The Eurogroup has approved short-term debt measures for Greece. The explanations on the ESM website are not very precise. A chronology of the Greek debt crisis and the European institutions.

Read More »BIS: The VIX is Dead, The Dollar is the new “Fear Indicator”

Over the past few years, one of the recurring themes on this website has been an ongoing discussion of how the VIX has lost its predictive value as a market risk indicator. This culminated recently with a note by Russel Clark who explained in clear term why the “VIX is now broken.” Today, in a fascinating note Hyun Song Shin, head of research at the Bank for International Settlements, the “central banks’ central bank”...

Read More »Conference in Honor of Bob King at the Study Center Gerzensee

Jointly with the Journal of Monetary Economics and the Swiss National Bank, the Study Center Gerzensee organized a conference in honor of Bob King, long-term supporter of the Study Center. Program: PDF. Jaume Ventura’s discussion of a paper on trade and growth by Alvarez and Lucas: PDF. My discussion of a paper on debt and debt constraints by Bhandari, Evans, Golosov, and Sargent: PDF.

Read More »Pawn Shops, Information Insensitivity, and Debt-on-Debt

In a BIS working paper (January 2015), Bengt Holmstrom summarizes some of the implications of the research on information insensitive debt. He cautions against moves to increase transparency in debt markets and defends the shadow banking system. He explains why opacity and information insensitivity are valuable and argues that debt-on-debt arrangements are (privately) optimal. It all started with pawn shops: The beauty lies in the fact that collateralised lending obviates the need to...

Read More »Puerto Rico and its Control Board

In the FT, Eric Platt offers an update on the debt situation in Puerto Rico: The U.S. territory carries a USD 70 billion debt burden. It has defaulted multiple times over the past year, “including on bonds backed with a constitutional guarantee.” It did not have access to a court-backed restructuring process until Congress recently passed and President Obama signed the Puerto Rico Oversight, Management and Economic Stability Act (Promesa). A seven-person control board controls the...

Read More »US Election: Status Quo vs. Who Knows?

What politicians say and what presidents do often have little to do with one another. U.S. President Franklin D. Roosevelt, for example, implemented the New Deal a year after the Democratic Party pledged to slash government spending. Still, with the U.S. presidential election fast approaching, the economists on Credit Suisse’s Global Markets team analyzed the campaign promises made to date in the hope of giving investors some sense of what the future might hold. They determined that if...

Read More »Greek Debt Sustainability

The IMF’s debt sustainability analysis paints a bleak picture … about previous IMF assessments and about the prospects for Greece.

Read More »New Questions about Greece’s Indebtedness

On the FT’s Alphaville blog, Matthew Klein reports about discrepancies between IMF and Greek (and EU) assessments of Greek net indebtedness. The IMF appears to report lower Greek financial asset holdings than the Greek Central Bank. Matthew Klein quotes the Greek Central Bank: We would like to clarify that the Bank of Greece compiles its financial accounts, from which data on the general government’s net debt are derived, according to European standards. The Bank of Greece’s data are...

Read More »Greek Debt: Now and Then

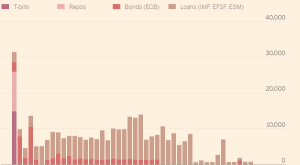

In the FT, Mehreen Khan offers a “Greek debt dilemma cheat sheet.” Face value: EUR 321 billion, thereof EUR 248 billion owed to official creditors. Official creditors: Eurozone countries (Greek loan facility), eurozone rescue funds (EFSF and ESM), IMF, ECB. Maturity profile: IMF proposal for restructuring:

Read More »China: Services Companies Benefit on Lower Tax with VAT introduction

Yesterday, China announced one of the most important tax reforms of the past twenty years. It is replacing a business tax on gross revenue for non-manufacturing companies with a VAT. Manufacturing companies have been subject to a VAT approach for a few years. The reform extends it from manufacturing and a few services in a pilot program to industry-wide application. It will now cover construction, real estate, finance and consumer services. The shift to the VAT is expected to reduce...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org