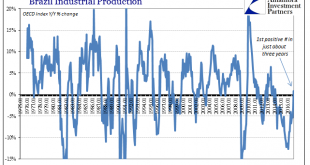

The cruelest part, perhaps, of this economic condition globally is how it plays against type. In all prior cycles, economies of all kinds and orientations all over the globe would go into recession and then bounce right of it once at the bottom. It was often difficult to see the bottom, of course, but once recovery happened there was no arguing against it. Since the Great “Recession”, which was global, no matter what...

Read More »Forget Bitcoin, but Remember Blockchain?

The most obvious potential use for blockchain technology is the one that already exists – payment systems. But there is much more to blockchain than this. Ever since bitcoin came on the scene in 2009, evangelists have proclaimed that the end of fiat currency is nigh. A so-called cryptocurrency,...

Read More »Is Bitcoin Safe?

Bitcoin isn't mainstream, and it may never be. And yet it would be unwise to ignore it. Some $14.9 billion worth of bitcoins were in circulation in January 2017, and blockchain, the technology underpinning bitcoin, has attracted plenty of attention for its disruptive potential in banking, trading, and even media. So how safe is bitcoin?...

Read More »Donald Trump’s Trade Policy Options

So far, there has been little clarity as to which specific trade policies the new president will introduce, but given how high trade ranks on his agenda, this will likely change quickly. But what actual powers does a US president have in the area of trade, and what measures might Mr. Trump implement?...

Read More »Economic Normalization vs. Political Polarization

The global economy appears to be enjoying a solid start to 2017. Business surveys such as the Purchasing Managers' Indices (PMI) indicate that momentum accelerated toward the end of 2016 in nearly all major economies. Still low interest rates, stable commodity prices, as well as a generally...

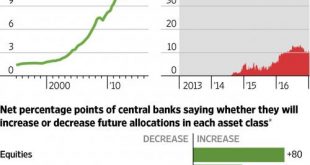

Read More »80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none...

Read More »Trade Friction a Key Risk as Trump Takes Power

The incoming US president Donald Trump has often struck a belligerent tone with regard to trade relations. Much of his anti-trade narrative – made public in tweets and remarks made on the campaign trail – has focused on China, raising concerns over trade frictions, if not an outright trade war. Yet what powers does the US president have in the area of...

Read More »Global Investor: Reshaping Patient Care Bit by Bit

So far, the healthcare sector has held back from digitalization, but it is about to change. Expenditure on healthcare is rising rapidly in developed and emerging economies. People are paying more money not only because they can afford it, but also because healthcare gains in importance as...

Read More »Europe’s Trump Cards

Pivotal elections are coming up in Europe. Their outcomes will have an impact on the economy and financial markets. Europe's political calendar may prove to be explosive. Germany, the Netherlands, and France will soon be holding elections. They have the potential to disrupt the political landscape...

Read More »What Will Be the Revolutionary Innovation of Our Century?

Robert J. Gordon, an American economist and university professor, in a conversation with Credit Suisse contemplates if roboadvisors could eliminate jobs and whether Facebook could become the new Ford. We often think of progress as gradual. Yet in his recent book, "The Rise and Fall of American...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org