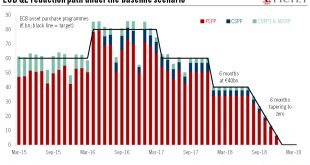

With important decisions on the future of its bond-buying programme looming, what are the ECB’s options?The European Central Bank (ECB) is expected to announce the bulk of its decisions on quantitative easing (QE) at its 26 October meeting. We would expect a broad commitment to extend QE beyond 2017 at a reduced pace, but several options are possible and additional technical details could be postponed to the 14 December meeting. Our baseline scenario remains that asset purchases will be...

Read More »ECB, a forced taper

As the ECB comes closer to a decision on the future of its quantitative easing programme, we look at the choices and dilemmas it faces.With the economic recovery in the euro area looking increasingly robust and broadbased, the ECB appears set to embark on a policy normalisation path, gradually phasing out of negative interest rate policy (NIRP) and quantitative easing. The ECB’s new narrative implies that the era of crisis-fighting unconventional monetary measures is over, as deflation risks...

Read More »ECB hints at October decision on QE

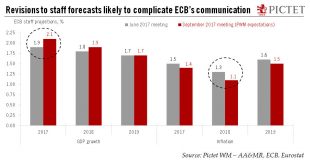

In spite of euro strength, a decision on tapering QE will likely come in October. We believe a reduction in monthly asset purchases could commence in H1 2018.The ECB left its assessment and communication broadly unchanged at its meeting on 7 September. Draghi confirmed that “the bulk of the decisions” on QE extension should be made at the 26 October meeting.The statement mentioned recent currency volatility as “a source of uncertainty” to be monitored in the future, and the staff...

Read More »Slow-motion exit from QE

The ECB’s Governing Council meeting on 7 September may see the first tentative steps toward an unwinding of QE, with a firm announcement on policy to come in October.The ECB will likely prepare for a cautious, flexible, slow-motion exit at its Governing Council meeting on 7 September, tasking its committees to study all policy options for 2018. We continue to expect an announcement in October that quantitative easing (QE) will be extended for six months, but at a reduced pace of EUR40bn per...

Read More »Sizing up the changes in ECB’s monetary policy

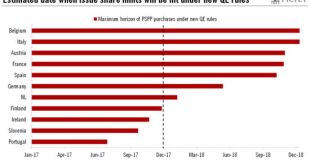

Along with extending its asset-buying programme, the ECB has made a number of changes to the parameters of that programme in a bid to deal with the issue of ‘bond scarcity’. But will it succeed?In December, the ECB made important changes to its quantitative easing (QE) programme, deciding to extend it by at least nine months to December 2017 while scaling down the pace of its asset purchases from EUR80 bn to EUR60 bn from April. The ECB also announced the easing of technical constraints...

Read More »Search for policy flexibility poses dilemma for ECB

Our base forecast is that the ECB will extend QE by six months, but will modify forward guidance.The European Central Bank (ECB) faces a communication dilemma ahead of its 8 December meeting. Amid growing evidence of a more robust recovery and improved policy transmission, there is a case for a reduction in the pace of asset purchases at some point in 2017. However, signalling an eventual tapering of asset purchases now would almost certainly trigger an unwarranted tightening of monetary...

Read More »ECB: tapering is no answer for bond scarcity

Tapering is not an immediate issue for the ECB, which we believe is much more likely to announce an extension of QE and measures to deal with the scarcity of bonds it can purchase. Spokespersons for the ECB have been anxious to beat back a Bloomberg story that the bank was attempting to “build a consensus” around the tapering of its bond purchases, saying the Governing Council (GC) had not even discussed this issue at its last policy meeting in September.The timing of the story is a...

Read More »ECB: reality check, no QE extension (yet)

The central bank’s growth and inflation forecasts were left largely unchanged on Sept. 8, but more intervention is in the offing. The ECB kept policy rates and QE unchanged at its 8 September meeting, in line with our expectations. ECB staff forecasts were broadly stable: the 2018 HICP projection, which was left at 1.6%, while the GDP growth was revised down slightly, from 1.7% to 1.6% in 2017 and 2018.The relative stability in the macroeconomic projections reflects, according to the ECB,...

Read More »ECB preview: getting the sequence right

Extension of quantitative easing (QE) along with changes to how QE works may be in the offing, but an announcement might wait until December. Ahead of its 8 September policy meeting, the European Central Bank (ECB) has expressed its “concerns” over the lack of upward momentum in core inflation. In our view, it is not a question of whether the ECB will ease (QE extension is a given, and more could be needed at some stage in the future), but more about getting the sequence right in order to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org