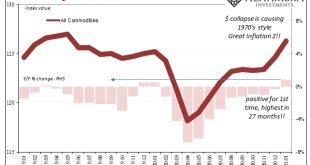

It’s worth taking a look at a couple of extremes, and the putting each into wider context of inflation/deflation. As you no doubt surmise, only one is receiving much mainstream attention. The other continues to be overshadowed by…anything else. To begin with, the US Bureau of Labor Statistics reported today that US import prices were up on annual basis for the first time in some time. Rising in January 2021 by 0.9% year-over-year, this was actually the fastest...

Read More »The Endangered Inflationary Species: Gazelles

Nevada is, by all accounts and accountants, in rough shape. Very rough shape. An economy overly dependent upon a single industry, tourism, in this case, is a disaster waiting to happen should anything happen to that industry. Pandemic restrictions, for instance. Nevadans cannot afford the government spending they “have” without a gaming industry attracting visitors at full throttle. Desperate, the state’s governor Steve Sisolak announced last week that officials...

Read More »They’ve Gone Too Far (or have they?)

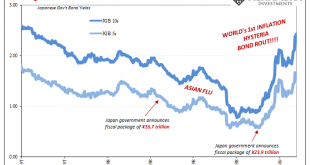

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months. The JGB 10-year yield had dropped to a low of just 77.2 bps during the depths of 1998’s Asian Financial Crisis (or “flu”, so noted for its regional contagious dollar...

Read More »Deflation: Friend or Foe?

Deflation is the most feared economic phenomenon of our time. The reason behind this a priori irrational fear (why should we be afraid of prices going down?) is the Great Depression. The most severe economic crisis of the 20th century was accompanied by a massive deflationary spiral that pushed prices down by 25% between 1929 and 1932 (this is equivalent to an annualized inflation rate of minus 7% over that period). Given the impact that the Great Depression...

Read More »Inflation Hysteria #2 (Slack-edotes)

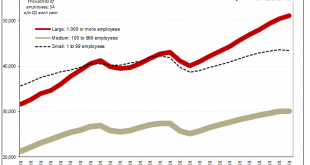

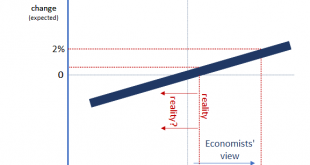

Macroeconomic slack is such an easy, intuitive concept that only Economists and central bankers (same thing) could possibly mess it up. But mess it up they have. Spending years talking about a labor shortage, and getting the financial media to report this as fact, those at the Federal Reserve, in particular, pointed to this as proof QE and ZIRP had fulfilled the monetary policy mandates – both of them. A labor shortage would’ve meant full or maximum employment, the...

Read More »Deflation Returns To Japan, Part 2

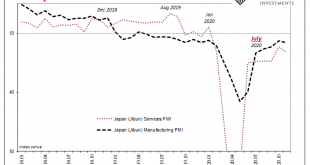

Japan Finance Minister Taro Aso, who is also Deputy Prime Minister, caused a global stir of sorts back in early June when he appeared to express something like Japanese racial superiority at least with respect to how that country was handling the COVID pandemic. For a country with a population of more than 126 million, the case counts and mortality rates suggest something in the nation’s favor. Total reported coronavirus cases didn’t top 100,000 until the end of...

Read More »Wait A Minute, What’s This Inversion?

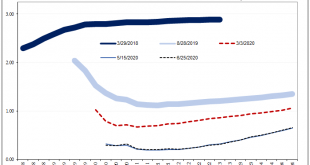

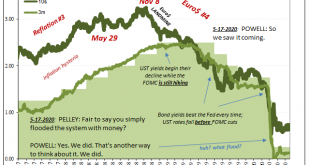

Back in the middle of 2018, this kind of thing was at least straight forward and intuitive. If there was any confusion, it wasn’t related to the mechanics, rather most people just couldn’t handle the possibility this was real. Jay Powell said inflation, rate hikes, and accelerating growth. Absolutely hawkish across-the-board. And yet, all the way back in the middle of June 2018 the eurodollar curve started to say, hold on a minute. That’s the part which caused so...

Read More »Why The FOMC Just Embraced The Stock Bubble (and anything else remotely sounding inflationary)

The job, as Jay Powell currently sees it, means building up the S&P 500 as sky high as it can go. The FOMC used to pay lip service to valuations, but now everything is different. He’ll signal to all those fund managers by QE raising bank reserves, leading them on in what they all want to believe is “money printing” (that isn’t). This provides the financial services industry with the rationalization those working within it desperately want for them to do what they...

Read More »No Flight To Recognize Shortage

If there’s been one small measure of progress, and a needed one, it has been the mainstream finally pushing commentary into the right category. Back in ’08, during the worst of GFC1 you’d hear it all described as “flight to safety.” That, however, didn’t correctly connote the real nature of what was behind the global economy’s dramatic wreckage. Flight to safety, whether Treasuries or dollars, wasn’t it. Back in March, while “it” was very obvious, even the New...

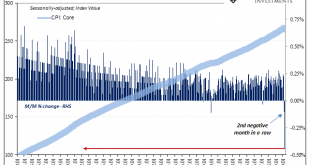

Read More »A Big One For The Big “D”

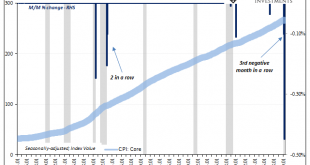

From a monetary policy perspective, smooth is what you are aiming for. What central bankers want in this age of expectations management is for a little bit of steady inflation. Why not zero? Because, they decided, policymakers need some margin of error. Since there is no money in monetary policy, it takes time for oblique “stimulus” signals to feed into the psychology of markets and the economy. Thus, a little steady inflation as insurance against the real evil....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org