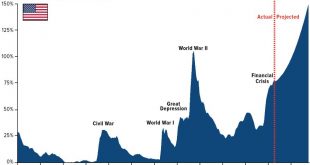

– “We have a stock market bubble” warns Greenspan– “Bond bubble will be the big issue” he tells Bloomberg TV (see video)– “Fiscally unstable long-term outlook in which inflation will take hold” – “Ratio of federal debt to GDP which is extraordinarily high” (see chart)– Higher interest rates, inflation and stagflation coming – Gold is the “ultimate insurance policy” – Greenspan Federal Debt Expected Rising, 1790 -...

Read More »Silver Bullion: Once and Future Money

Silver Bullion: Once and Future Money – “Silver is as much a monetary metal as gold” – Rickards – U.S. following footsteps of Roman Empire which collapsed due to currency debasement (must see table) – Silver bullion is set to rally due to a combination of supply/demand fundamentals, geopolitical pressures creating safe haven demand, and increasing inflation expectations as confidence in central banking and fiat money...

Read More »Cyber War Coming In 2018?

– Cyber war is increasing threat – Investors are not prepared for– Third most likely global risk in 2018 is cyber war say WEF – “Scale and sophistication of attacks is going to grow”– EU, US, NATO lay down ground rules for offensive cyber war– Ireland is viable target for attackers but is ‘grossly unprepared for cyber war’– UK should expect attack that cripples infrastructure within 2 years – Trump administration may...

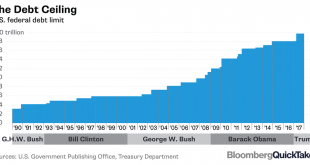

Read More »Government Shutdown Ends – Markets Ignore Looming Debt and Bond Market Threat

Government Shutdown Ends – Markets Ignore Looming Debt and Bond Market Threat For Now – U.S. Senate pass a temporary spending plan through Feb. 8 to end shutdown– Markets shrug off both government shutdown and re-opening– Markets, government and media ignoring worsening US debt position – Gold responding positively to U.S. dysfunction, rising US Treasury yields & weaker dollar – U.S. government national debt is...

Read More »The Next Great Bull Market in Gold Has Begun – Rickards

The Next Great Bull Market in Gold Has Begun – Rickards on Peak Gold And Technicals – ‘Gold is in the early stages of a sustainable long-term bull market’ Rickards – Rickards believes the next bull market in gold will be even more powerful than those of 1971–1980 and 1999–2011 – This new rally could send gold $1,475 or higher by next summer thanks to Fed rate hikes – Warns of Peak Gold ‘Physical gold is in short...

Read More »Gold Bullion May Have Room to Run As Chinese New Year Looms

Gold bullion tends to rise January and February before Chinese New Year (see table) Gold is nearly 8% and $100 higher since Fed raised rates one month ago Options traders are bullish and suggest gold has room to run (see chart) Nervous in short term, positive in medium term – gold at $1,500 in 2018 From Bloomberg: Gold’s breakneck rally eased this week, but tailwinds in both physical and paper markets suggest it’s...

Read More »Digital Gold Flight To Physical Gold Coins and Bars

‘Digital Gold’ Bitcoin Flight To Safe Haven Physical Gold – Latest bitcoin, crypto crash causes gold coin and bar demand to surge– Bitcoin down 40% from high, Ripple down 50% and Ethereum down 30%– Ripple and ‘Digital gold’ Bitcoin fall past key psychological price levels– $300bn wiped from cryptocurrency fortunes in just 36 hours– New research says that there is ‘Price Manipulation in the Bitcoin Ecosystem’– Savvy...

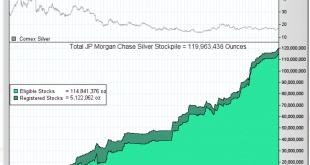

Read More »Silver Prices To Surge – JP Morgan Has Acquired A “Massive Quantity of Physical Silver”

Silver Prices To Surge – JP Morgan Has Acquired A “Massive Quantity of Physical Silver”– JP Morgan continues to accumulate the biggest stockpile of physical silver in history– “JPM now holds more than 133m oz -more than was held by the Hunt Bros” – Butler– Silver hoard owned by JPM has increased from Zero ozs in 2011 to 120m ozs today – Money managers showing more optimism towards silver through record buying– “Near...

Read More »London Property Crash Looms As Prices Drop To 2 1/2 Year Low

London Property Crash Looms As Prices Drop To 2 1/2 Year Low – London homeowners cut property prices by another 1.4% in January – Average price for a London house dropped by £22,000 to £600,926 in 2017– Takes 78 days to sell a home on average, the highest level since 2012– London’s downtrend continues after 2017 performance as worst UK housing market– UK regional house prices begin to falter as house prices climb slows...

Read More »Gold Hits All-Time Highs Priced In Emerging Market Currencies

Gold Hits All-Time Highs Priced In Emerging Market Currencies – Gold at all time in eight major emerging market currencies– A stronger performance than seen when priced in USD, EUR or GBP– As world steps away from US dollar hegemony expect new gold highs in $, € and £ – Gold is a hedge against currency debasement and depreciation of fiat currencies Gold Prices in Emerging Markets Currencies, 2010 - 2018(see more posts...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org