The Philippine central bank moved to an interest rate corridor Saudi Arabia is preparing to sell its first global bond ever Transport Minister Yildirim, a close ally of President Erdogan, will become Turkey’s new Prime Minister The new Brazil cabinet continues to take shape with a market-friendly bias In the EM equity space, South Africa (+2.2%), Singapore (+1.1%), and Taiwan (+1.0%) have outperformed this week, while UAE (-3.4%), Brazil (-2.2%), and Colombia (-2.0%) have underperformed....

Read More »Emerging Markets Preview: Week Ahead

EM ended last week on a soft note, and that weakness seems likely to carry over into this week. Dollar sentiment turned more positive after firm retail sales data on Friday, though US rates markets have yet to reflect any increase in Fed tightening expectations. Over the weekend, China reported weaker than expected April IP, retail sales, and fixed asset investment. This continues a string of weak data for the month, and will undercut notions that the world’s second largest economy is...

Read More »EM FX Technical Picture

In light of the Fed’s dovish tilt in March, the global liquidity outlook turned further in favor of EM. As a result, EM extended the bounce off the January/February lows. There’s no clear narrative as to why EM is softer this week, but it just seems to be a much-needed correction and positioning flush-out. Bottom line: a dovish Fed (for now) should limit this sell-off, and the EM rally could resume for a while longer before turbulence returns later this year. We expect many EM...

Read More »Emerging Market Preview for the Week Ahead

EM ended the week on a firm note, which should carry over into this week. The biggest near-term risk to EM is the US jobs data on Friday, as the weekly claims data points to another strong gain. Otherwise, the global liquidity backdrop remains EM-supportive. Thailand reported April CPI earlier today. It rose 0.07% year-over-year. The market expected another decline after the -0.5% in March. This is well below the 1-4% target range. However, growth remains quite robust, averaging...

Read More »Global Tensions Lessened, but Bound to Increase Ahead of June FOMC Meeting

We expect the FOMC statement this week to recognize the improvement in the global conditions that have been an increasing worry for officials over Q1. At the same, time the soft patch of the US economy is undeniable. We suspect the Fed will look past the weakness of the US economy. The strength of the labor market, with weekly initial jobless claims at their lowest level since 1973 and continuing claims at their lowest level since 2000, it is difficult to get too negative the US...

Read More »Emerging Markets: Preview of the Week Ahead

EM ended last week on a soft note. Perhaps the main driver was rising US yields, as markets become wary of a more hawkish Fed this Wednesday. Perhaps it was technical, as the EM rally became over-extended. Whatever the reasoning, the correction continued into the weekend and is likely to carry over to this week as well. While we remain cautious on EM at such rich valuations, a significant correction (which we have not seen in quite some time) could make some assets more attractive. ...

Read More »Chinese Dragon: Breathing Credit Fumes

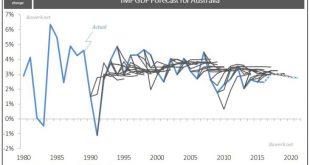

Economic forecasting, no matter how complex the underlying model may be, is essentially about extrapolating historical trends. We showed last week how economic models completely fail to pick up on structural shifts using Japan as an example. On the other hand, if an economy doesn’t really change much, as in the case of Australia over the last thirty years, model “forecast” are generally quite accurate. However, spending millions of dollars to do the job of a ruler doesn’t seem like wise...

Read More »Emerging Markets: What has Changed

(from my colleague Dr. Win Thin)China’s central bank may be leaning less dovish Turkey has a new central bank governor Argentina issued external debt for the first time since it defaulted 15 years ago Brazil's lower house voted to impeach President Rousseff by a 367-137 vote In the EM equity space, Russia (+2.7%), Indonesia (+1.9%), and UAE (+1.8%) have outperformed this week, while China (-3.0%), Taiwan (-1.9%), and Hungary (-1.2%) have underperformed. To put this in better context, MSCI...

Read More »Emerging Consumer Spending: Short-Term Pain, Long-Term Growth

Consumers in emerging economies can be forgiven for having a less than rosy outlook these days. Currency weakness, market volatility, and in some countries, political risk, drove declines in consumer sentiment throughout much of the developing world in 2015, according to the Credit Suisse Research Institute’s 2016 Emerging Consumer Survey. In the long-term, however, consumption in the emerging world is still a growth story – one driven by an emerging middle class and optimistic young...

Read More »Emerging Markets: Preview of the Week Ahead

EM ended last week on a firm note. Given the absence of any Fed-specific risks or any major US data releases, that firmness could carry over into this week. The failure to reach an agreement in Doha by oil producers is weighing on some countries through lower oil prices, but the global liquidity story ultimately remains risk-supportive for the time being. China data last week was also helpful for market sentiment. Specific country risk remains in play. The Brazil impeachment process...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org