The ECB’s announcement on bond purchases leads us to expect its QE programme to end by Q1 2019, with a hike of the main refi rate in September that year.The European Central Bank’s (ECB) decisions today were in line with our and consensus expectations, including a slower pace of asset purchases (rescaled from EUR60bn to EUR30bn per month), a longer and open-ended extension (until September 2018, or beyond if necessary), and stronger forward guidance (committing to keeping policy rates at present levels until “well past” the new horizon of net asset purchases). Meanwhile, said the ECB, reinvestment of bond proceeds will continue “for an extended period of time” after the end of QE. Crucially, while stressing the importance of reinvestment flows, the ECB stopped short of gross monthly

Topics:

Frederik Ducrozet considers the following as important: ECB monetary decisions, ECB negative deposit rate, ECB quantitative easing, ECB refi rate, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The ECB’s announcement on bond purchases leads us to expect its QE programme to end by Q1 2019, with a hike of the main refi rate in September that year.

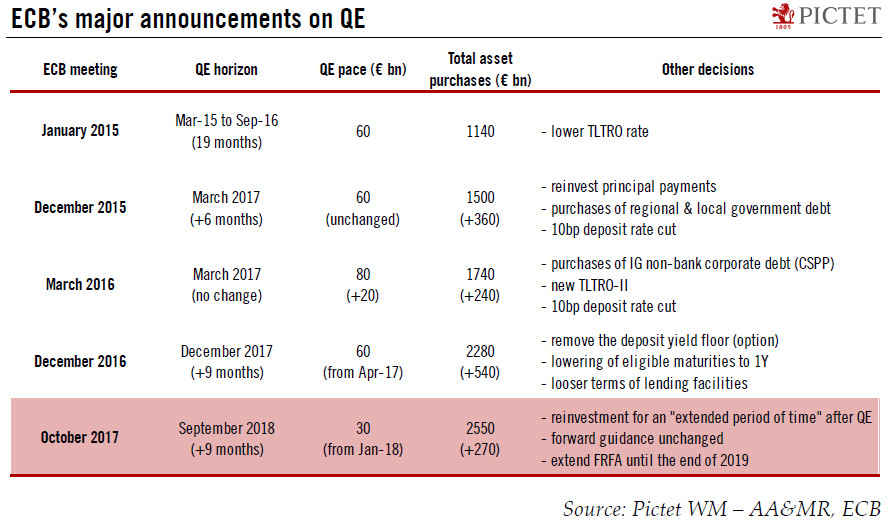

The European Central Bank’s (ECB) decisions today were in line with our and consensus expectations, including a slower pace of asset purchases (rescaled from EUR60bn to EUR30bn per month), a longer and open-ended extension (until September 2018, or beyond if necessary), and stronger forward guidance (committing to keeping policy rates at present levels until “well past” the new horizon of net asset purchases). Meanwhile, said the ECB, reinvestment of bond proceeds will continue “for an extended period of time” after the end of QE. Crucially, while stressing the importance of reinvestment flows, the ECB stopped short of gross monthly targets which would have implied smaller net purchases.

Mitigating technical constraints to its bond purchases remains absolutely crucial for ECB’s broad guidance to be credible. Our analysis of bond scarcity suggests that QE could continue until Q1 2019 at this new EUR30bn monthly pace, or longer at a reduced pace if asset purchases are adjusted towards a larger share of corporate bonds. President Draghi’s seeming unconcern about bond scarcity suggests that our estimates are probably broadly accurate.

Assuming that “well past” implies a period of at least six months after the end of net asset purchases, the earliest date possible for a rate hike would be March 2019, or more likely June 2019 if the ECB tapers QE in full between September 2018 and early 2019. We have left our forecast unchanged for a first hike in the ECB’s main refinancing rate in September 2019 – one month before Draghi leaves office – with risks skewed towards an earlier move.

Meanwhile, we acknowledge that the one-off deposit rate hike we have long been expecting in 2018 had become much less likely unless the EUR depreciates significantly. The banking sector would welcome less negative rates… and so would the German public. However, pleasing these constituencies is not the ECB’s mandate.

Beyond the vicissitudes of QE, our main concern remains that since its December 2016 decision not to raise issuer limits, ECB normalisation is being largely driven by political and legal constraints, leaving several key questions unanswered. What will the ECB do if and when financial conditions tighten too rapidly? What will be the policy tools of choice in the next recession? Notwithstanding Draghi’s immense talent and communication skills, he may need one more thing to be successful – luck.