– New all time record highs for gold in 2019– ‘Powerful bull market’ will likely send gold to ,000 to ,000– If USD & Treasuries keep falling, stocks may decline at ‘moment’s notice’– Traditional portfolio of stocks and bonds will not protect investors– “Gold will replace bonds as the go-to hedge” by Brian Delaney of Secure Investments Gold is gaining momentum after a 5-year consolidation and is set to challenge the 2011 highs some time next year. Once gold clears ,000, a powerful bull market should drive the gold price meaningfully higher. Gold has been an unloved asset class for years but that is about to change. I am expecting a bear market in equities and rising yields as a consequence of years of

Topics:

Mark O'Byrne considers the following as important: Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

– New all time record highs for gold in 2019

– ‘Powerful bull market’ will likely send gold to $5,000 to $10,000

– If USD & Treasuries keep falling, stocks may decline at ‘moment’s notice’

– Traditional portfolio of stocks and bonds will not protect investors

– “Gold will replace bonds as the go-to hedge”

by Brian Delaney of Secure Investments

| Gold is gaining momentum after a 5-year consolidation and is set to challenge the 2011 highs some time next year. Once gold clears $2,000, a powerful bull market should drive the gold price meaningfully higher.

Gold has been an unloved asset class for years but that is about to change. I am expecting a bear market in equities and rising yields as a consequence of years of central bank QE. A traditional portfolio of stocks and bonds will not protect investors during the next downturn. I expect gold will replace bonds as the go-to hedge. Ultimately, I think gold will reach $5,000/oz-$10,000/oz, as a multi-year bear market in equities and the USD unfolds (along with a USD currency crisis), but let’s get to $2,000/oz first. Should gold continue on its bullish trajectory, the gold (and silver) miners will explode higher. |

Gold Weekly, Apr 2008 - 2018 |

| $XAU is an index of gold and silver mining companies, and are they on sale today, following a catastrophic collapse from 2011 to 2016. Miners are cheaper today than they were all the way back in 2000 when the gold bull market began (and gold was trading at $250/oz). Many gold and silver mining companies are now breaking out from multi-year base formations.

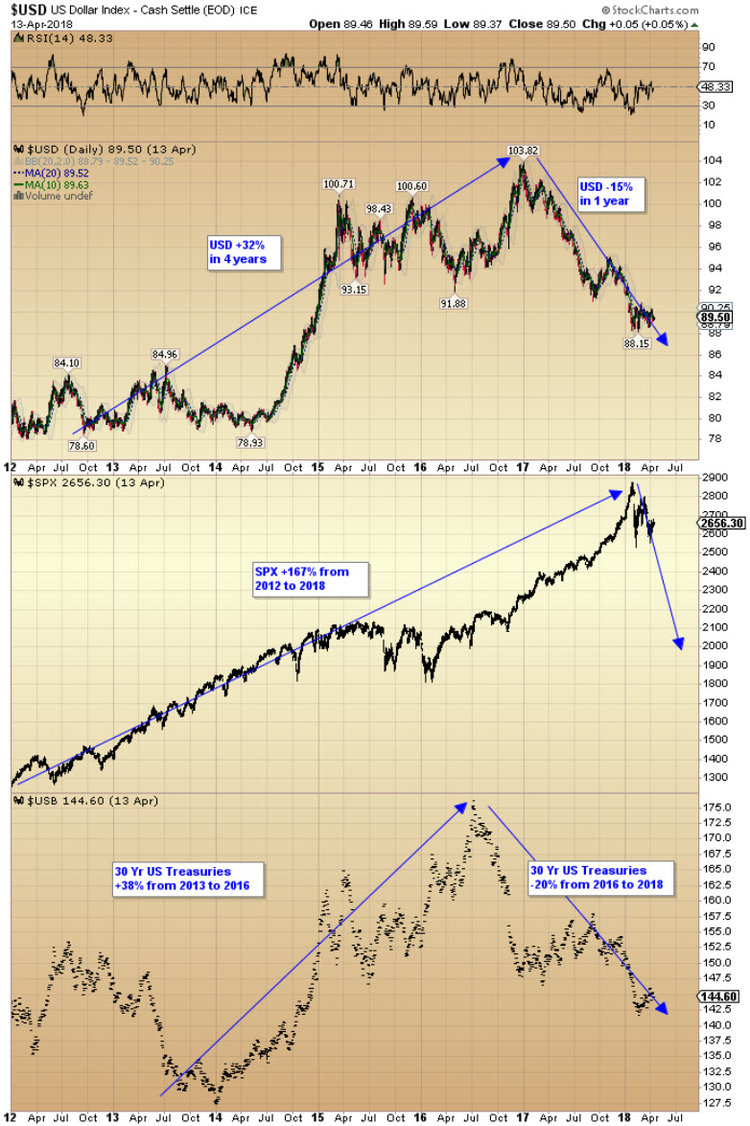

Fortunes will be made in this sector over the next 5-10 years. Last Friday, I reviewed the performance of US equities, bonds and USD in the run up to the 1987 stock market crash to see if there are any similarities to today’s markets. From 1981 to 1986, US equities and bonds went on a tear. The S&P 500 rallied +237% from 1982 to 1987, while bonds surged +84% higher. The USD ran up +68% and then collapsed -42%. The combination of an overvalued stock market, overly bullish investor sentiment, a collapsing currency and automatic trading programmes in place at the time resulted in the panic now known as Black Monday. Today, stocks are more expensive, debt levels are much higher across the board and interest rates are much lower too. The US stock market has rallied +167% from 2012 to 2018. US Treasuries added almost +40% from 2013 to 2016 before falling -20% over the last two years. The USD added +32% from 2013 to 2017 before declining -15% over the last 15 months. |

Gold and Silver Index, 1984 - 2018 |

| Investors with a bullish bias should be rooting for both US Treasuries and USD to stabilize. If the USD and Treasuries continue to fall, the stock market will surely follow and the decline could accelerate at a moment’s notice.

Silver has been in a trading range for over four years and is now preparing to launch higher. More volatile than gold, silver is also considered a precious metal and the upside potential from here is significant. Silver cleared $17 yesterday. I think $18 and $20 will fall shortly as the next leg of the precious metals bull market gets underway. Just as I expect gold to break out to new all time highs next year above $2,000/oz, silver has a good chance of doing the same. |

US Dollar Index, 2012 - 2018 |

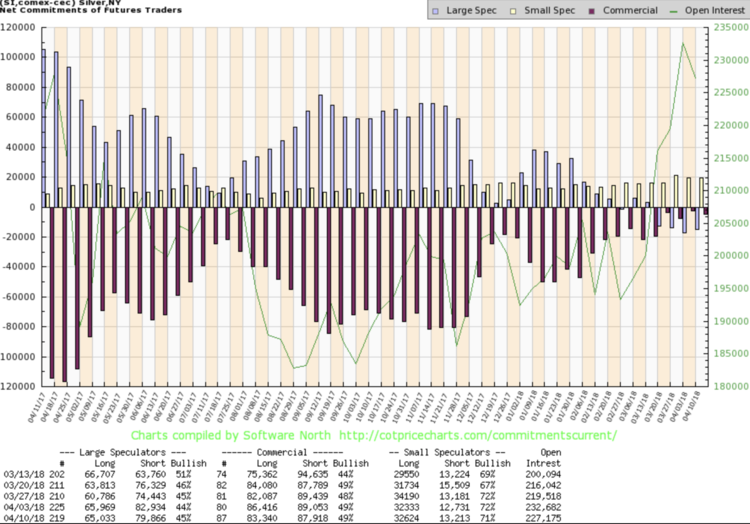

| The latest Commitment of Traders report is also favouring a sharp move higher in silver prices. The Commercial Traders (smart money, purple bars) who are always short the metal to hedge silver producer production, are holding their smallest short position in years. |

Silver Daily, 2005 - 2018 |

| Meanwhile, the Large Speculator position (blue bars) is now short silver for the first time in years. The scene is set for a rocket launch in silver prices. |

Net Commitments of Futures Traders, Apr 2017 - 2018 |

| Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube |

Tags: Daily Market Update,Featured,newsletter