We have seen several explanations for the financial crisis and its lingering effects depressing our global economy in its aftermath. Some are plain stupid, such as greed for some reason suddenly overwhelmed people working within finance, as if people in finance were not greedy before 2007. Others try to explain it through “liberalisation” which is almost just as nonsensical as government regulators never liberalised...

Read More »Saudi-Arabia: Peg or Banking Crisis?

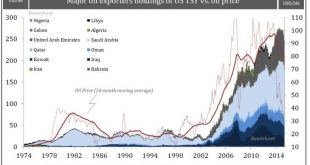

Oil exporters recycled their dollar in US treasuries During the reign of the mighty petro-dollar standard, it was necessary for major oil exporters to recycle their dollar holdings back into the dollar-based financial system to maintain their self-imposed exchange rate pegs. US government bonds are the very centrepiece of this elaborate system and it is thus no surprise to see the dollar price correlate well with overall OPEC TSY holdings. In other words, when oil prices were high, oil...

Read More »Notes from ECB Press Conference

ECB press conference June 2 2016 Held in Vienna with Governor Nowotny Keep key ECB interest rates unchanged Will be kept at present or lower for an extended period of time, exceeding asset purchase program (80bn per month) which will end March 2017 sector program will start June 8 TLTRO start in June New measures will strengthen growth in euro area through credit expansion Very low inflation must not become entrenched in second round effects through effects on wages and prices. ECB...

Read More »Academic Skulduggery – How Ivory Tower Hubris Wrecks your Life

In the 1970s economists started to incorporate rational expectations into their models and not long after the seminal Kydand & Prescott (1977) article named Rules Rather than Discretion: The Inconsistency of Optimal Plan was published. Their work has been driving the mainstream macroeconomic debate ever since. The question raised in this debate is how policy-makers can credible commit to promises made today when future events may cause short-term pain if restricted by stringent rules...

Read More »Hillary Will be the Least of Your Worries – America has Economic Diarrhea

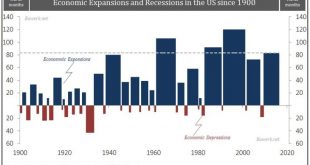

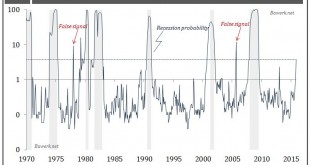

Economic Expansions and Recessions in the US since 1900 According to the National Bureau of Economic Research (NBER), the official recession arbiter, the US economy is currently at its fourth longest expansion in history. By the sheer nature of a capitalistic society with its inherent cyclicality it is a safe bet that a new economic recession will hit in the not too distant future. We have argued since June last year that the next recession is imminent and we now feel increasingly...

Read More »Chinese Dragon: Breathing Credit Fumes

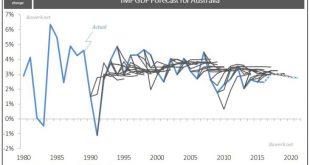

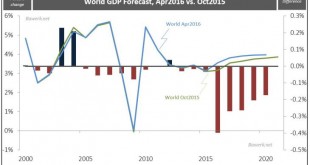

Economic forecasting, no matter how complex the underlying model may be, is essentially about extrapolating historical trends. We showed last week how economic models completely fail to pick up on structural shifts using Japan as an example. On the other hand, if an economy doesn’t really change much, as in the case of Australia over the last thirty years, model “forecast” are generally quite accurate. However, spending millions of dollars to do the job of a ruler doesn’t seem like wise...

Read More »Circulus in probando

In the latest semi-annual Keynesian incantation spewed out by the world’s best pseudo-scientists, we learn that growth has been too slow for too long and that in itself is the cause of slow growth. First, they promote debt-funded consumption because spending – money supply/credit and velocity – is equivalent to nominal GDP growth, and as long as you have nominal GDP growth you can always add more debt to the existing stock ad infinitum. That obviously came crashing down in 2008. At that...

Read More »OPEC’s Doha Dilemma: 3mb/d US lock in?

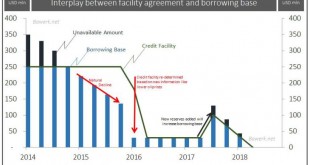

Bawerk shows that more than 3 mb/d of American oil production was helped by US$55.5bn in credit facilities, by excessive debt. This production is now at risk and the debt may not be repaid. The big OPEC players are playing against US shale oil and some smaller OPEC members that have higher costs. Another month, another flight to Hamad international airport for 17th April after initial agreement to hold ‘upstream horses’ in February 2016. While it’s no doubt great fun getting back...

Read More »Greenspan, the Sheepherder

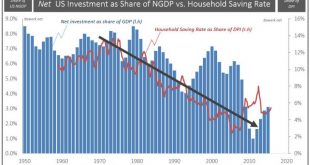

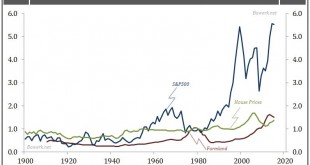

It is common knowledge by now that Federal Reserve Chairman Alan Greenspan oversaw, enabled and approved of, a major transition in the US economy. His infamous “Greenspan-put” in which his actions at the central bank would be driven, if not dictated, by the whims of financial markets, clearly led to higher asset prices. Investors obviously picked up on the strong bias in the Greenspan-Fed’s conduct of monetary policy as they slashed rates at the tiniest hiccup in financial markets, and...

Read More »Increasing Price Inflation is Not a Sign of Healthy Recovery, but the Last Stage Before Recession

In a recent article by Kessler Companies (hat tip Zerohedge) they correctly point out that inflation, as measured by the consumer price index, have a tendency to accelerate as the US economy moves into a recession. Contrary to popular belief, the beginning of a recession is not deflationary but the exact opposite. As can be seen from the chart, consumer prices do indeed move higher into recessions as represented by the shaded areas. Why? The most obvious explanation is simply that the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org