers

Summary: Bawerk explains how China will be the lender of last resort of many oil producers. China might let collapse a smaller producer and become much smarter at covering its political bases across producer states to protect longer term sunk costs. It took a while to play through, but our assessment that China would increasingly become the petro-state lender of last resort is starting to come good. The...

Read More »Emerging Markets: Preview of the Week Ahead

EM ended last week under pressure. With two potentially disruptive events (FOMC meeting and Brexit vote) still in play, we think that EM softness should carry over into this week. Markets remain jittery about the June 23 Brexit vote, as a vote to leave would be very negative for risk assets such as EM. No action is expected at the FOMC meeting Wednesday. However, we think July remains very much in play and the FOMC...

Read More »Emerging Markets: What has Changed

China granted US asset managers a CNY250 bln ($38 bln) quota under the existing QFII system Bank of Korea surprised the market by delivering a 25 bp rate cut to 1.25% Oman issued its first global bond since 1997 Polish President Duda softened his CHF loan conversion plan Central Bank of Russia resumed its easing cycle with a 50 bp cut to 10.5% There appears to have been a significant change in FX strategy from the...

Read More »Emerging Markets: Preview of the Week Ahead

EM ended the week on a firm note after the US jobs shocker. While we view the weak reading as a fluke, shifting market perceptions of Fed tightening risk should keep EM bid near-term. However, we think the July FOMC meeting is still very much alive. That and the upcoming Brexit vote are potential pitfalls for EM in the coming weeks. Meanwhile, oil prices shrugged off disappointment with OPEC inaction last week, with WTI oil remaining near $50 to close out the week. The central banks...

Read More »Emerging Markets: What has Changed

Local press is reporting that RBI Governor Rajan does not want to serve another term The incoming Philippine government is signaling looser fiscal policies ahead Polish President Duda’s team of experts may present several plans for consideration A second cabinet minister in Brazil was forced to resign Colombia eliminated its FX intervention program The IMF boosted Mexico’s Flexible Credit Line (FCL) from $67 bln to $88 bln Equities In the EM equity space, China (+4.1%), Brazil...

Read More »Saudi-Arabia: Peg or Banking Crisis?

Oil exporters recycled their dollar in US treasuries During the reign of the mighty petro-dollar standard, it was necessary for major oil exporters to recycle their dollar holdings back into the dollar-based financial system to maintain their self-imposed exchange rate pegs. US government bonds are the very centrepiece of this elaborate system and it is thus no surprise to see the dollar price correlate well with overall OPEC TSY holdings. In other words, when oil prices were high, oil...

Read More »Emerging Market Preview

EM ended last week on a soft note. The icing on the cake was Yellen’s speech Friday afternoon, which confirmed the more hawkish stance seen in the FOMC minutes and other recent official comments. We warn that with the FOMC meeting and Brexit vote next month, markets are likely to remain volatile and that risk assets (such as EM) are the most vulnerable. Looking at country-specific EM risk, the Brazilian political outlook remains murky as more reports have surfaced of other PMDB officials...

Read More »Emerging Markets: What has Changed

Korea will extend trading hours for stock and FX markets by 30 minutes effective August 1 The Monetary Authority of Singapore said it will withdraw BSI Bank’s license for breaches of money-laundering rules The US lifted a decades-old arms embargo on Vietnam The Nigerian central bank said it would allow “greater flexibility” in the FX market Poland signaled a compromise over the judicial row that triggered EU scrutiny Brazil Budget Minister Romero Juca was forced to step down Banco de...

Read More »Emerging Market Preview for the Week Ahead

EM had another rocky week, but managed to end on a slightly firmer note Friday. Market repricing of Fed tightening risk was the big driver last week, and that could carry over into this week. There are several Fed speakers in the days ahead, capped off with Fed chief Yellen on Friday. Several EM central banks meet this week, including Israel, Turkey, Hungary, and Colombia. There is some risk of a dovish surprise from Turkey, while Hungary is expected to continue easing. Colombia is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org