Is the currency reset or global monetary reset (GMR) upon us? Russia dumped half their US Treasuries in April ($47.4 billion out of the $96.1 billion it had held) and bought 600k ozs of gold worth less than $800 million in May Has the IMF “pegged” gold to SDRs at 900 SDR per ounce? China stops buying US Treasuries and quietly accumulates gold China has over $3 trillion in fx reserves and Russia has $461 billion...

Read More »London House Prices Fall 1.9 percent In Quarter – Bubble Bursting?

London house prices down 1.9 per cent in Q2 (yoy) London house prices still 50% above 2007 bubble peak (see chart) Brexit and weak consumer confidence to blame say experts Little sign that U.K. property “weakness” is likely to change London property bubble appears to be bursting Editors Note: The London property bubble appears to be in the early stages of bursting. House prices are falling with reports of falls of as...

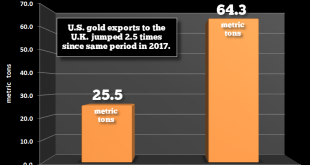

Read More »Gold Exports To London From U.S. Surge 152 percent In 2018

Gold Exports To London From U.S. Surge 152% In 2018 – U.S. gold exports to UK (primarily) London jumped over 150% from 25.5 metric tons to 64.3 mt in the first four months of 2018 (yoy)– Largest countries receiving U.S. gold exports are China/ Hong Kong, Switzerland and the UK – U.S. gold exports to London (UK) alone nearly as much as total U.S. gold production – Gold flowing from weak hands in West to strong hands in...

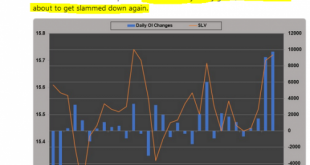

Read More »Manipulation of Gold and Silver Is “Undeniable”

Manipulation of Gold and Silver by Bullion Banks Is “Undeniable” by David Brady via ZeroHedge Manipulation in precious metals is undeniable Now so chronic that it is obvious and therefore predictable Central banks around the world are repatriating their gold from the U.S. in preparation for some major event to come I want to be long … “when that event occurs” Silver Change - Click to enlarge As a former...

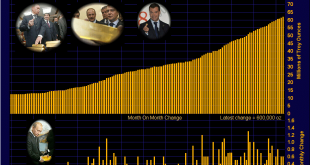

Read More »Russia Buys 600,000 oz Of Gold In May After Dumping Half Of US Treasuries In April

Russia adds another 600,000 oz to it’s gold reserves in May Holdings of U.S. government debt slashed in half to $48.7 billion in April ‘Keeping money safe’ from U.S. and Trump – Danske Bank Trump increasing the national debt by another 6% to $21.1 trillion in less than 18 months Asian nations accumulating gold as shield against dollar devaluation and trade wars Russia dumps Treasuries for gold and in a Trade war China...

Read More »In Gold, Silver and Bitcoin We Trust? Goldnomics Podcast with Ronald-Peter Stoeferle

In Gold, Silver and Bitcoin We Trust? Goldnomics Podcast (Episode 5) interview with Ronald-Peter Stoferle We interview our friend Ronald-Peter Stoeferle, partner in Incrementum in Liechtenstein and author of the must read, annual gold report ‘In Gold We Trust’ in this the fifth episode of the Goldnomics Podcast. There are 3 key “tides of change” that Ronni has analysed and he warns that the “liquidity party” of the...

Read More »“Without Gold I Would Have Starved To Death” – ECB Governor

– “Without gold I would have starved to death” – Ewald Nowotny, governor of Austrian central bank and member of ECB’s governing council – “I was born in 1944. When I was a baby, my mother could only buy food because she still had some gold coins…” – “When the going gets tough, gold becomes the ultimate money” reports Die Presse Under central bank governor Ewald Nowotny, Austria has brought back half of its gold reserves...

Read More »Swiss Government Pension Fund To Buy Gold Bars Worth Some $700 Million

Swiss Government Pension Fund Allocating 2% Of Pension Fund To Gold Bars via IPE Quest The Swiss government pension fund, Switzerland’s AHV/AVS fund, has decided to diversify into physical gold bars in their substantial CHF35.2bn (€30.5bn) pension portfolio. At the end of last week the first pillar buffer fund tendered a custodianship and storage for CHF 700m (EUR 600m / USD 700m / GBP 525m) in gold bars via IPE Quest....

Read More »Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” Later

Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” In Physical Later Guest post by Dominic Frisby of Money Week This year’s “gold standard” of gold-related research has just come out. Conveniently enough – given gold’s “safe haven” reputation – it’s arrived just in time for another major financial market scare, this time in the form of Italy. Below, I consider some of the most pertinent points…...

Read More »Gold And Silver Bullion Obsolete In The Crypto Age?

Are Gold And Silver Obsolete In The Crypto Age? What is the outlook for the global economy, financial markets, crypto currencies such as bitcoin and gold and silver bullion in the digital age? TOPICS IN THIS INTERVIEW 01:00 Diagnosis of the economy and rising inflation 06:00 Possible stock market correction? 09:30 What is triggering higher oil prices? 13:05 Impacts of rising oil prices on the mining sector 14:40 Gold...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org