Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month. We are doing this to make room for some new reports, podcasts and...

Read More »FX Daily, July 26: Equities like EU-US Trade Truce more than the Euro

Swiss Franc The Euro has fallen by 0.29% to 1.1597 CHF. EUR/CHF and USD/CHF, July 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar is mostly firmer. The Australian dollar is off the most (~0.35%, ~$0.7425), after peaking a little above $0.7460. The price action reinforces the $0.7300-$0.7500 range. The yen is the strongest of the majors. Near JPY110.80, the yen...

Read More »Brent’s Back In A Big Way, Still ‘Something’ Missing

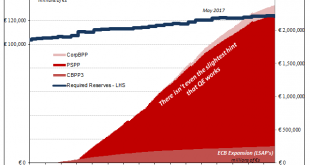

The concept of bank reserves grew from the desire to avoid the periodic bank runs that plagued Western financial systems. As noted in detail starting here, the question had always been how much cash in a vault was enough? Governments around the world decided to impose a minimum requirement, both as a matter of sanctioned safety and also to reassure the public about a particular bank’s status. Later on, governments...

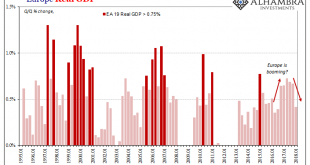

Read More »What Really Happened In Europe

The primary example of globally synchronized growth has been Europe. Nowhere has more hope been attached to shifting fortunes. The Continent, buoyed by the persistence of central bankers like Mario Draghi, has not just accelerated it is actually booming. Or so they say. Last September, politicians were lining up to confidently declare as much, often deploying that specific word. When Jean-Claude Juncker gave his annual...

Read More »FX Weekly Preview: Next Week in Context

A year ago, the Dutch and French elections signaled that UK referendum to leave the EU and the US election of Trump did not usher in a populist-nationalist epoch, such as the one that proceeded the last great financial crisis. The euro gapped higher and did not look back. We have contended that Macron’s victory, in particular, sparked a correction to the euro’s decline that began in mid-2014. Using technical tools, we...

Read More »Great Graphic: EMU Inflation Not Making it Easy for ECB

The Reserve Bank of New Zealand is credited with being the first central bank to adopt a formal inflation target. Following last year’s election, the central bank’s mandate has been modified to include full employment. To be sure this was a political decision, and one that initially saw the New Zealand dollar retreat. The dual mandate that originated with the Fed has been questioned in the US, but Congress has shown...

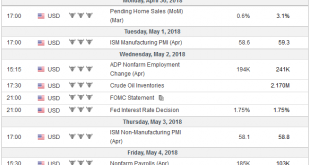

Read More »FX Weekly Preview: The Fed and More

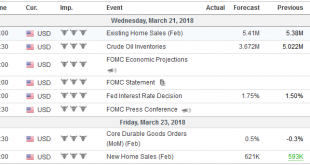

The most significant event in the coming week is the first FOMC meeting under the Chair Powell. At ECB President Draghi’s first meeting he cut interest rates. He cuts rates at his second meeting as well, underwinding the two hikes the ECB approved under Trichet. At BOJ Governor Kuroda’s first meeting, an aggressive monetary policy was announced that was notable not only in its size, but also in the range of assets to be...

Read More »FX Weekly Preview: Thumbnail Sketch Four Central Bank Meetings and US Jobs Data

The German Social Democrats have endorsed the Grand Coalition, ending the period of political uncertainty and paralysis in Germany since the last September’s election. The polls have suggested nearly 60% of the SPD would support joining the government and the actual outcome looks to be closer to 66%. In 2013, when the SPD had a similar vote, three-quarters favored a Grand Coalition. Among the differences is that the SPD...

Read More »FX Weekly Preview: Four Key Numbers in the Week Ahead

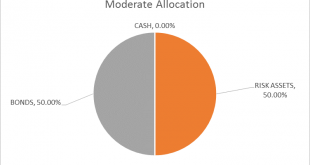

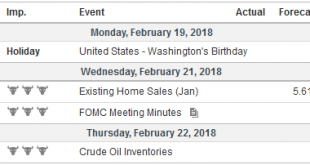

The US markets are closed on Monday, and many parts of Asia will continue to celebrate the Lunar New Year. The economic schedule is fairly light, and market psychology appears fragile after the dramatic activity in equities and what appears to be shifting macro-relationships. To help navigate the challenging investment climate, we identify four “numbers” that can illuminate the path ahead. The equity market is center...

Read More »The Historical Warnings of Money

It’s interesting, to me anyway, that an image of the Roman goddess Juno remains to this day on the logo of the Bank of England. There are many stories about her role as it relates to money, but what cannot be denied is that the very word itself came to us from her temple. The Latin moneta was derived from the word monere, a verb meaning to warn. Moneta was Juno’s surname. One fable has it where the goddess’s sacred...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org