“It is not surprising the Fed once again failed to take action as their expectations for economic growth were once again lowered. In fact, as I have noted previously, the Federal Reserve are the worst economic forecasters on the planet. As shown in the table/chart below, not only are the expectations for economic growth now the lowest on record, the Fed has given up on 2% growth for the economy with the long-run...

Read More »Do our money managers really believe this will end well?

Central banks are currently creating the mother of all bubbles. To my view it was caused by masses of cheap labor in China that entered the global economy in the early 1990s.This reduced inflation and interest rates, while Chinese productivity continously improved, in particular when rural workers came into the cities.The mother of all bubbles will pop at the latest, when Chinese wages approach Western levels....

Read More »Weekend Reading: Another Fed Stick Save, An Even Bigger Bubble

As I noted on Thursday, the Fed non-announcement gave the bulls a reason to charge back into the markets as “accommodative monetary policy” is once again extended through the end of the year. Of course, it is not surprising the Fed once again failed to take action as their expectations for economic growth were once again lowered. Simply, with an economy failing to gain traction there is little ability for the Fed to...

Read More »Labour Productivity, Taxes and Okun’s Law

[unable to retrieve full-text content]The great “science” of economics once discovered an empirical relationship between GDP and unemployment that has been dubbed Okun’s Law. It simply states that the unemployment rate rises as GDP contracts, or vice versa, as production shrinks less peo...

Read More »Toward Stagflation

Norway Real House Price Per M2 We have all heard the incredible stories of housing riches in commodity producing hotspots such as Western Australia and Canada. People have become millionaires simply by leveraging up and holding on to properties. These are the beneficiaries of a global money-printing spree that pre-dates the financial crisis by decades. The road toward such outsized gains in property is not paved...

Read More »Stupid is What Stupid Does – Secular Stagnation Redux

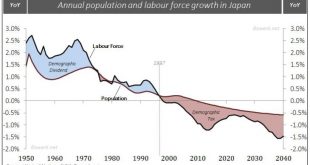

Annual population and labour force growth in Japan Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking...

Read More »Economics: The Core

The Economist reviews core ideas in economics. The introductory article points out that economists’ fundamental mission is not to forecast recessions but to explain how the world works. It argues that economists have delivered and it discusses six exemplary areas of economic research: Nash equilibrium; Mundell-Fleming trilemma; Minsky financial-instability; Stopper-Samuelson effect of trade on wages; Keynes fiscal-multiplier; and Akerlof’s and others’ work on information asymmetries....

Read More »Brexit or not, the pound will crash

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience we believe it says something...

Read More »Money confuses and blurs economic relations

Money, generally accepted medium of exchange, acts as a veil that confuse and blurs economic relations. This is especially true when it comes to intertemporal considerations. Whilst probably the most important institution in a free market, money can be highly destructive when politicized. Why? Because politics is about power and distribution of real wealth. And since money affect almost every single transaction,...

Read More »China the lender of last resort for many oil producers

Summary: Bawerk explains how China will be the lender of last resort of many oil producers. China might let collapse a smaller producer and become much smarter at covering its political bases across producer states to protect longer term sunk costs. It took a while to play through, but our assessment that China would increasingly become the petro-state lender of last resort is starting to come good. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org