– EU and euro face growing risks including trade wars, energy independence and war with Russia in Middle East – Middle East war involving Russia may badly impact energy dependent & fragile EU – Trade and actual wars on European doorstep show the strategic weakness of the EU– Toxic combination due to growing anti-EU and anti-Euro sentiment in many EU nations– Investors should diversify to hedge investment, currency and systemic risk Recent economic data in the Eurozone has pointed to slowing economies. Retail sales and industrial production is down in many nations (see Bloomberg chart above – source). Germany, the prime driver of growth in the region has seen exports plunge due to the euro strengthening against the

Topics:

Mark O'Byrne considers the following as important: Daily Market Update, Featured, GoldCore, newslettersent, Victor Orban, Vladimir Putin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

– EU and euro face growing risks including trade wars, energy independence and war with Russia in Middle East

– Middle East war involving Russia may badly impact energy dependent & fragile EU

– Trade and actual wars on European doorstep show the strategic weakness of the EU

– Toxic combination due to growing anti-EU and anti-Euro sentiment in many EU nations

– Investors should diversify to hedge investment, currency and systemic risk

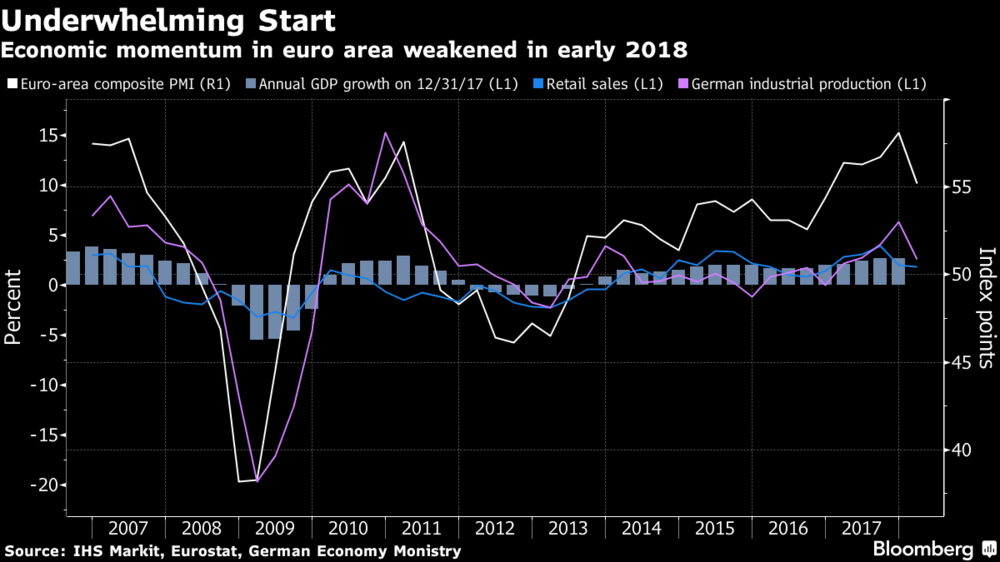

| Recent economic data in the Eurozone has pointed to slowing economies. Retail sales and industrial production is down in many nations (see Bloomberg chart above – source). Germany, the prime driver of growth in the region has seen exports plunge due to the euro strengthening against the dollar and due to the risk of tariffs and a potential global trade war on the horizon.

Brexit has disappeared from the headlines, debt crises are yesterday’s news and frequent terrorist attacks in different EU nations seem to be taken in their stride. So one might think that things are on the up for the European Union. This could not be further from the truth. The single-economic area has a major flaw: it is in a permanent state of dependence. Whether on democratically elected national leaders to tow the EU line, governments not to overspend, the rest of the world to tolerate the EU’s current account surpluses, Russia to supply energy and the powder keg that is the Middle East not to explode into a major conflagration and war. Not to mention many chronically indebted nations with still fragile banks and banking systems. Contrary to perceptions, systemic risk has not gone away. Many events going on both within and around the EU have exposed these major cracks in what is supposed to be the answer for peace and economic prosperity in Europe. The dangers to the union right now are manifold and look soon to manifest. |

Underwhelming Start 2007 - 2018 |

Going to war with our energy supplierIn recent days, we have covered the tragic state of affairs that is Syria, Trump tweets and the risks that a ‘Franz Ferdinand’ moment leads to a wider world war involving many nations who appear gung ho to eschew diplomacy and adopt military options. Many western governments, media and indeed social media such as Facebook are keen to finger blame on Russia for literally everything they don’t like right now – whether a chemical attack on civilians or meddling in national elections on Facebook and Twitter. One problem the EU in particular has with adopting a very aggressive U.S. military stance with Russia in Syria is that it is the EU’s largest supplier of gas. There is also the risk from the fact that Turkey appears to be breaking away from the EU and this could result in war at the borders of the EU. War, terrorism and new immigrant crisis on a scale of what was seen in recent years would be very destabilising. Russia supplies of gas have been growing each year. 2017 was a stellar year for Gazprom who delivered record stocks of gas to the EU, with Germany and Austria responsible for record sales. This is despite sanctions. The EU is much more dependent on Russia then is realised in this regard. For all the talk by France’s and the UK’s foreign secretaries of coming down hard on Russia’s involvement in Syria, Putin knows they can only go so far given the gas tap is in his backyard. |

|

| Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below |  |

Politico reminds us:

Trade surplus and wars are a danger to the EULast week European stocks tanked as China and the US traded angry words with one another regarding tariffs. Europe is firmly caught in the crossfire. The threat is twofold – firstly we are hugely exposed to any trade war between the world’s biggest economies but secondly Trump may decide to impose his own sanctions on the EU too. Jack Ewing in the New York Times explains the dilemma currently facing the single-market:

The EU cannot afford to have its trading relationships screwed up by Trump or Xi Jinping. The recovery, post-crisis, is now losing momentum and industrial production figures are slowing down. There is a danger that countries within the EU will be forced to negotiate separately with both China and the US, rather than collectively, as each fights to protect their economy. As a collective the EU will have to work hard to persuade trading partners that it should not face trade tariffs. But this will be tricky given its trade surplus and Germany’s trade surplus in particular, which (until now) countries have put up with. The macroeconomic dependency is more subtle, but it shows up in trade policy. The eurozone had a current account surplus of 3.5 per cent of GDP in 2017 — almost €400bn — a sum that needs to be absorbed by offsetting deficits in the rest of the world. The trade surplus explains why the EU is not keen to impose counter-sanctions to the US steel and aluminium tariffs once the temporary exemption ends on May 1. Wolfgang Munchau, FT. |

|

Collective action with singular mindsetsThe fault with the EU (and one that so many in Brussels are keen to ignore) is that the model only works if based on a singular mindset. However, how can this work when it is formed of so many small countries with their own singular mindsets and national interests? When the Dutch far-right party failed to win the election in 2017, many Eurocrats decided this signalled that populism and the anti-establishment movement were in decline. In fact, this couldn’t be further from the truth Take, for example, Victor Orban in Hungary. His eight-year rule has established him as the role-model for the anti-establishment movement that is sweeping across Europe, from Poland to Serbia to France. The two-thirds parliamentary majority secured on Sunday by Orban is something the EU would like to make go away, so polar opposite to its own values is the Fidesz party. But some politicians of the EU are not so sure. Following the victory French National Front leader Marine Le Pen said Orban’s win was rejection of “the change of values and the mass immigration extolled by the EU.” |

Even in Germany there was some support from on high as reported by Bloomberg:

“I’m pleased with the election victory, it’s once again a very clear win for Viktor Orban,” Horst Seehofer, German federal interior minister, told reporters in Munich. He fired a volley at the EU to stop lecturing the Hungarian government over its shift to the right, adding: “I’ve always thought that this policy of arrogance and paternalism with respect to other member states is wrong.”

Italy is another example. And an extreme one. It is a country that has a serious tug-of-war with its own mindset and that of the EU. The tug-of-war that is the country’s current coalition government is made up of various parties, elected because of discontent regarding pretty much everything that is going on in Italy.

The same can be said in Hungary and Poland.

Poland has been at loggerheads with the EU establishment for over two years now over Polish national interests. Like Orban’s party, the ruling Law and Justice Party (PiS) has capitalized on the frustration with the post-communist transition. They are fed up with what they view as unequal economic paths and a lack of progress in catching up with the advances of the West.

In Italy they are tired of falling behind. The March 4 vote saw the anti-establishment 5-Star Movement take the most votes for a single party, but it wasn’t enough to secure leadership. Meanwhile a rightist alliance, including the League, Brothers of Italy and Berlusconi’s Forza Italia (Go Italy!) group won the biggest bloc of seats.

Coalitions have been formed but egos are now firmly in the way, in both the Italian parliament and in Brussels which is determined to prevent the 5 Star Movement from having any power, at all.

The problem is that no one comes close to the 5-Star Movement’s 26-30% majority. But this doesn’t seem to matter to the ivory tower residents in Brussels, who are deaf to the cries of the unemployed and economically fed up and blind to see the irony with which they bang on about democracy while ignoring the wishes of the citizens of the member states.

Even if the rightist alliance does manage to secure power, the major flaw is that Berlusconi and the League’s Salvini do not see eye to eye on much at all. Not the euro, taxes or immigration…

Salvini is an admirer of Orban. Following Sunday’s victory the party leader tweeted: “Hungary voted with the heart and with the head, ignoring the threats of Brussels and Soros’s billions…”

For all of the EU’s dismissal of these parties, they fail to miss one vital point – they keep winning elections and gaining in popularity.

We’re forgetting one important risk …the EuroA few years ago we were considering how the euro itself might be the downfall of the Eurozone. It still might well be. Amongst the rising populism, outside threats and trade wars, the risks posed by the single currency will also challenge the EU in the coming months and years. As Sebastian Mallaby recently wrote in the Washington Post:

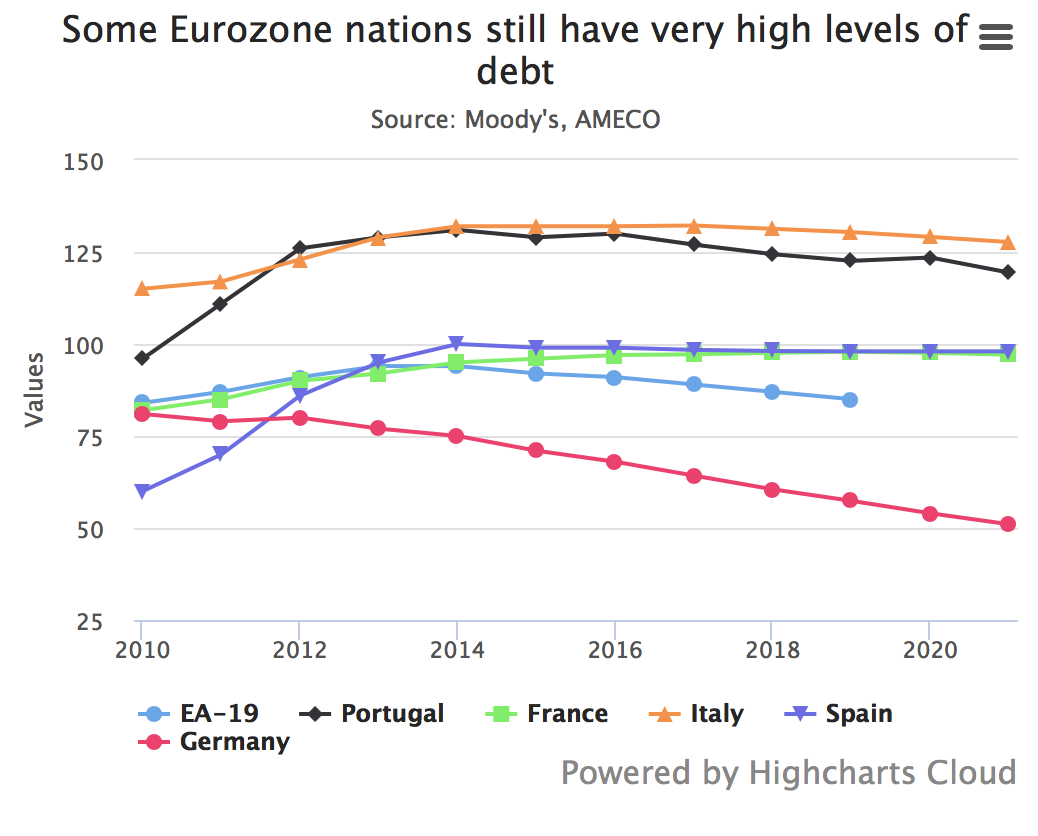

The EU has economists, policy wonks and many and varied proposals as to how best to protect the euro. The problem is they all rely on everyone agreeing. Why would the wealthier economies such as Germany allow their currency to continue to be debased in order to keep a dysfunctional monetary union intact? The EU and indeed the monetary union in its current state is totally unsustainable. The political uprisings across the Union are one of the results of the single currency union itself, the union of political rule and the union of values – none of which have worked. This weakness now leaves Europe hugely exposed to wider global events such as trade wars and actual wars on our doorstep in the Middle East. This is the absolute opposite of the initial goals and vision of those who dreamt up this economic ‘solution’ post World Wars. It is now not difficult to see the looming threats to the stability of the European financial and political systems. |

Eurozone Debt 2010-2020 |

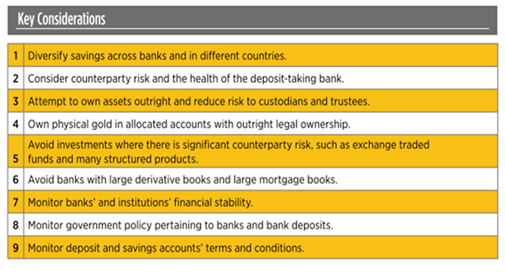

Protect yourself from EU banking and euro riskInvestors and savers in the EU should be aware that these risks have not gone away and are merely dormant. They should focus their energies on diversifying and protecting themselves from banks in the EU, the ongoing debasement of the euro and the not inconsequential risk of European monetary dis-union. European banks, including Deutsche bank in Germany, remain vulnerable and the risk of bail-ins and the confiscation of deposits from savings account remains real. Two years ago, the ECB approved the bail-in tool. In simple terms it gave them the right to bail out banks using the cash of unsecured creditors including individuals’ and companies. |

Key considerations |

Besides banking and currency risk, there is also the risk of national stock markets, bond markets and property markets under performing as they did during the financial crisis.

Savers need to consider counter party risk and diversify accordingly. Gold and silver bullion, if owned in the safest manner, remain one of the best options in this regard as if owned in the safest ways, it is very difficult indeed to confiscate them.

Physical, allocated and segregated bullion coin and bars ownership ensures all important liquidity, gives outright legal ownership and protection from counter party risk.

There is no dependency on single company websites and platforms and there are no counter parties who can claim it is legally theirs or legislation that rules that deposits can be confiscated to bail out failing banks.

Gold and silver bullion are important hedges and financial insurance against bail-ins, political mismanagement, and overreaching government and financial institutions.

To read more about how you can protect your savings in the bail-in era then read our comprehensive bail-in guide here.

Tags: Daily Market Update,Featured,newslettersent,Victor Orban,Vladimir Putin