EM assets for the most part fared well last week, and positive sentiment should carry over into this week. China reported January foreign reserves over the weekend, and they fell less than expected to $3.231 bln. China markets are closed this week for the New Year holiday. While there should be little risk of negative headlines from the mainland, markets should watch how CNH trades in the offshore markets that are open. Oil prices should also be regarded as an important factor behind...

Read More »China’s 3 trillion dollar mistake

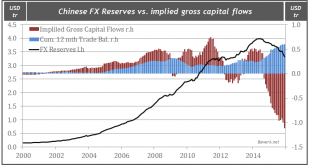

When looking at the current state of the Chinese economy it is important to note what happened leading up the ongoing predicament. By managing the USD/CNY exchange rate the Chinese factory worker was essentially funding excess consumption in the United States. One of the many perks enjoyed by global reserve issuer. The factory worker obviously did not do this out of his own volition; on the contrary, he was duped into it by swallowing the propaganda spewed out by party apparatchiks in...

Read More »Emerging Markets: What has Changed

1) China relaxed some rules on foreign capital flows 2) Malaysian Prime Minister Najib is tightening his grip on power 3) The Czech National Bank (CNB) has tilted more dovish 4) Ukrainian Economy Minister Abromavicius resigned abruptly, throwing the ruling coalition into turmoil 5) Argentina unexpectedly settled with holdout Italian investors 6) Press reports suggest Brazil’s central bank is considering rate cuts later this year.In the EM equity space, UAE (+6.2%), Indonesia (+4.0%),...

Read More »Emerging Market Preview: Week Ahead

As we suspected, the current EM bounce still has some legs. The BOJ’s surprise easing helped EM and risk end on last week on a strong note, and we expect that to carry over into this week. Within EM, we will start to see the first readings for January. The biggest risk perhaps is the jobs report on Friday. Soft US data has helped push out Fed tightening expectations, but a strong reading here could put it back on the radar screen. Brazil reports December trade data on Monday. ...

Read More »Emerging Markets: What has Changed

1) Korea’s Financial Services Commission will introduce a so-called “omnibus account” for foreigners investing in local stocks2) Malaysian Attorney General Apandi Ali closed the investigation into transfers of foreign money into Prime Minister Najib Razak’s personal bank accounts 3) The South African Reserve Bank increased the pace of its tightening 4) The Egyptian central bank eased restrictions on dollar cash deposits 5) The Turkish central bank raised its 2016 and 2107 inflation...

Read More »Emerging Market Preview: Week Ahead

(from my colleague Dr. Win Thin) EM enjoyed a nice bounce to end last week. The global liquidity outlook has clearly moved in favor of EM, at least for now. However, the overall global backdrop has not shifted in favor of EM just yet. Bottom line: enjoy this EM rally with a short-term timeframe in mind, with the idea that EM turbulence will likely return later this year. Idiosyncratic risks abound in the usual suspects. The Brazilian real is likely to underperform in light of COPOM’s...

Read More »Emerging Markets: What has Changed

(from my colleague Dr. Win Thin) 1) Malaysia’s central bank kept rates steady at 3.25%, as expected, but cut bank reserve ratios from 4% to 3.5%2) S&P downgraded Poland one notch to BBB+ with negative outlook3) Brazil’s central bank did a complete about-face and left rates steady at 14.25%4) Mexico may tweak its FX auction program again when it is extended this month5) Argentine officials met with IMF chief Lagarde at the World Economic Forum in Davos In the EM equity space, Russia...

Read More »Central Bank’s Dovish Tilt Will Weigh on Brazilian Assets

(from my colleague Dr. Win Thin) Brazilian central bank President Tombini said it will take into account the IMF’s revised forecasts for a deeper recession when it meets this week to decide on policy. Sorry, but we don’t buy it. No central bank should ever be affected by IMF forecasts. Yes, the IMF has great economists and often has excellent advice for its member countries. But no policymaker worth their salt should base their decisions on updated IMF forecasts. We’d add that the...

Read More »Emerging Markets: Week Ahead Preview

EM ended last week on a sour note. The most important factor for global risk appetite has become China, with the Fed tightening cycle now on the back burner. Our base case remains that China muddles through, but policymakers there need to communicate better with the markets. The PBOC fix and Chinese equity market performance will likely be the biggest drivers for global markets this week. Commodity prices continue to slide, with oil and copper making new cycle lows last week and...

Read More »Emerging Markets: What has Changed

1) The Hong Kong dollar posted its biggest two-day decline since 1992 2) Bank Indonesia restarted its easing cycle, cutting rates for the first time since February 2015 3) Poland’s current Monetary Policy Council (RPP) held its last policy meeting 4) Poland’s president proposed a draft bill on FX loan conversion 5) Russia will reportedly cut budgetary expenditures by 10% due to low oil prices 6) Russia’s central bank has turned more hawkish 7) Argentina officials and debt holdouts met...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org