David McWilliams has written an interesting article in which he puts forward the case that Trump is likely to turn on the “enemy within,” the Federal Reserve and bully them into “printing money.” He points out that this was seen in 1971 when Nixon bullied the Fed into printing and debasing the dollar. McWilliams says this would be bad for stocks markets which would fall in value as was seen in the 1970s. This would be...

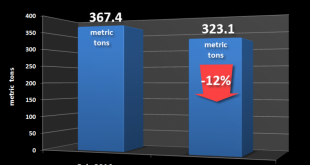

Read More »Silver Production Has “Huge Decline” In 2nd Largest Producer Peru

– Silver production sees “huge decline” in Peru – Production -12% in one month in 2nd largest producer – Silver decline is due to ‘exhaustion of reserves’ in Peru – GFMS recognise that ‘Peak Silver’ was reached in 2015 – Global silver market had large net supply deficit in 2016 – Silver rallied 13.5% in Q1 in 2017 – Base metal production accounts for 56% of silver mining – Base metal demand under threat from global...

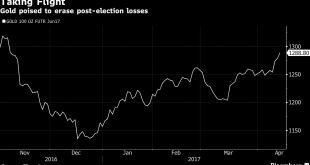

Read More »Gold Bullion Erases Post- Election Fall as Trump Wrong on Dollar – Daily Prophet

Gold Bullion Erases Post- Election Fall as Trump Wrong on Dollar – Daily Prophet Robert Burgess of Bloomberg Prophets President Donald Trump sent currency markets into a tizzy late Wednesday when he signaled his preference for a weaker dollar. “I think our dollar is getting too strong, and partially that’s my fault because people have confidence in me,” Trump told the Wall Street Journal. Although the greenback...

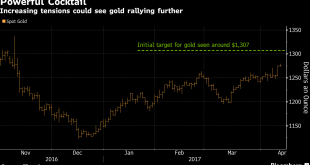

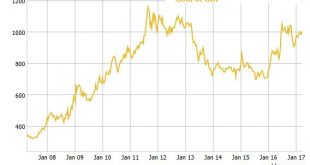

Read More »Gold Price Surges Above Key 200 Day Moving Average $1270 Level

– Gold price breaks above key 200-day moving average– Gold hits 5-month high on back of investor nervousness– Safe haven has 10% gains in 2017 after 9% gains in 2016– Gold options signal more gains as ETF buying increases– Geopolitical uncertainty over North Korea & Middle East– Tensions high -World awaits US move & Russia response– Russia says chemical attack was terrorist “false flag”– Poor March jobs report...

Read More »Gold Price Surges Above Key 200 Day Moving Average $1270 Level

– Gold price breaks above key 200-day moving average– Gold hits 5-month high on back of investor nervousness– Safe haven has 10% gains in 2017 after 9% gains in 2016– Gold options signal more gains as ETF buying increases– Geopolitical uncertainty over North Korea & Middle East– Tensions high -World awaits US move & Russia response– Russia says chemical attack was terrorist “false flag”– Poor March jobs report...

Read More »Bank of England Rigging LIBOR – Gold Market Too?

– Bank of England implicated in LIBOR scandal by BBC – “We’ve had some very serious pressure from the UK government and the Bank of England about pushing our Libors lower.” – “This goes much much higher than me” -UBS’ Tom Hayes – Libor distraction as all markets are manipulated today – Central bank’s “rigging” bond markets and likely gold – Risks of bank ‘holidays’, capital controls and of course bail-ins remains Bank...

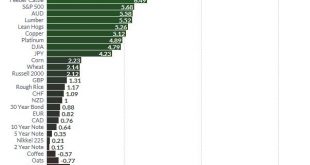

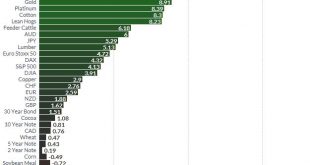

Read More »Gold, Silver Best Performing Assets In Q1, 2017

– Gold, silver two of the best performing assets in the first quarter of 2017 with gains of 8% and 14% respectively – Gold outperforms benchmarks – S&P 500 up 6%, MSCI (All Country World Index) up 6.4% (see tables) – Nasdaq and German DAX rise 11.8% and 7.6% – Silver best performing currency in quarter – Five best performing currencies in Q1 are in order – silver, bitcoin, Mexican peso, Russian ruble and gold –...

Read More »Brexit Gold Buying – UK Demand for Gold Bars Surges 39 percent

As the UK triggered its formal departure from the European Union yesterday, gold demand from UK investors remained ongoing and robust with increased numbers of British investors diversifying into physical gold in order to hedge the considerable uncertainty and volatility that the coming months and years will bring. The U.K. government yesterday triggered Article 50–the legal mechanism which will start negotiations on...

Read More »Safe Haven Gold Rises 2.5 percent As Stocks Fall and ‘Trump Trade’ Fades

Gold and silver jumped another 1% overnight in Asia, building on the respective 1.5% and 2.2% gains seen last week. The ‘Trump trade’ is fading, impacting stock markets and risk off has returned to global markets with the Nikkei, S&P 500 futures and European stocks weakening. The precious metals had their second consecutive week of gains last week. Gold rose 1.5% and silver 2% while platinum rose 0.5% and palladium...

Read More »Peak Gold – Biggest Gold Story Not Being Reported

– Peak gold – Biggest gold story not being reported– Gold ‘Mining Zombie Apocalypse’ caused miners to slash exploration budgets– Decline in gold production at world’s top 10 gold mining companies – Byron King– “No new big mines being built in the world today” – Glencore CEO Glasenberg– Primary global gold output declined in 2016 – Thomson Reuters via Mining.com– 2016 was first year of fall in mine production since 2008–...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org

-310x165.jpg)