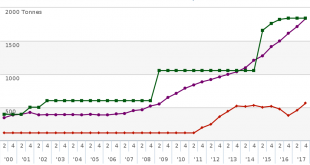

– Russia buys 300,000 ounces of gold in March and nears 2,000t in gold reserves – Russia now holds just over 1,861 tonnes, more than officially reported by China at 1,842t – Both Russia and China have the power to destabilise US dollar by dumping dollar-denominated assets – Turkey has removed all gold held in the U.S. opting for Bank of England and BIS – Turkey follows trend set by both Germany, Netherlands and others...

Read More »Family Offices and HNWs Invest In Gold Again

Family Offices and HNWs Are Investing In Gold Again – Rising interest by family offices and high-net-worth (HNW) into gold bullion investments – Gold ETF assets have reached almost $100 billion due to HNWs and pension funds’ increased demand – Volatility in equities, concerns over trade wars, Trump’s Presidency and other economic worries are spurring demand for gold coins and bars – Prudent money ‘trickle’ back into...

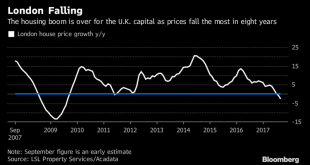

Read More »London House Prices See Fastest Quarterly Fall Since 2009 Crisis

– London house prices fell by 3.2% in the first quarter – Halifax – Brexit, financial and geo-political uncertainty lead to falls– Excluding sale of seven £10m-plus houses in London, prices were down 3.4% in the year– UK house prices climb by just 0.4% in April, the slowest increase since 2008 for same period– Sales transactions fall by 19% and asking versus selling prices show turning into buyers’ market– Homeowner or...

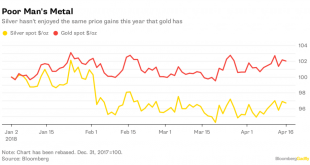

Read More »Silver Bullion Remains Good Value On Positive Supply And Demand Factors

– Silver bullion remains good value on positive supply and demand factors– Industrial demand set to continue to climb from 2017, into 2018 and beyond– Speculators are bearish on silver as net short positions in silver futures reach record– Investment demand sees silver ETF holdings at eight-month high of 665.4 million ozs– 2017 saw fifth consecutive annual physical deficit in scrap silver, of 26 moz– Global silver mine...

Read More »New All Time Record Highs For Gold In 2019

– New all time record highs for gold in 2019– ‘Powerful bull market’ will likely send gold to $5,000 to $10,000– If USD & Treasuries keep falling, stocks may decline at ‘moment’s notice’– Traditional portfolio of stocks and bonds will not protect investors– “Gold will replace bonds as the go-to hedge” by Brian Delaney of Secure Investments Gold is gaining momentum after a 5-year consolidation and is set to...

Read More »Palladium Bullion Surges 17% In 9 Days On Russian Supply Concerns

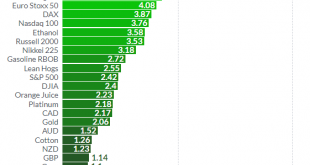

Palladium bullion has surged a massive 17% in just nine trading days. From $895/oz on Friday April 6th to over $1,052/oz today (April 19th). The price surge is due to palladium being due a bounce after falling in the first quarter and now due to Russian supply concerns. In a volatile month, precious metals and commodities have been the clear winners so far, with palladium having the greatest gains of all – up 10.7% in...

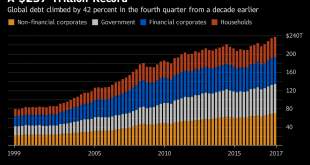

Read More »Global Debt Bubble Hits New All Time High – One Quadrillion Reasons To Buy Gold

– Global debt bubble hits new all time high – over $237 trillion– Global debt increased 10% or $21 tn in 2017 to nearly a quarter quadrillion USD – Increase in debt equivalent to United States’ ballooning national debt – Global debt up $50 trillion in decade & over 327% of global GDP – $750 trillion of bank derivatives means global debt over $1 quadrillion – Gold will be ‘store of value’ in coming economic...

Read More »Volatile Week Sees Oil and Palladium Surge Over 8%, Gold and Silver Marginally Higher and Stocks Gain

– Gold & silver eke out small gains; palladium surges 8% and platinum 2% – Oil (WTI) surges over 8% to over $66.90/bbl; supply disruption risk – U.S. dollar and Treasuries fall; geopolitical, trade war and fiscal concerns– Stocks rally and shrug off trade war, macro and geo-political risks – Bitcoin, major cryptos (Ethereum, Ripple etc) rise sharply– Russia-US tensions high: Trump warns attack ‘could be very soon or...

Read More »EU and Euro Exposed To Risks Including Trade Wars and War With Russia In Middle East

– EU and euro face growing risks including trade wars, energy independence and war with Russia in Middle East – Middle East war involving Russia may badly impact energy dependent & fragile EU – Trade and actual wars on European doorstep show the strategic weakness of the EU– Toxic combination due to growing anti-EU and anti-Euro sentiment in many EU nations– Investors should diversify to hedge investment, currency...

Read More »Trump Tweets Russia “Get Ready” For Missiles In Syria – Gold, Oil Rise and Stocks Fall

– Dow set to drop 300 points at open after Trump tweet today – Stocks see sell off and gold pops to test resistance at $1,350/oz – US stock futures suggest over 1% losses at New York open – Oil surged to a two-week high and has surged nearly 7% this week – U.S. bombing Syria may provoke escalation of conflict with Russia and wider conflict in volatile Middle East - Click to enlarge President Donald Trump warned...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org