– Gold gains due to concerns about slowing growth, monetary and geopolitical risks – Increasing possibility of ‘No Deal’ Brexit heightens recession risks in UK, Ireland – Brexit uncertainty is impacting UK & Irish economies; Likely do long term damage – UK sees sharp slowdown in mortgage approvals in February as housing market slows – Gold surges to near all time record highs in Australian dollars at $1,860/oz –...

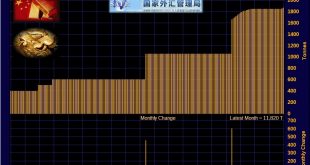

Read More »China Gold Reserves Rise To 60.26 Million Ounces Worth Just $79.5 Billion

China increased its gold reserves for a third straight month in February, data from the People’s Bank of China (PBOC) showed this morning. The value of China’s gold reserves rose slightly to $79.498 billion in February from $79.319 billion at the end of January, as the central bank increased the total amount of gold reserves to 60.260 million fine troy ounces from 59.940 million troy ounces. The People’s Bank of China...

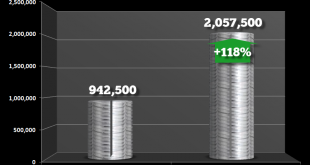

Read More »U.S. Mint Suspends Silver Bullion Coin Sales After Sales Double In February

U.S. Mint suspends silver bullion coin sales after sales double in February Silver investment demand for American Eagles (one ounce) silver bullion coins depletes West Point Mint inventories U.S. Mint suspended sales of American Eagle (1 oz) coins on Feb. 21 because it had no coins left to sell With increased investment demand, the Mint is experiencing a resurgence in steady demand with sustained purchases of the...

Read More »Gold Prices In Pounds and Euros Gain More as Economic Growth Falters in the UK and EU

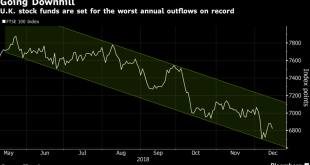

Gold prices in pounds and euros as economic growth falters in UK and EU Euro & pound gold tests multi year resistance; likely to surpass due to strong demand Improved risk appetite sees stocks rise which may be hampering stronger gains for gold Investors concerns regarding trade wars, Brexit, Italexit, the economic outlook and looser monetary policies is seeing robust demand for gold bullion Gold prices broke...

Read More »Large Gold Bullion Shipment Moves From London to Dublin Gold Vaults As Brexit Concerns Deepen

-Large Gold Bullion Shipment Moves From London to Dublin Gold Vaults As Brexit Concerns Deepen– Growing demand from investors to relocate tangible assets out of the UK– “Zurich continues to be the most sought-after location for storage, but Dublin has already surpassed Hong Kong and will likely usurp the second spot from London” Gold bars sit across a one kilo gold bar at precious metals storage specialist GoldCore....

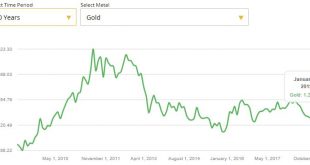

Read More »Buy Bitcoin or Gold? Bitcoin Buyers Investing In Gold In 2019

Buy bitcoin or gold? Bitcoin buyers are investing in gold in 2019 Poll of 4,000 bitcoin buyers shows their No 1 investment in 2019 is gold “Gold lost to bitcoin and now it’s going the other way…” says ETF strategist “Gold is a store of value and there’s no disputing that…” Buy Bitcoin or Gold(see more posts on gold price, )Gold in USD (10 Years) – GoldCore.com - Click to enlarge via CNBC.com Bitcoin’s hot streak is...

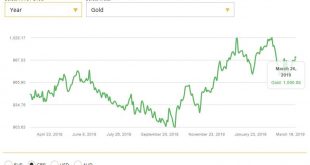

Read More »Gold Consolidates Above $1,300 After 1.2 percent Gain Last Week

via Marketwatch: Gold futures settled above $1,300 an ounce on Friday, with prices for the yellow metal at their highest since June as the U.S. dollar pulled back and investors eyed geopolitical turmoil and global growth worries. Rising gold prices reflect “political uncertainty” in the U.S., Eurozone, Venezuela and pockets of South America, as well as China-U.S. trade talks, said George Gero, managing director in RBC....

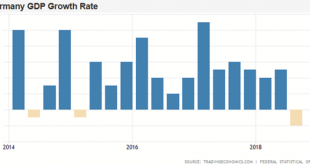

Read More »Brexit, EU, Germany, China and Yellow Vests In 2019 – Something Wicked This Way Comes

“Something wicked this way comes” warns John Mauldin Shaky China: Chinese landing could be harder than expected Brexit and EU Breakage: “I have long thought the EU will eventually fall apart” Helpless Europe: If Germany sneezes, their banks & the rest of continent catches cold We may see “yellow vests” spread globally: Economics is about to get interesting … by John Mauldin via Thoughts from the Frontline For a...

Read More »Political Turmoil in UK & US Sees Gold Hit 2 Week High

For first time in over 16 years, palladium futures settle at a premium to gold futures Gold futures on Wednesday resumed their climb toward the psychologically important price of $1,300 an ounce, settling at their highest in nearly two weeks on the back of political turmoil in the U.K. and U.S. Caution among traders had deepened “ahead of a no-confidence vote on British Prime Minister Theresa May’s government and other...

Read More »Gold Holds Steady Near $1,300/oz As Geopolitical Risks Including Brexit Loom Large

Gold Holds Steady Over £1,000 – Increased Likelihood Of A Disorderly Brexit – Gold supported near $1,300/oz ahead of important British Brexit no-confidence vote – Gold is consolidating in range between $1,280 and $1,300/oz (over £1,000/oz and €1,100/oz) – A break of resistance at $1,300 will likely see gold rise rapidly in all currencies – Physical demand for gold coins and bars has picked up in the UK and Ireland,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org