Finanz und Wirtschaft, June 5, 2021. PDF. The debt brake addresses some political economy frictions, but not others. Focusing too narrowly on explicit government debt it provides incentives to accumulate implicit debt, sell assets, or engage in creative accounting. The political pressure to raise SNB profit disbursements is a symptom of these incentives.

Read More »The end of central banking as we know it

The severest crisis the European Central Bank (ECB) ever faced coincided with the early days of a new Executive Board. Over the past year and a half, the board’s six members, including the ECB’s president and vice president, have all been replaced, either because they resigned, or because their eight-year mandate expired. New team By order of appointment, the new board consists of: Luis de Guindos, who replaced Vitor Constancio as vice president in June 2018...

Read More »They’ve Gone Too Far (or have they?)

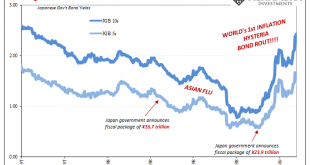

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months. The JGB 10-year yield had dropped to a low of just 77.2 bps during the depths of 1998’s Asian Financial Crisis (or “flu”, so noted for its regional contagious dollar...

Read More »Growing Dollar Demand, Silver Weirdness, Market Report, 15 June

The Federal Reserve has become more aggressive again, after several years of acting docile. As you can see on this chart of the Fed’s balance sheet, it has very rapidly expanded from a baseline from (prior to) 2015 through 2018, of about $4.4 trillion. After which, it had attempted to taper, getting down to $3.8 trillion last summer. Then it was obliged to reverse itself well before responding to the COVID lockdown. Since then, its balance sheet has gone vertical....

Read More »The Federal Counterfeiter

Suppose you wanted to run an enterprise the right way (we know, we know, this is pretty far-out fiction, but bear with us). And, your enterprise has a $1 million dollar piece of equipment that wears out after 10 years. You must set aside $100,000 a year, so that you have $1 million at the end of 10 years when the equipment needs replacing. There’s a word, now archaic, to describe the account in which you set aside this money. From Wikipedia: “A sinking fund is a...

Read More »What to Expect from the World Bank and IMF

The spring meetings of the World Bank and IMF will be held virtually this week amid a profound economic crisis spurred by a novel coronavirus. Unlike previous such viruses, this went global in such a destructive way that many countries have responded the same way. Encouraging social distancing, closing non-essential businesses, and enforcing lockdowns. The economic contraction that has begun is beyond what has been seen since the Great Depression. Even before the...

Read More »The Out Has Not Yet Begun to Fall, Market Report 31 March

So, the stock market has dropped. Every government in the world has responded to the coronavirus with drastic, if not unprecedented, violations of the rights of the people. Not to mention, extremely aggressive monetary policy. And, they are about to unleash massive fiscal stimulus as well (for example, the United States government is about to dole out over $2 trillion worth of loot). The question on everyone’s mind is what will be the consequences? The standard...

Read More »FX Weekly Preview: Sources of Imbalance and the Pushback Against New Divergence

The US dollar’s surge alongside gold has eclipsed the equity market rally as the key development in the capital markets. Even the traditional seemingly safe-haven yen was no match for the greenback. The dollar appeared to have been rolling over in Q4 19, as the sentiment surveys in Europe improved, Japanese officials seemingly thought the economy could withstand a sales tax increase, and data suggested the Chinese economy was gaining some traction. However, 2020 has...

Read More »“THE BIGGEST PROBLEM IS THE DEBT PROBLEM” – INTERVIEW WITH H.S.H. PRINCE MICHAEL OF LIECHTENSTEIN (PART I)

“In fact, it is easier for governments to control the spending of people in debt than those with savings. A person with financial resources is free, while debtors are hostage to their creditors.”H.S.H. Prince Michael of Liechtenstein The rare resilience and the economic and strategic prowess of the Principality of Liechtenstein have elevated the small alpine nation to a bright example internationally in terms of prudent governance. It offers countless lessons in long-term planning, in...

Read More »Who Would Invest in a Gold Bond?

Berkshire Hathaway CEO Warren Buffet famously dismissed gold. “Gold has two significant shortcomings, being neither of much use nor procreative.” I have recently written about how a government with gold mining tax revenues can use gold. The benefits of issuing gold bonds include reducing risk, and getting out of debt at a discount. Pretty useful, eh? As to his second point, one should never confuse suppressed with...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org